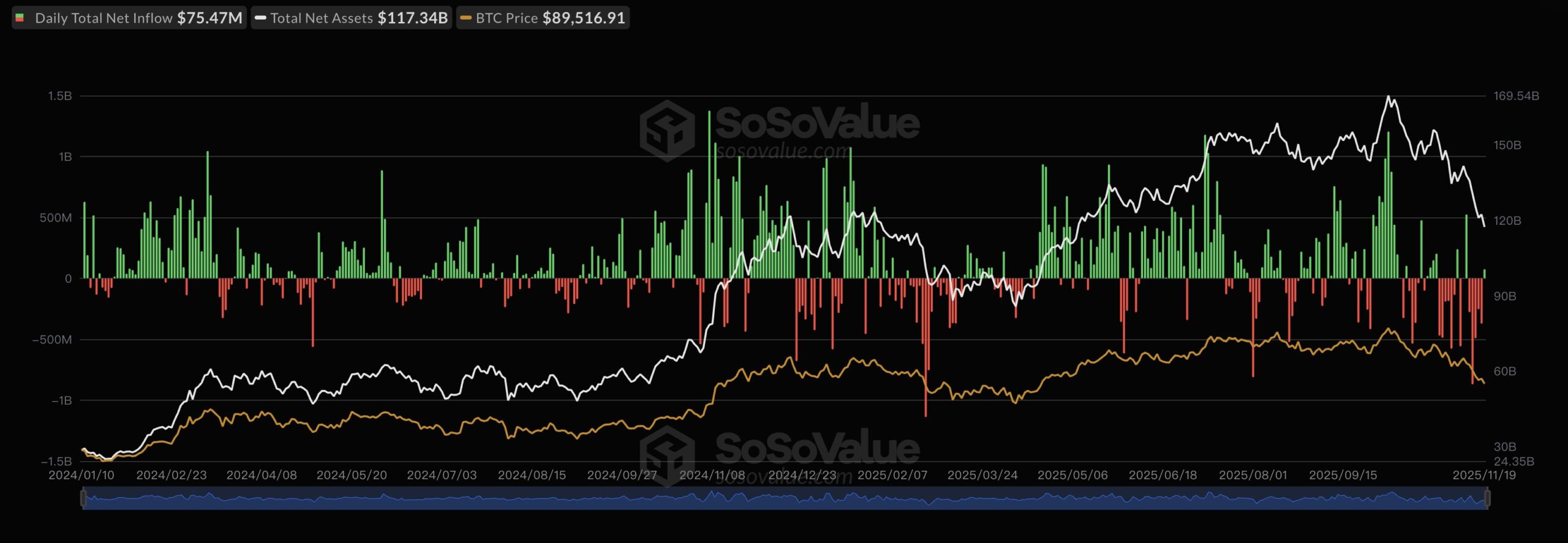

Spotlight in the USA on November 19 cryptocurrency ETF There has been a remarkable change in direction in the market. Bitcoin  $91,789.74 While a total of 75.4 million dollars entered its ETFs, Ethereum

$91,789.74 While a total of 75.4 million dollars entered its ETFs, Ethereum  $3,011.35 $37.5 million came out of his ETFs. On the same day, Solana and XRP ETFs also remained in positive territory with inflows of $55.6 and $15.8 million, respectively.

$3,011.35 $37.5 million came out of his ETFs. On the same day, Solana and XRP ETFs also remained in positive territory with inflows of $55.6 and $15.8 million, respectively.

Bitcoin ETFs Gain Strength Again

traded in the USA spot Bitcoin ETF‘s attracted attention with the strong capital inflow again as of November 19th. SoSoValue According to data, the total net inflow was $ 75.47 million, while most of this amount came from BlackRock’s iShares Bitcoin Trust (IBIT) fund. There was an investment inflow of $60.61 million in IBIT alone. With this picture, it would not be wrong to say that investor interest has turned to Bitcoin again after the weak ETF performance in recent weeks.

market experts BitcoinHe emphasizes that fund movements in , especially in terms of restoring institutional investor confidence, are critical. More than 10 spot Bitcoin ETFs traded in the US continue to manage billions of dollars in assets, and IBIT’s share is decisive in this space.

Outlook Mixed on Ethereum, Solana, and XRP ETFs

Ethereum ETFOn the ‘s side, the table is in the opposite direction. While there was a total outflow of $ 37.35 million from Spot Ethereum ETFs, the red streak moved to the seventh day. Analysts evaluate that these outflows are due to uncertainty about Ethereum’s short-term performance and expectations of a transition to staking-oriented products.

On the other hand Solana ETF‘s 55.61 million dollars, XRP ETF’s attracted a net inflow of $15.8 million. Two assets stood out as indicators of growing interest in altcoin ETFs. Especially solanaThe increase in transaction volume and institutional adaptation rate throughout the year are among the main factors supporting the flow of funds through ETFs.