Starknet price prediction 2025 has become an increasingly discussed topic as STRK shows unusual strength against a broadly bearish crypto market. Despite heavy volatility across major cryptos, Starknet price today reflects meaningful resilience supported by rising fundamentals, stronger activity metrics, and technical improvements that hint at a potential long-term shift.

STRK’s Unexpected Comeback: Market Defies the Trend

After months of stagnant performance, STRK price USD surged once Starknet confirmed the Stwo prover upgrade went live on November 5. The announcement triggered a powerful rally from $0.10 to $0.218 within five days marking a dramatic 110% move. Even though many investors booked early profits, causing a brief dip to $0.132, the token regained momentum in mid-November.

Notably, STRK bounced off its 20-day EMA and later broke above the 200-day EMA, officially flipping Starknet crypto’s long-term trend from bearish to bullish. From November 13 to November 21, STRK has managed to climb another 110% rally extension to reach $0.280, significantly outperforming the broader market even as major assets declined amid geopolitical tensions, especially Russia and Ukraine are once again grabbing each other’s collars.

Despite Market Stress, STRK Maintains Strong Structure

Unlike many altcoins that saw deep corrections, the Starknet price chart shows only a modest 17% pullback from its November high. This stability, during a period when BTC and ETH experienced sharper declines, suggests underlying confidence in Starknet’s evolving fundamentals.

However, STRK/USD still trades over 90% below its 2024 all-time high of $2.78. As a result, while the recent rally is encouraging, long-term investors view it as only an early stage of potential recovery rather than a complete turnaround.

On-Chain Fundamentals Strengthen Quietly but Significantly

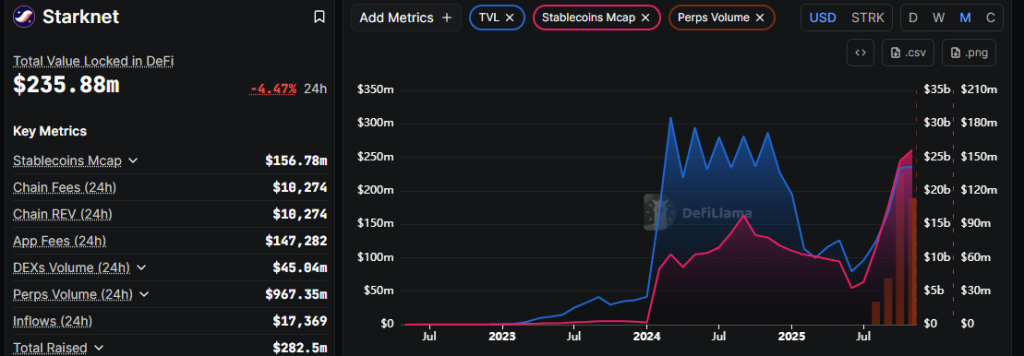

Starknet’s fundamentals have accelerated. For instance, STRK crypto’s total value locked (TVL) has climbed to $235.88 million on DeFiLlama, nearing its 2024 peak of $317 million.

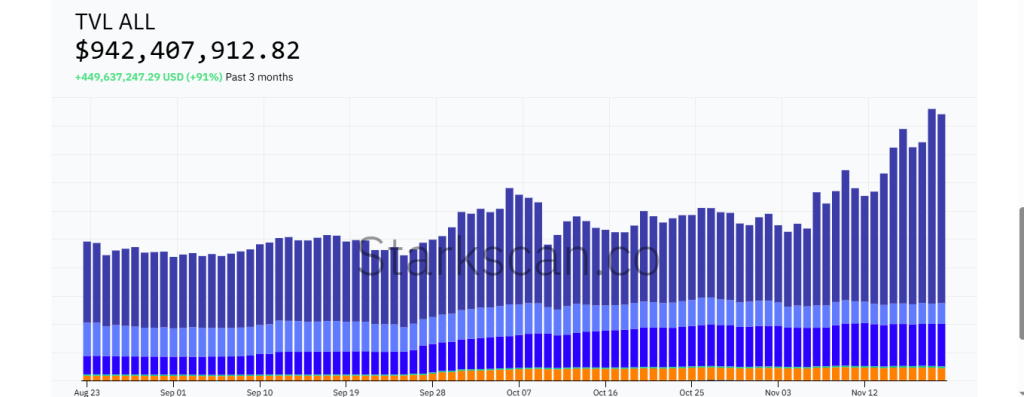

Meanwhile, StarkScan official website reports an even higher figure of $942 million which is up 90% in three months indicating deeper capital participation within the ecosystem.

Similarly, trading activity is surging. Perpetual volume reached $22 billion in October, while November already shows $18 billion in monthly volume.

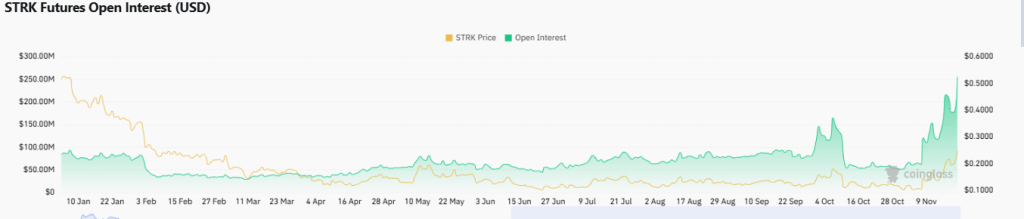

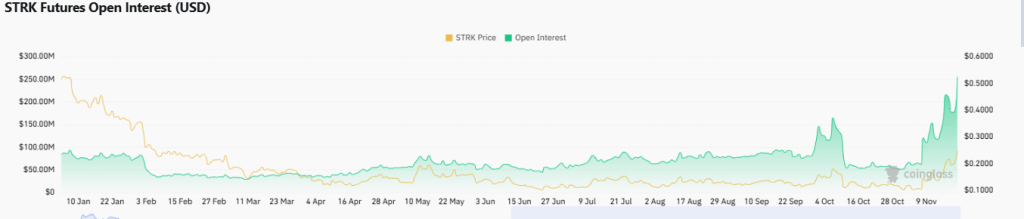

Coinglass confirms this momentum, with daily perpetual activity surpassing $1.5–$2.2 billion. Futures open interest has hit an all-time high of $255.80 million, reinforcing elevated trader engagement.

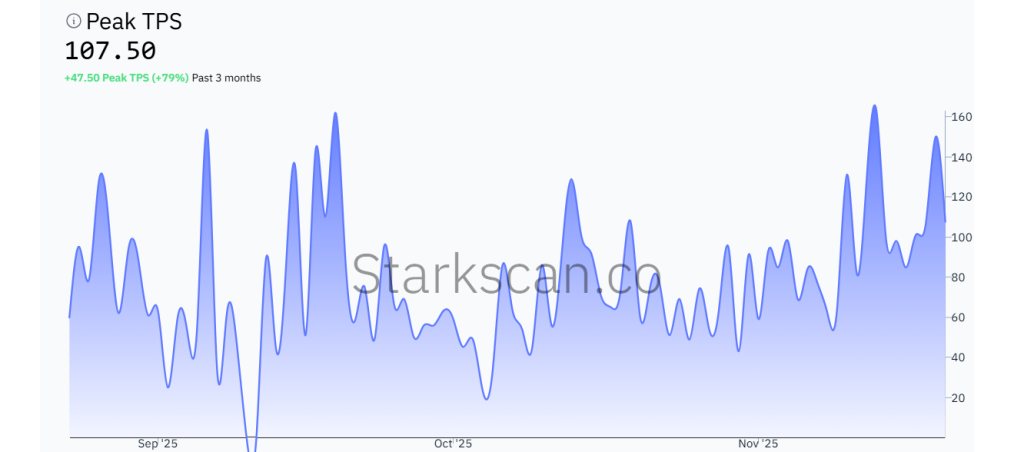

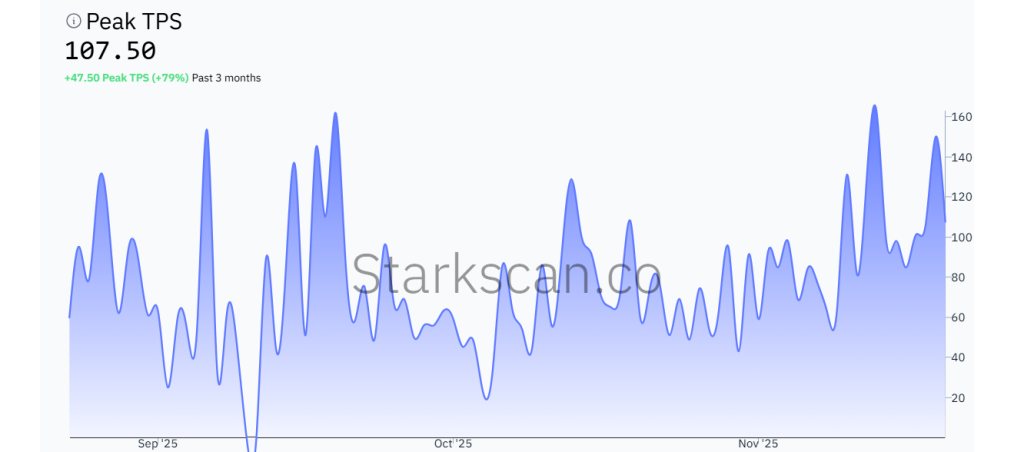

On the stablecoin market cap it has soared to $156.76 million, up from just $1.98 million in January 2024. Network activity is also improving, with Starknet TPS rising from 23 in early October to 163 on November 13 and still holding above 100 TPS.

Technical Outlook: What STRK Must Break to Signal Recovery

Based on current conditions, the critical level for the Starknet price forecast is $0.63. A year-end close above this barrier would shift STRK from survival mode into recovery mode. Successfully flipping this zone could open the path toward $1.36 by early 2026 and potentially a full retest of $2.78 if momentum aligns.

As November progresses, the Starknet price prediction 2025 outlook will depend on whether these strengthening fundamentals can sustain investor confidence.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.