Bitcoin  $84,181.30 It has lost sharp value in the last month and a half, falling more than 30 percent from its all-time high recorded in early October. The biggest hit fell below $81,000 on Friday, testing its lowest level since April. cryptocurrency It soon recovered to around $5,000. However, technical indicators and investor behavior may herald a new wave of decline in the market.

$84,181.30 It has lost sharp value in the last month and a half, falling more than 30 percent from its all-time high recorded in early October. The biggest hit fell below $81,000 on Friday, testing its lowest level since April. cryptocurrency It soon recovered to around $5,000. However, technical indicators and investor behavior may herald a new wave of decline in the market.

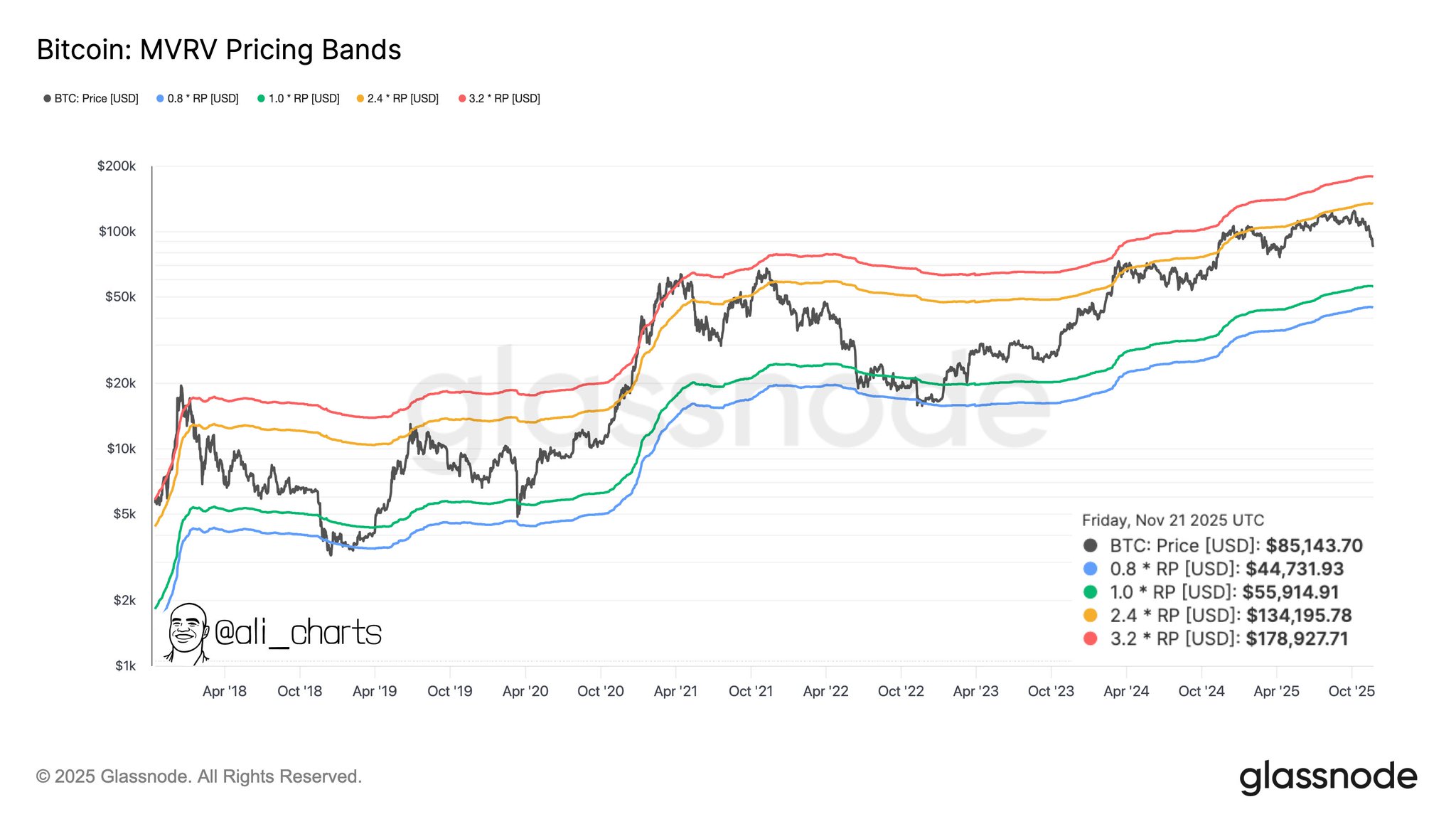

If History Repeats, $44,700 May Come to the Agenda

cryptocurrency analyst Ali MartinezConsidering Bitcoin’s historical lows relative to its price bands, it indicates the potential for a deeper decline. does. According to Martinez, Bitcoin has formed a bottom in the green and blue band range in the past, and if this scenario repeats, the price could drop to $44,700. Reaching this level would mean an additional loss of approximately 50 percent from current prices.

The picture is darker on the investor side. Especially known as those with large wallets whale It is reported that investors have sold a significant amount of BTC in recent days. The fact that some well-established investors who have been in the market for a long time have also disposed of their assets shows that the loss of confidence is increasing.

On the other hand, in the USA spot Bitcoin ETFThe fact that there has been an outflow of more than 1.2 billion dollars from ‘s in the last week also supports this picture. In particular, BlackRock’s IBIT fund has become one of the products with the highest outflows in recent days.

Bitcoin Influx to Exchanges

According to the data shared by Martinez, 20,000 units were sold in the last week. BTCIt was determined that it was sent to the stock exchanges. These transfers, worth approximately 2 billion dollars, indicate that sales pressure will increase. According to the analyst, investors moving this amount to central exchanges may cause the price to weaken further in the short term.

Moreover cryptocurrency marketGeneral capital inflows have decreased dramatically in the last three months. Total capital flow decreased from $86 billion to $10 billion, revealing the sharp decline in risk appetite. All these data give signals that not only Bitcoin but the entire cryptocurrency market may shake again.