Bitcoin  $91,356.83 BTC is returning to $91,000 as its price moves towards Thursday as the breaking point. Concerns are growing that the decline in cryptocurrencies will deepen shortly before the US market opens. So what do senior analysts who know what really happened say? What does Fitch Ratings expect in 2026?

$91,356.83 BTC is returning to $91,000 as its price moves towards Thursday as the breaking point. Concerns are growing that the decline in cryptocurrencies will deepen shortly before the US market opens. So what do senior analysts who know what really happened say? What does Fitch Ratings expect in 2026?

2026 Outlook Fitch Ratings

When we superficially examine the report published a few minutes ago, some details about the coming year seem remarkable. Global government bonds There is a very negative atmosphere for Japan due to the developments in Japan. However, analysts here describe the industry outlook for bonds next year as neutral and are not that worried.

Analysts expect GDP growth to remain flat and expect uncertainty about customs duties to decrease. this too cryptocurrencies important for. The report also warns us not to ignore significant risks arising from structural changes in financial markets.

“There is a deepening recession in China, a reassessment of returns on AI investments, overheating in the US, and financial market shocks. Greater clarity on US tariff policy has emerged following a series of announcements and agreements, but much of its impact is yet to be felt. Given the US approach, regulatory challenges, US-China rivalry, and the planned review of the USMCA, volatility looks set to continue in 2026, but within a narrower range than in 2025.”

It’s good to know that the worst is over, at least for tariffs. Of course, the Supreme Court’s decision could turn this upside down.

Cryptocurrency Predictions

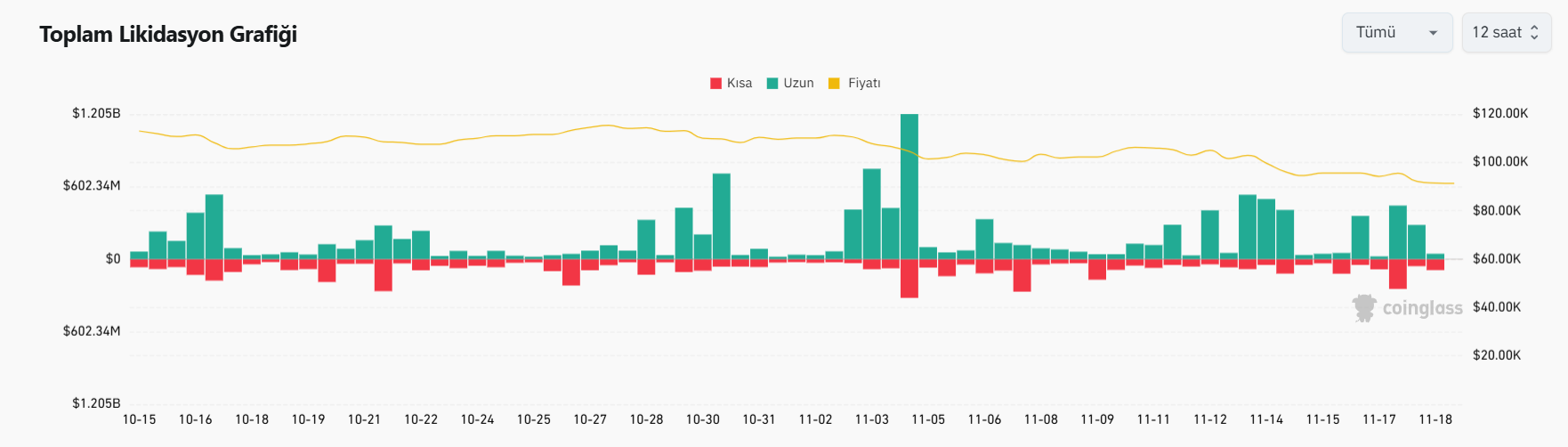

Liquidations reached a record level in October, and the October 10 drop formed the basis for this. Nansen’s research analyst Nicolai Sondergaard says that the intensity of leveraged transactions, that is, greater risks taken with money that does not exist, produces such painful consequences. Leverage in crypto was quite high as larger tops were expected and we saw major price movements to clear this. Of course, billions of dollars were liquidated as a result.

BTC It is below the January 1 price, that is, it went back to where it started, but it also saw bigger bottoms during the year. Especially the 76 thousand in April was terrible. Strategy lost 29% of its value in 1 month and BitMine lost 35%. Its losses compared to BTC were leveraged just like the rise.

The total value of derivative contracts, which was around 130 billion dollars in July, exceeded 220 billion dollars in the October ATH period and returned to July levels today after successive liquidations.

Crypto Jake Ostrovskis, OTC head of company Wintermute, said there is still interest in leveraged transactions and that unless there are restrictions, in crypto He says he will continue this. For the rise, it is good to wait for the interest here to recover faster and for the price to move to get the short liquidity accumulated above while the price is still cheap.

Bitwise CIO Matt Hougan on government reopening cryptocurrency He thinks markets could experience an ETF frenzy. While more than 100 ETFs are waiting their turn, he hopes the new wave of investors will come from here.