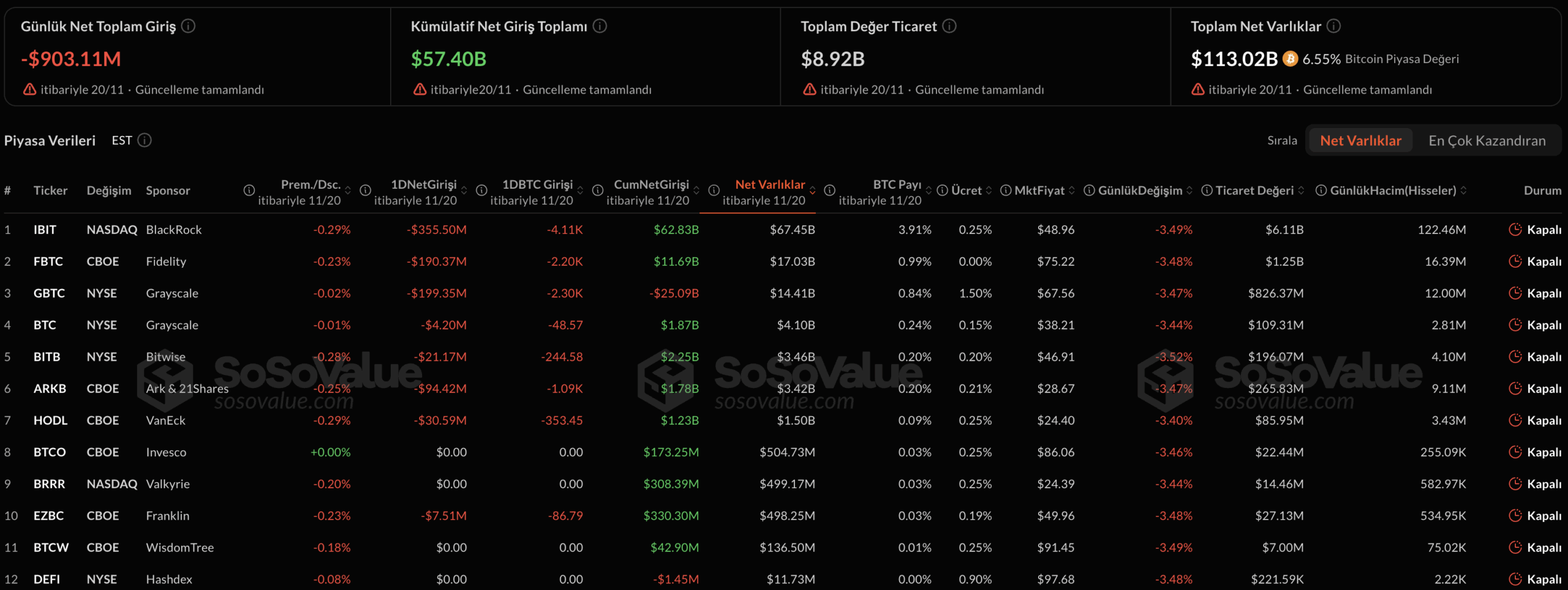

Spot traded in the USA Bitcoin  $82,845.16 There was a net outflow of $903 million from ETFs on November 20. Thus, the sharpest daily loss was recorded in ETFs since the tariff shock in February. Data shows investors are rapidly moving away from risky assets and market sentiment has changed drastically.

$82,845.16 There was a net outflow of $903 million from ETFs on November 20. Thus, the sharpest daily loss was recorded in ETFs since the tariff shock in February. Data shows investors are rapidly moving away from risky assets and market sentiment has changed drastically.

Corporate Exits Suppress Bitcoin

SoSoValue According to data from eight different countries in the USA Bitcoin ETFThere was a total net outflow of 903.11 million dollars. Biggest exit with $355.5 million BlackRockIt was in the IBIT fund of . Grayscale‘s GBTC is $199.35 million, Fidelity‘s FBTC lost $190.4 million. There was also an exit from the funds of Bitwise, Ark & 21Shares, VanEck and Franklin Templeton.

The total outflow amount was recorded as the highest level since the sales wave caused by President Donald Trump’s unexpected trade tariff announcement on February 25. BTC Markets analyst Rachael Lucasdescribed the latest move as not a return to a bear market but a drastic shift in sentiment. Lucas stated that Nvidia balance sheet data weakened the risk perception throughout the market and said that the volatility of technology giants narrowed liquidity in all areas.

The Decline in Stocks Also Hit Cryptocurrencies

Nvidiareported a 62 percent annual revenue increase in its third quarter balance sheet announced on Wednesday. However, accounts receivable reaching $33.4 billion made investors nervous. The company’s shares closed Thursday at $180.64, down 3.15 percent. S&P 500 1.56 percent, Nasdaq While it decreased by 2.15 percent, coinbase 7.44 percent, BitMine 10.83 percent and Strategy It traded with a loss of 5 percent.

While the price of Bitcoin fell below $ 85,000, the US employment data weakened interest rate cut expectations, increasing the sales pressure. However, cumulative inflows into ETFs are still at $57.4 billion, with total assets accounting for 6.5 percent of Bitcoin’s market value. Lucas said, “Institutions did not abandon the ship, they just lowered the sails a little” and pointed out that long-term investors maintained their positions.

Ethereum  $2,698.71 While an outflow of $261.6 million was observed in based ETFs on the same day, positive flows continued on the altcoin ETFs side. Bitwise XRP While the ETF attracted $105 million in inflows on launch day. solana Its ETFs recorded positive flows of $23.66 million.

$2,698.71 While an outflow of $261.6 million was observed in based ETFs on the same day, positive flows continued on the altcoin ETFs side. Bitwise XRP While the ETF attracted $105 million in inflows on launch day. solana Its ETFs recorded positive flows of $23.66 million.