popular opinion in cryptocurrencies The decline will accelerate and investors are in a panic. You will see that the names that stand out for bigger tops in the rise and deeper bottoms in the fall are bold. This situation causes investors with weak psychology to run from side to side. But Julien Bittel warns.

Julien Bittel and Cryptocurrency Predictions

Julien took the stage in an environment where everyone suddenly panicked and criticized those who bury their heads in the sand when things go bad. BTC price At the time of writing, it returned to 85 thousand dollars but is still at a 6% loss.

“Most people back down because they don’t want to be ridiculed. I understand. None of us want that. But if you’re in this game, that’s part of the job. You have to learn to take the hits…

I’ve been doing this for a long time. I’ve made the right decisions over the years, but I’ve also made the wrong decisions. That’s the nature of markets. It keeps everyone humble. If you don’t like these views, unfollow. It’s that simple.

Almost no one wants to express an opinion right now. Everyone has their head in the sand and no one wants to hear bullish arguments.

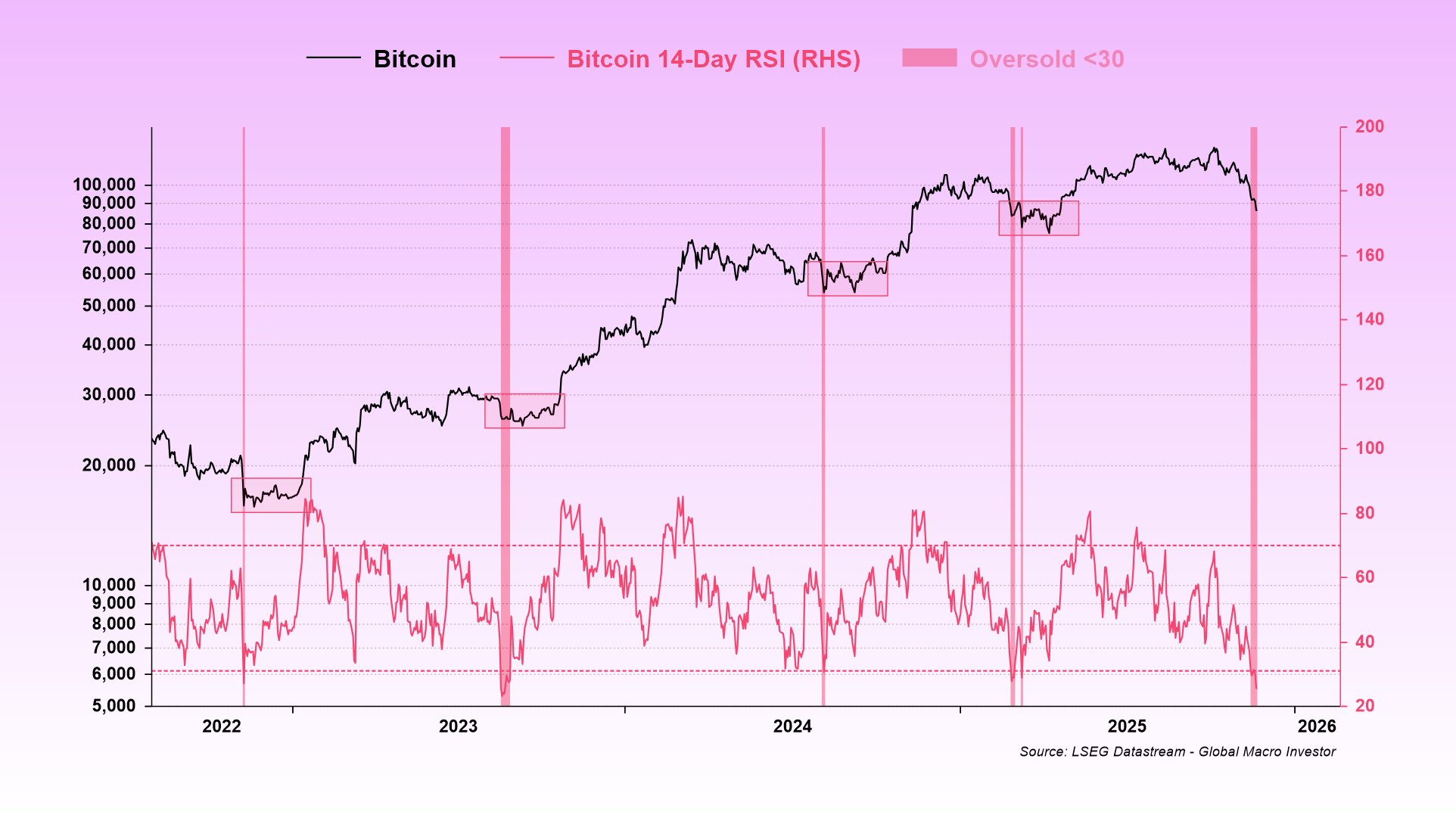

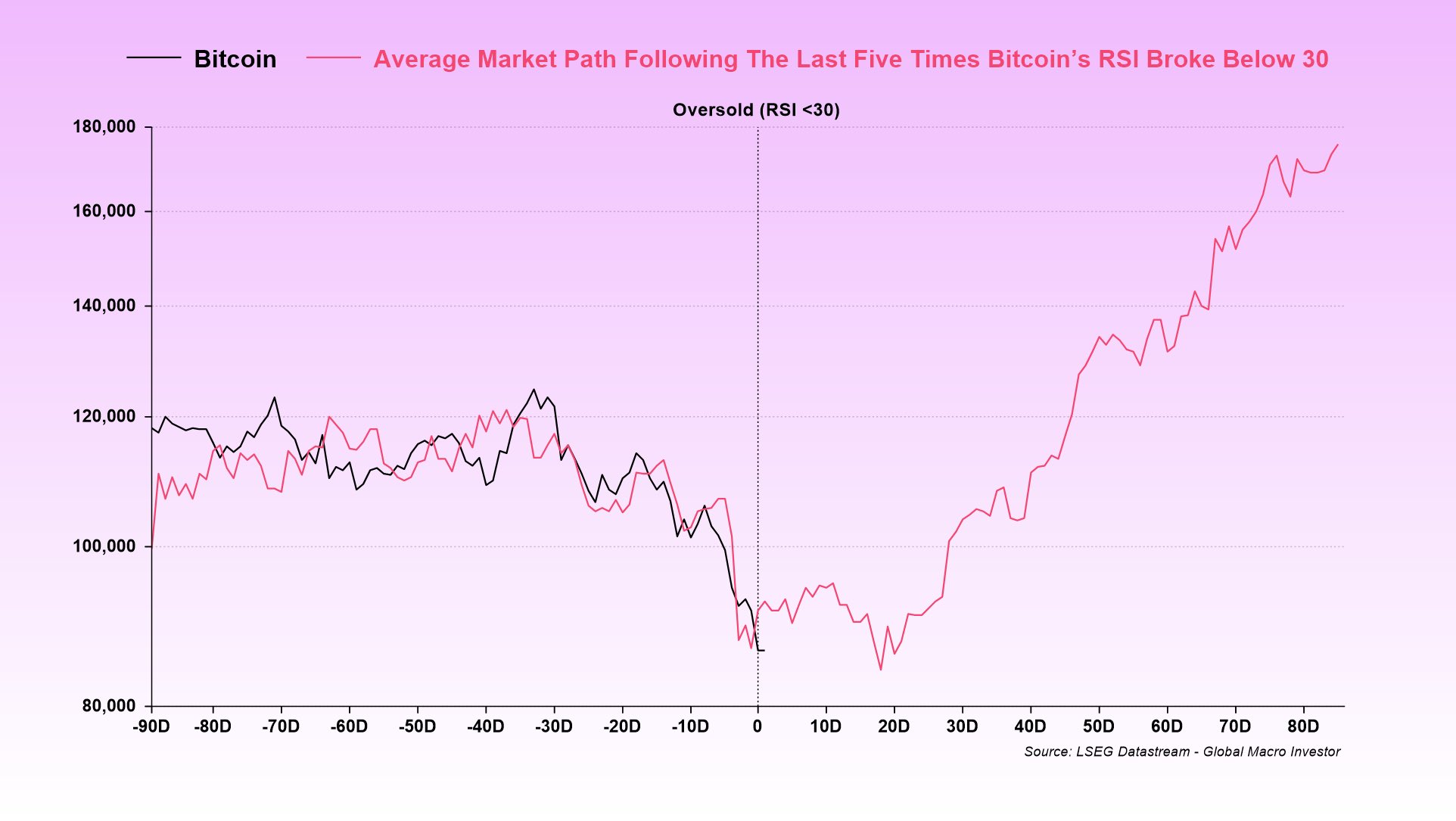

As the market declines like this, it becomes almost impossible to separate the signal from the noise as each narrative competes for emotional bandwidth. That’s why I’m sharing this. This is not a call and it is not an opinion. This is a fact. What we need now is an objective perspective, not a subjective one. “This market is oversold, but it takes time for the bottom to form.”

“Given past oversold conditions, Bitcoin has been

$82,845.16The last five times the RSI has fallen below 30, the path of least resistance has been higher on average.

Important note: If you think the bull market is over and we are entering a twelve month period of pain, these charts are not for you. Continue…”

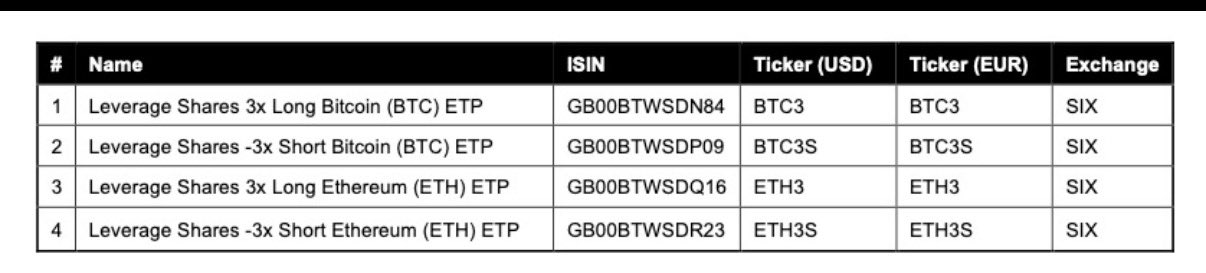

LeverageShares launches world’s first 3x and -3x in Europe next week Bitcoin And Ether ETFs will launch it. This is an important detail and we will see more products next year.

AI Bubble

The decline caused by Lisa Cook’s bubble statements drowned cryptocurrencies, but this was the comment of a single Fed member. Even Powell, despite his hawkish stance, said in his interest rate decision statements at the end of October that we are not in a dot-com-like period and that artificial intelligence companies have products that attract attention even though they do not yet bring net profit.

Fed member Jefferson recently made statements supporting this view;

“dot-com I see important differences between the era of artificial intelligence and today’s artificial intelligence era. The financial system remains sound and resilient. The differences between the current market and the dot-com era make it less likely that what happened in the late 1990s will happen again. More limited use of leverage could reduce the magnitude of sentiment shifts reflected in the economy, but we are closely monitoring the debt issuance of AI companies.

A.I. The stock gains related to AI are largely due to real gains from AI companies, unlike the dot-com boom. It’s too early to know what impact AI will have on the labor market, inflation and monetary policy.

of your balloon “I don’t have a particular view on what’s going on, I’m not leaning for or against what’s going on in the financial markets.”