The crypto market has continued to bleed, led by Bitcoin (BTC). The total crypto market cap slipped 2% to hover around $3.12 trillion on Monday, November 17 during the late North American trading session.

As a result, more than 154k traders were liquidated, with total liquidations totaling about $801 million. Out of this, around $500 million involved long traders, thus further strengthening the midterm crypto selloff through a long-squeeze.

Crypto Traders Fear for the Worst

The crypto market has been trapped in a series of brutal sell-offs in the past four weeks. In the past 41 days, the total crypto market cap has dropped over $1.1 trillion amid heavy liquidations of long traders.

Source: X

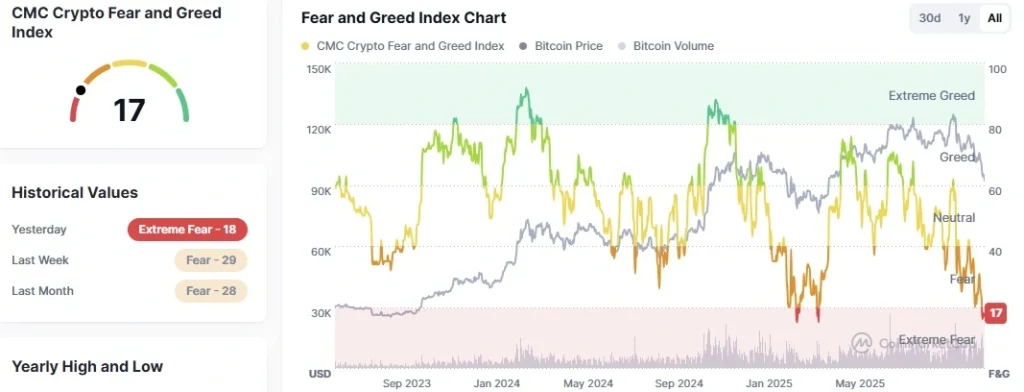

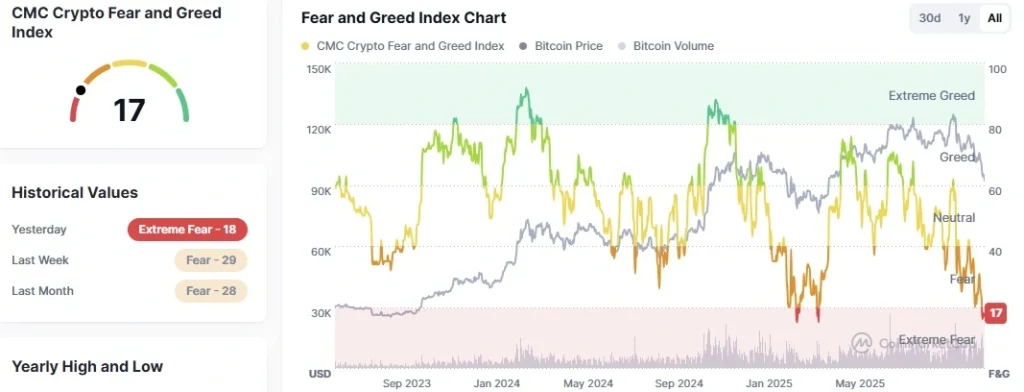

As a result, the fear of a further crypto crash is palpable. According to Binance-backed CoinMarketCap (CMC), the Crypto Fear and Greed Index has dropped to 17, almost the lowest level year-to-date.

Source: CoinMarketCap

What’s Next for Altseason?

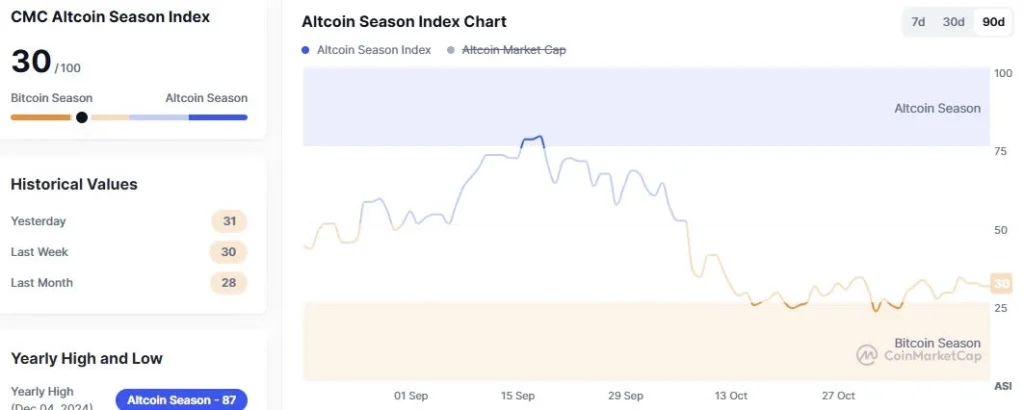

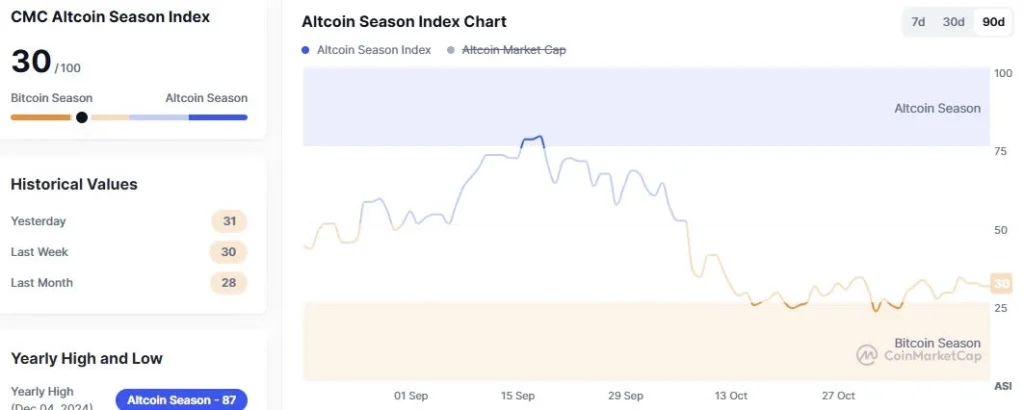

According to market data analysis from CMC, crypto traders have been favoring a Bitcoin season in the past few days. The CMC’s Altcoin Season Index hovered around 30/100 as the majority of the crypto projects bleeds amid low fresh liquidity.

Source: CoinMarketCap

However, several key macroeconomic events are expected to trigger a fresh wave of global liquidity injection. Historically, a spike in global money supply has favored bullish sentiment for the wider crypto market. Some of the wider macroeconomic events to consider for bullish altseason 2025 include:

- The US is preparing $2,000 stimulus checks.

- Japan is preparing a $110 billion stimulus package.

- China has approved a $1.4 trillion stimulus package.

- The Fed is officially ending Quantitative Tightening (QT) on December 1st.

- Canada is restarting its Quantitative Easing program.

- Global M2 money supply is at a record $137 trillion.

- Global rate cuts are at more than 320 over the last 24 months.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.