Morgan Creek Capital founder Mark Yusko of cryptocurrencies He examined the period he was in and shared his evaluations about today and the future. On the other hand, Bloomberg ETF expert Eric pointed out the liveliness in the ETF channel a few minutes ago. The increase in BTC price may be related to the details shared by Eric.

ETF Activity

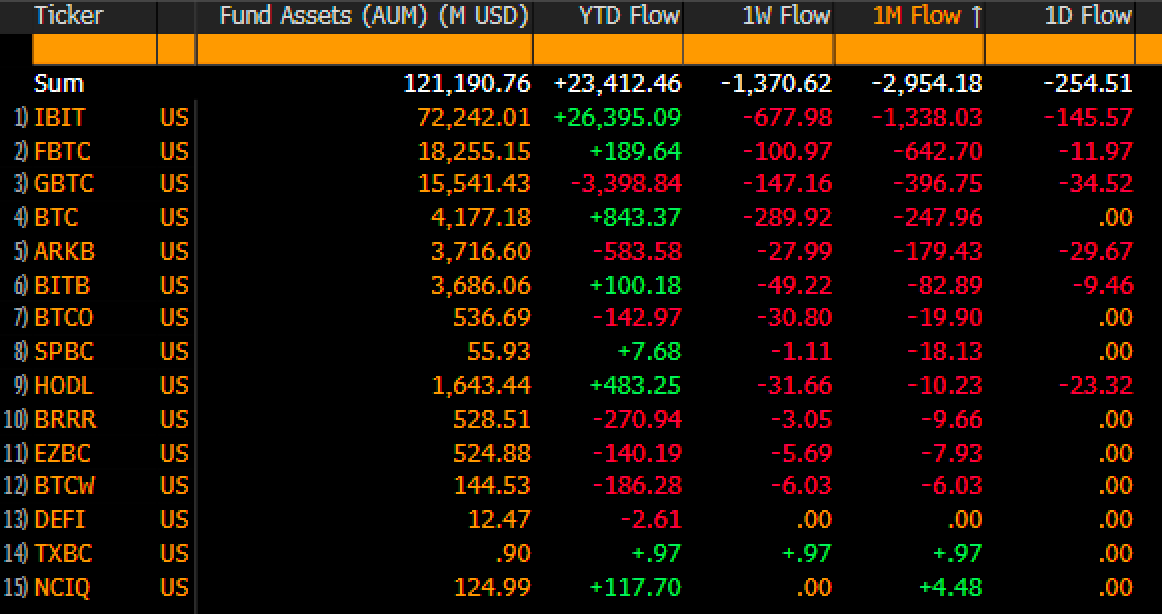

Bitcoin  $90,927.60 price After falling to $ 89,253 in the last 24 hours, it returned above 93 thousand dollars. For now, it is good to get back 92 thousand dollars, but what is important is the continuation of daily closings above it. Eric Balchunas today ETF Drawing attention to the activity on the side, he said that excessive sales have begun to reverse.

$90,927.60 price After falling to $ 89,253 in the last 24 hours, it returned above 93 thousand dollars. For now, it is good to get back 92 thousand dollars, but what is important is the continuation of daily closings above it. Eric Balchunas today ETF Drawing attention to the activity on the side, he said that excessive sales have begun to reverse.

“ETFs are buying on dips as usual… $7 billion in daily flows. This pullback is insignificant compared to the Tariff Turmoil, and they set a Q1 record at the time. We’ll see… The only notable thing is that $7 billion in flows there are heading into treasuries. It used to be stocks + gold, now it’s stocks + treasuries.”

Bitcoin ETFs It exited for $250 million, it exited for $3 billion last month, about 2.5% of total assets, 97.5% is still there. Still, $23 billion year-to-date, that’s incredible. People forget how much of an uptick there was in the 18 months before the sell-off. “Overall, it’s not bad, considering the ‘over-the-top horror’ vibe.”

Eric doesn’t see that serious of a problem and is hopeful for the future. Although the atmosphere of fear in the market is reminiscent of the April and February sell-offs in many metrics, BTC is relatively strong. Let’s see if this bearish sentiment is exaggerated. We will see this before the end of the month.

Cryptocurrency Predictions

Everyone is talking about crypto winter. altcoins It is passing from winter to winter before it has yet experienced the bull markets, and although BTC has made impressive gains, many well-known names think that the peak should be higher. This negativity is interesting, even though it has seemingly legitimate reasons as the Fed moves towards monetary expansion.

Yusko says we are in bear markets and admits that long-term investors are finally taking profits, accelerating the decline. Intense pressure in futures markets has increased this, but we will not see a repeat of 2018 or 2022. At least that’s what he expects.

Run by Tim Peterson and followed for years Metcalfe’s Law Focusing on his model (Metaf Law model), Yusko implies that we have not yet seen the real peak. In 2017, the fair value was around $10,000 while the cycle peak was at $20,000. In 2021, it was around 33 thousand dollars and the peak was reached at 69 thousand dollars. The fair value in the current four-year cycle in 2025 is $91,000, and the peak of $126,000 is puny compared to that.

DCA Yusko, who advises, is optimistic that the next cycle peak could reach half a million dollars. Although it accepts the definition of crypto winter in the short term, as I mentioned above, this will be a mild winter compared to the previous ones.

So what awaits in the worst case scenario? Historical data does not predict a bottom below $56,000 or a loss of that area. However, Yusko marks $70,000 as the bottom.