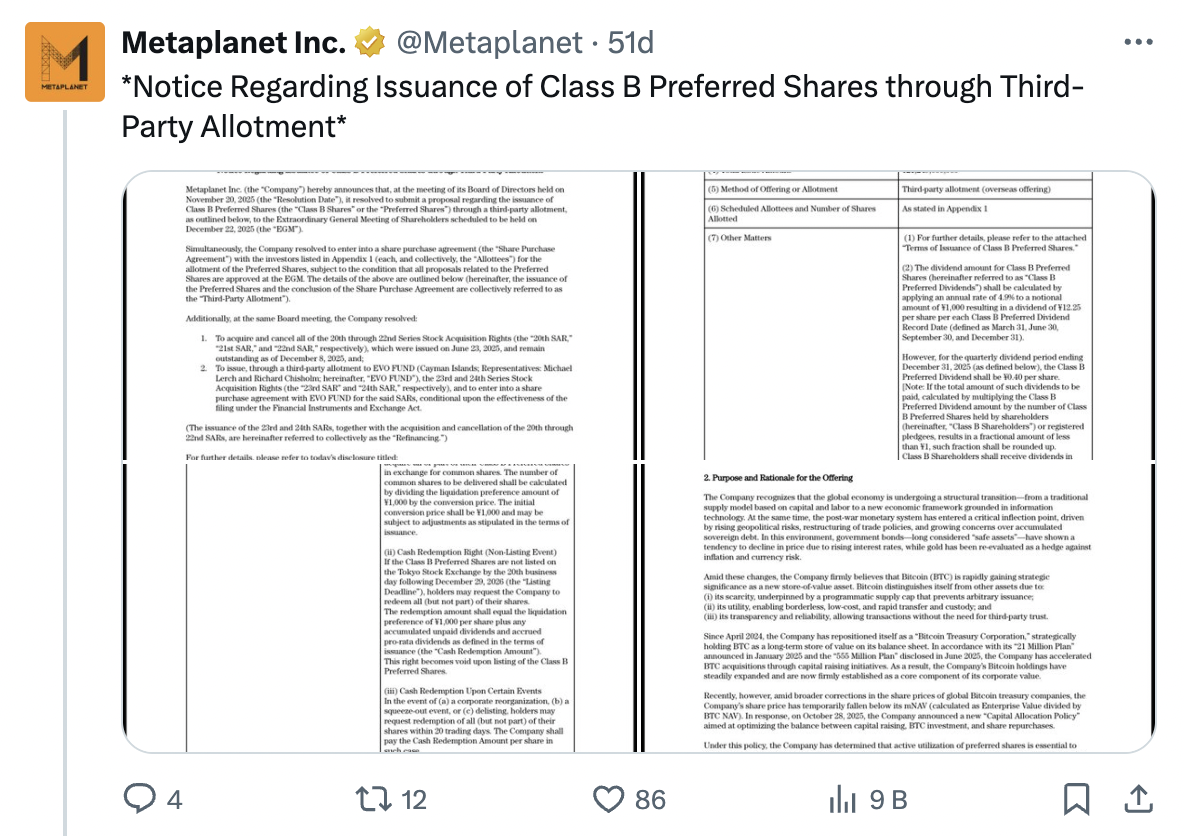

based in japan metaplanet,Bitcoin  $91,789.74 In order to increase the size of its investment, it will issue indefinite preferred shares in the amount of 150 million dollars. announced. In the statement made by the company, it was stated that this step will be financed through Class B shares offering a fixed dividend yield of 4.9 percent annually. The funds collected are new funds in line with Metaplanet’s aggressive growth strategy. Bitcoin will be used in purchases.

$91,789.74 In order to increase the size of its investment, it will issue indefinite preferred shares in the amount of 150 million dollars. announced. In the statement made by the company, it was stated that this step will be financed through Class B shares offering a fixed dividend yield of 4.9 percent annually. The funds collected are new funds in line with Metaplanet’s aggressive growth strategy. Bitcoin will be used in purchases.

Bitcoin-Focused Corporate Model Will Be Strengthened

Metaplanet, which is traded on the Tokyo Stock Exchange, stands out as one of the pioneering companies that combines the traditional financial structure with the cryptocurrency economy. The company produces over 30,000 units Bitcoin portfolioThus, it has become one of Asia’s largest institutional cryptocurrency investors. The new share issuance supports Metaplanet’s long-term reserve policy and places Bitcoin as a strategic asset. store of value positions it as .

Financing modelChoosing an indefinite privileged share structure will allow the company to strengthen its capital base without increasing its debt burden. This structure, which offers investors a fixed income instrument, also increases the interest in Bitcoin-based asset strategies in corporate markets. In this respect, Metaplanet is developing an exemplary model for other technology and financial institutions in the region.

New Phase in Digital Transformation and Capital Strategy

Metaplanet management argues that Bitcoin assets strengthen the company’s long-term financial resilience. In institutional reserves cryptocurrencyThe inclusion of these is considered a remarkable strategic initiative even for markets with strict regulations, such as Japan. The company aims to grow its existing Bitcoin portfolio while also providing a stable income stream to its shareholders.

Experts describe Metaplanet’s plan as “the maturation phase of institutional cryptocurrency finance.” With traditional financing methods blockchain This approach, which blends asset-based asset strategies, paves the way for a new investment paradigm both in Japan and globally.