A tariff crisis or other periods of decline would be understandable. For example, Trump would come out and say something and then everything would fall apart. Many investors were caught off guard as this latest decline started slowly and accelerated. The S&P 500 and Nasdaq lost their 50-day moving average after 138 days.

S&P 500 and Nasdaq Decline

Bitcoin  $90,927.60 digital gold and Ethereum

$90,927.60 digital gold and Ethereum  $3,030.97 It is seen as digital oil. However, their digital aspect causes gold and oils to diverge. U.S. as cryptocurrencies continue to be treated like tech stocks in technology stocks weakness hits them too. The reasons that hit the stocks also affect cryptocurrencies.

$3,030.97 It is seen as digital oil. However, their digital aspect causes gold and oils to diverge. U.S. as cryptocurrencies continue to be treated like tech stocks in technology stocks weakness hits them too. The reasons that hit the stocks also affect cryptocurrencies.

The decline we are experiencing these days was triggered after the big selling wave, and Dow Jones experienced its worst three-day period since the tariff drop in April. Stocks constantly broke new records. After new records, short corrections and then bigger peaks, the artificial intelligence story inflated the prices.

Although cryptocurrencies could not benefit sufficiently from the rise in the stock market, they were greatly affected by the decline. Because perhaps more than 10 reasons affect risk markets, such as concerns about whether economic growth will continue in the new year, the new peak in Japan’s 10-year period, and the approach of the Supreme Court tariff decision. We talked about these in detail.

What broke the camel’s back was major tech companies’ plans to continue massive capital expenditures, increasingly through borrowing, and while this was happening, OpenAI’s announcements about government guarantees on borrowings and investments. Goldman Sachs Asset Management says we must face the reality of companies that will not be able to compete in this new world.

Amid all this, the tech-heavy Nasdaq was down 0.8% and the S&P 500 was down 0.9% at the start of the week. The loss of the 50-day moving average is something that indicates that the decline may intensify. A deeper bottom was seen below this line in the sales in April-May.

What Markets Need

It’s clear what we need to see in the coming days. NVIDIA earnings report should exceed expectations. We should see the Trump administration work for infrastructure that will balance the shock sales and panic caused by uncertainty and chaos against a possible adverse decision by the Supreme Court. September employment figures will be released on Thursday with a delay, and they are below expectations. Fed’s It should contribute to the December interest rate cut expectation.

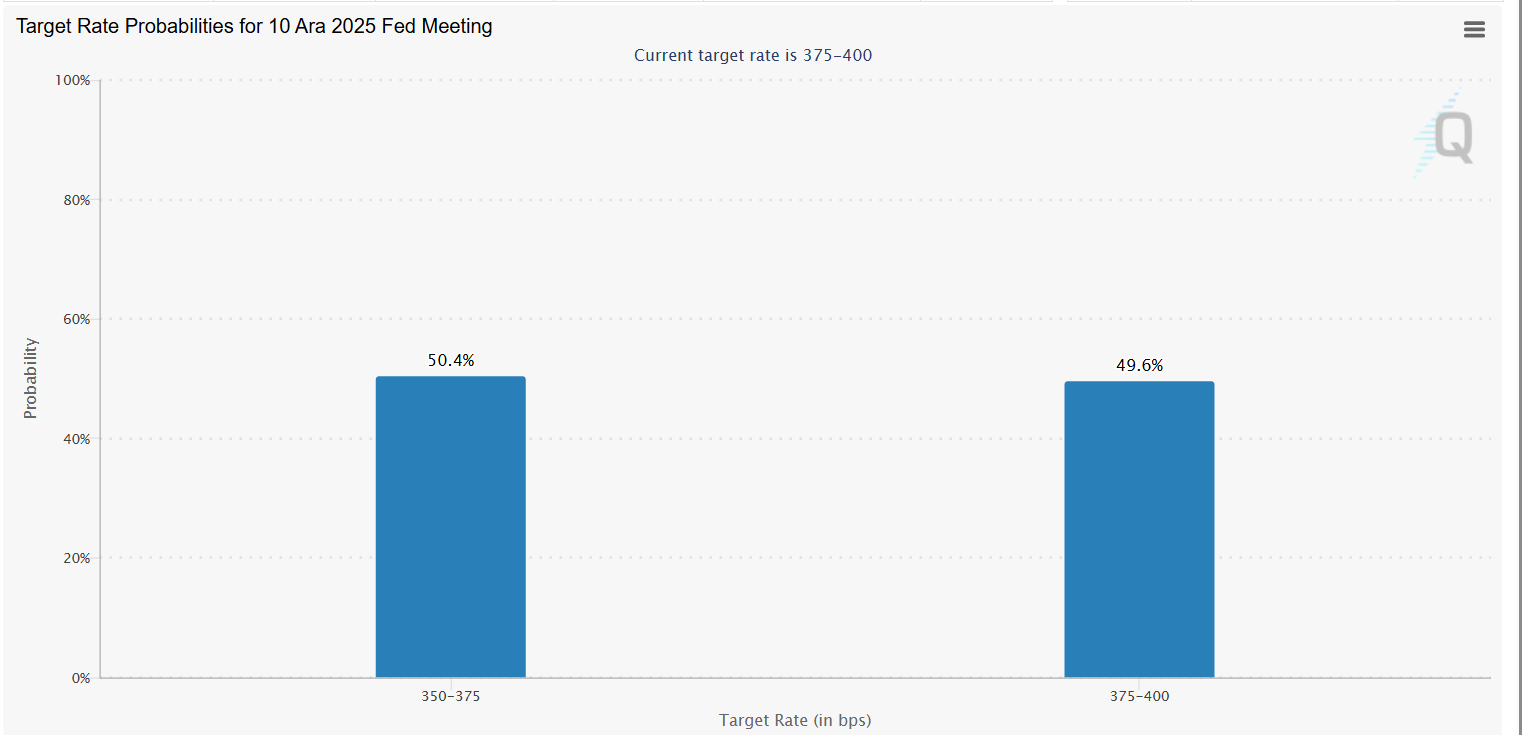

On the bright side, interest rate cut expectations have exceeded 50% again. This may help shift the trend there with future data. Moreover, since Japan’s $110 billion incentive package disrupts the balances, there is a necessity to relax faster than the Fed predicted.

It is easiest to act with fear and panic in a fall. And do the exact opposite on the rise. Loss and gain become easier as there are extreme emotions in both directions in cryptocurrencies.