Although the BTC price jumped to 85 thousand dollars with the Fed statements throughout the day, it has not yet reached the safe area. BTC, which fell back to 83 thousand dollars after the US data came in, continues to linger in the 83 thousand region. In cryptocurrencies liquidations exceeded $2 billion. So what’s coming today? US data What does it tell us?

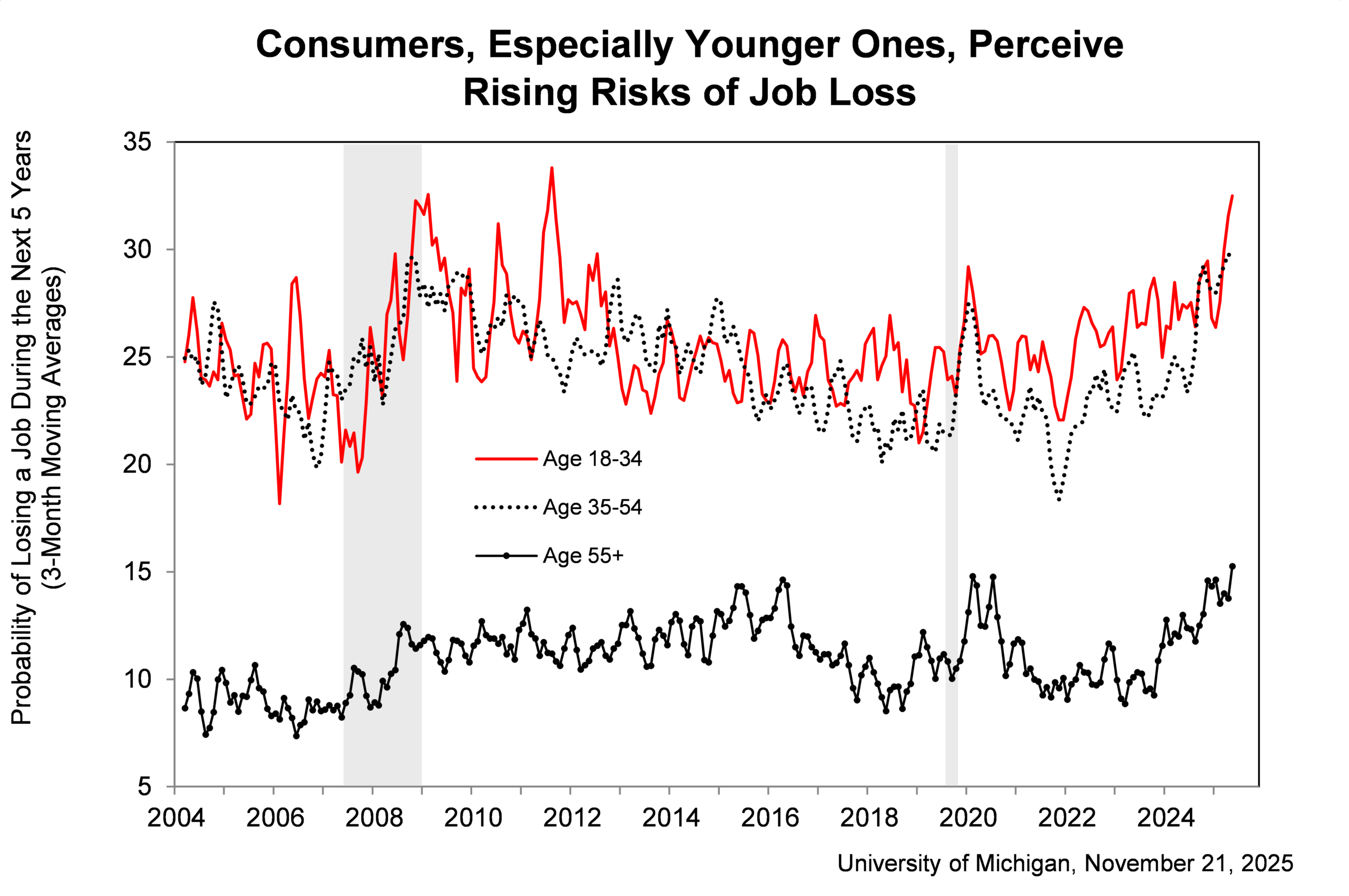

Michigan Data

Fed While making the December 10 interest rate decision, he will not find many important reports on his desk. This was one of the reasons for the decline, the postponed data fed the expectation that the Fed would leave interest rates constant, and yesterday Lisa Cook made statements that ruined everything. That’s why Michigan data or other less important reports become important. Michigan Sentiment data is out today.

While the forecast for sentiment was 50.6, it was announced as 51, exceeding the previous month’s 50.3. Consumer confidence, however, remains well below 71.8 in 2024. While the economic conditions expectation was 58.6 last month, it came to 51.1 this month, which is below last year’s 63.9. Economic The outlook for conditions has weakened. Consumer expectations came in at 51, down from 50.3 last month, and there is some recovery, albeit below last year’s 76.9.

The next data will come on December 5, before the Fed meeting. Consumer Surveys Director Joanne Hsu said;

“Consumer confidence This month it was little changed, with a decrease of 2.6 points compared to October, and this decrease remained within the margin of error. Following the end of the federal government shutdown, the confidence index rose slightly from its mid-month level. But consumers are still frustrated by continued high prices and weakening incomes. This month, current personal finance and durable goods purchasing conditions have fallen by over 10%, while future prospects have improved slightly. By the end of the month, the confidence of most stock-holding consumers had lost the gains seen in leading data. This group’s confidence fell by approximately 2 index points compared to October; The reason for this decline is probably the declines in the stock market in the last two weeks.

Inflation expectations for the coming year decreased from 4.6% last month to 4.5% this month. This represents three months of decline in a row, but short-term inflation expectations still remain above January’s 3.3%. Long-term inflation expectations fell to 3.4% in November from 3.9% last month. These expectations are currently slightly above the 3.2% level in January 2025. “Despite these improvements in the future course of inflation, consumers continue to report that their personal finances are currently under pressure from higher prices.”

The improvement in inflation expectations is good. However, Trump just announced that he will not lift sanctions on Russian oil and BTC returned below 83 thousand dollars.

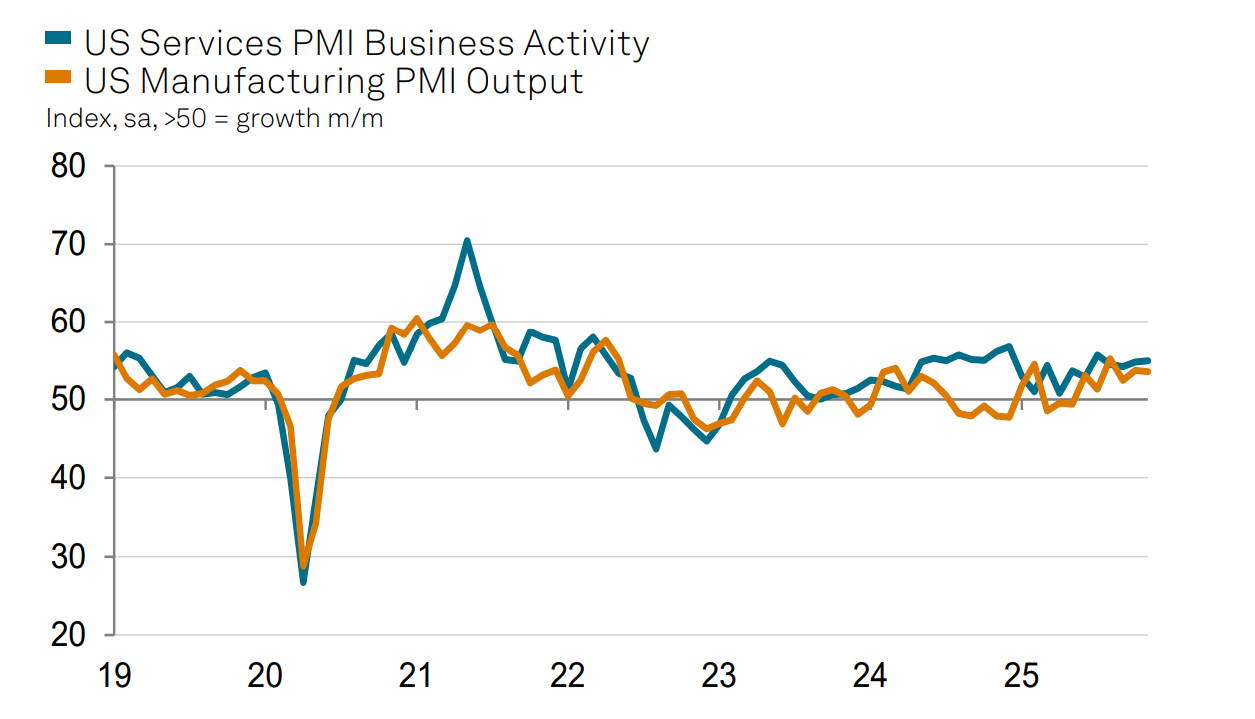

US PMI Data

PMI data is very important to see the situation of the economy on the production and growth side. This will be more important for the Fed meeting. Today, the leading PMI data arrived, so although they shed light on the exact PMI data, they are figures that should be evaluated cautiously due to their high deviation rate.

- US S&P Services PMI Leading Index Announced: 55 (Expected: 54.6 Previous: 54.8)

- US S&P Manufacturing PMI Leading Index Announced: 51.9 (Expected: 52 Previous: 52.5)

S&P Global Market Intelligence Chief Economist Chris Williamson in the US economy He says it reflects relative liveliness. Supportive for .5% GDP.

“For now, this upturn appears to be encouragingly broad-based, with production rising in manufacturing and the broad services economy. A marked increase in business confidence about the prospects for next year adds to this good news. Hopes for further cuts in interest rates and an end to the government shutdown have boosted optimism, with economic optimism rising and concerns about the political environment easing. “However, manufacturers have reported a worrying combination of slowing growth of new orders and record increases in finished goods inventories. The accumulation of unsold inventories indicates that factory production will grow more slowly in the coming months unless demand revives, which could lead to slowing growth in many service sectors. “Also, although jobs continued to be created in November, the employment rate continues to be constrained by cost concerns associated with tariffs. Both input costs and sales prices rose at increasing rates in November, which will be a cause for concern for inflation hawks.”

PMI data is supportive for interest rate cuts.