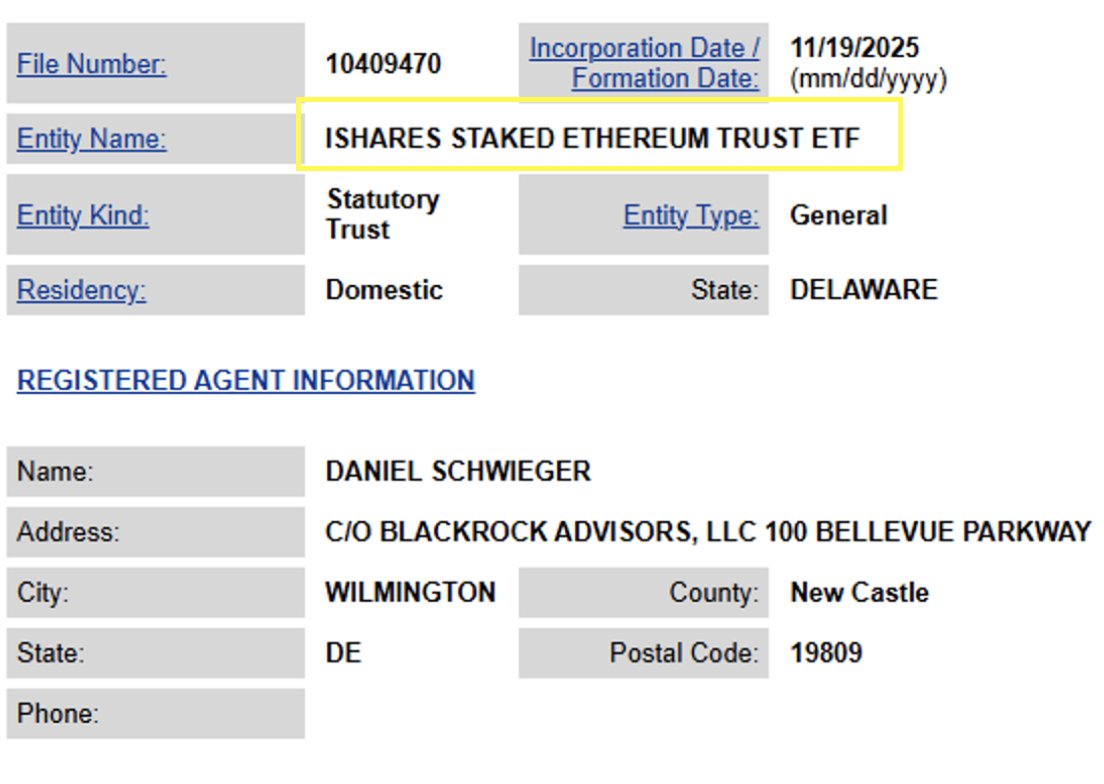

BlackRockEthereum  $3,071.75It has completed official registration in Delaware for a new investment vehicle based on , which includes staking features. The new structure created under the name “iShares Staked Ethereum Trust” is the asset management giant’s Ethereum It shows that it is preparing to move into a new era in its based products. Bloomberg ETF analyst Eric balchunasAccording to , BlackRock is expected to make its official application under securities law shortly.

$3,071.75It has completed official registration in Delaware for a new investment vehicle based on , which includes staking features. The new structure created under the name “iShares Staked Ethereum Trust” is the asset management giant’s Ethereum It shows that it is preparing to move into a new era in its based products. Bloomberg ETF analyst Eric balchunasAccording to , BlackRock is expected to make its official application under securities law shortly.

The Next Stage in Ethereum Staking ETFs

BlackRock’s move US Securities and Exchange CommissionIt came after (SEC) accepted the staking permission request made through Nasdaq. The company previously used spot Bitcoin  $91,356.83 and Ethereum ETF applications had similarly initiated registration procedures in Delaware. The decision process, which the SEC postponed last September, now includes the staking feature. ETFIt prepares the ground for the approval of . In case of approval, BlackRock will keep the assets it holds on behalf of its customers in its ETF. ETHBy staking ‘s, investors will have the opportunity to directly reflect the return.

$91,356.83 and Ethereum ETF applications had similarly initiated registration procedures in Delaware. The decision process, which the SEC postponed last September, now includes the staking feature. ETFIt prepares the ground for the approval of . In case of approval, BlackRock will keep the assets it holds on behalf of its customers in its ETF. ETHBy staking ‘s, investors will have the opportunity to directly reflect the return.

The SEC recently cryptocurrency Removing the 19b-4 filing requirement for ETPs for products that meet certain standards is also considered as a step that could accelerate the process. BlackRock Head of Digital Assets Robert Mitchnickdescribed the staking approval as “the next phase in the evolution of Ethereum ETFs.” Thus, the company aims to both increase its product diversity and provide direct access to the returns investors receive from the Ethereum ecosystem.

Competition Is Increasing in Staking-Focused ETFs

Products focused on Ethereum staking are rapidly becoming widespread in the global ETF market. 21Shares, Fidelity And Franklin Templeton Major fund providers such as have applied to add staking features to their Ethereum ETFs. REX SharesWhile ‘s “REX-Osprey ETH + Staking ETF (ESK)” product was launched as the first staking-focused ETF in the USA, it could only reach an asset size of 2.4 million dollars. However Grayscaleannounced that it has staked 32,000 ETH by starting the staking process in ETHE and ETH ETFs.

BlackRock’s existing Ethereum ETF, ETHA, is the largest product on the market with over $11.5 billion in assets under management. However, with the recent market decline, there was an outflow of nearly 200 million dollars from the ETF. The staking system, which increases the return by reducing the supply of Ethereum, has become an important tool that provides income diversification for fund managers. Still, operational issues such as regulatory risks, validator selection and slashing penalties are among the topics that fund issuers must manage carefully.