Bitcoin  $91,789.74fell below $86,000 as delayed employment data announced in the USA showed that inflationary pressures continued. The price of the largest cryptocurrency dropped 7.3 percent in the last 24 hours to $ 85,700, hitting the lowest level in the last seven months. Investors are united in the view that the interest rate cut expected in December alone will not be enough to create a permanent recovery in the markets.

$91,789.74fell below $86,000 as delayed employment data announced in the USA showed that inflationary pressures continued. The price of the largest cryptocurrency dropped 7.3 percent in the last 24 hours to $ 85,700, hitting the lowest level in the last seven months. Investors are united in the view that the interest rate cut expected in December alone will not be enough to create a permanent recovery in the markets.

Macro Pressures Increase Weighing on Bitcoin

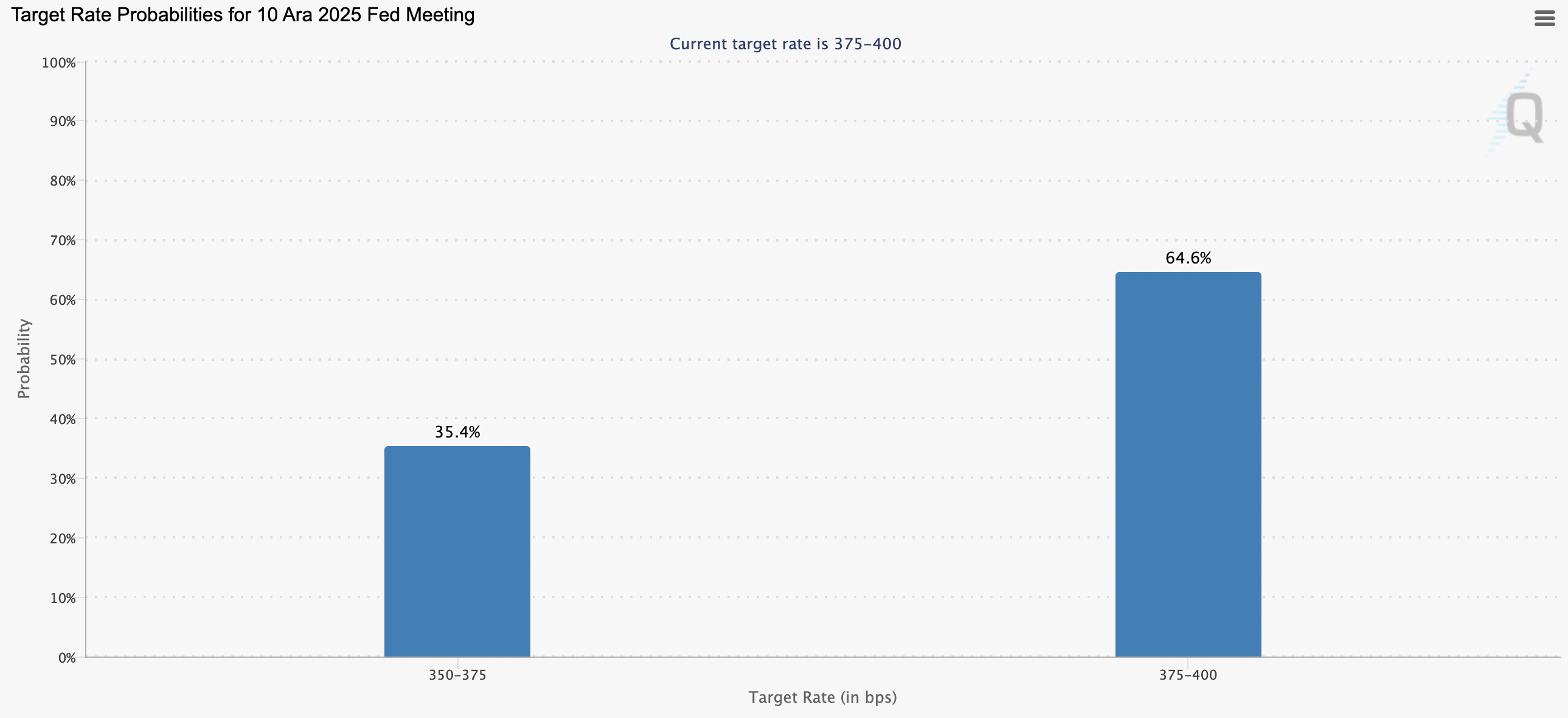

US non-farm employment data for September showed that 119,000 new jobs were added to the economy. This figure was well above the market expectation of 50,000. Strong employment data indicated that inflationary pressures were not easing, overshadowing the Fed’s monetary policy easing plans. CME Group FedWatch The broker began pricing the possibility of a 25 basis point rate cut in December as only 35.4 percent after data.

CIO of Kronos Research Vincent Liu“Employment data that came above expectations weakened the hopes for a December interest rate cut. Liquidity is low, short-term profit taking magnifies the price movement,” he said. Liu emphasized that a mere interest rate cut will not be enough for a sustainable recovery, and fresh capital inflow and blockchain demand must increase.

Known as a fear indicator in the cryptocurrency market Crypto Fear and Greed Index It continues to remain at the level of 11, that is, in the “extreme fear” zone. The total decrease in the market in the last 24 hours reached 6.6 percent. The outlook shows that investors are strengthening their risk aversion tendency in the face of macro uncertainties.

Analysts: The Decline Is A Healthy Correction

LVRG Research Director Nick RuckHe described the current price decline as a healthy resolution of overpositioning. Ruck stated that intra-blockchain data shows that the selling pressure in the spot and futures markets has stabilized, which indicates that the end of the capitulation process is approaching.

Liu, on the other hand, said that it would not be enough for the Fed to stop tightening alone for a permanent price return. According to him, for the market to gain strength again, four elements must occur simultaneously: the Fed’s stopping of balance sheet shrinkage, new capital inflow, increase in intra-Blockchain demand and positive investor sentiment.

Bitcoin’s price has fallen 32 percent since its peak of $126,000 in October. Analysts state that cryptocurrencies have become more sensitive than ever to macro data, so economic data from the USA in the coming weeks will determine the direction of the market.