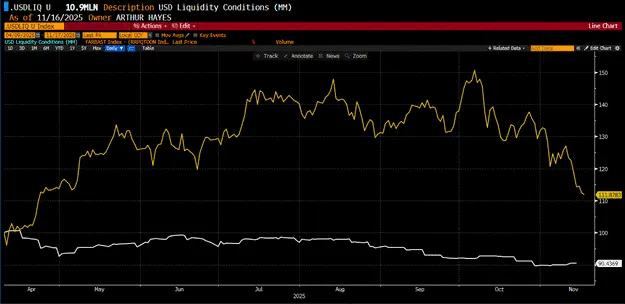

Co-founder of BitMEX Arthur Hayes last published in the blog post Bitcoin  $95,650.36He emphasized that the fall below $90,000 was not due to the fundamentals but to the contraction in dollar liquidity. Hayes said that as the effect of ETF arbitrage and digital asset treasuries (DAT) decreases, the selling pressure has strengthened, and the largest cryptocurrency may fall to the $ 80,000-85,000 band in the short term. However, the famous investor predicts that the money supply, which will increase again after a possible correction in US stocks, may move Bitcoin to the range of $ 200,000-250,000 by the end of the year.

$95,650.36He emphasized that the fall below $90,000 was not due to the fundamentals but to the contraction in dollar liquidity. Hayes said that as the effect of ETF arbitrage and digital asset treasuries (DAT) decreases, the selling pressure has strengthened, and the largest cryptocurrency may fall to the $ 80,000-85,000 band in the short term. However, the famous investor predicts that the money supply, which will increase again after a possible correction in US stocks, may move Bitcoin to the range of $ 200,000-250,000 by the end of the year.

“Liquidity is Declining, Bitcoin is Under Pressure”

According to Hayes Bitcoinis a free market indicator of the global fiat money supply. As dollar liquidity in the US declined, the flow of institutional funds into ETFs and DAT shares came to a halt. In the period April–October Bitcoin ETFThe capital directed to ‘s decreased rapidly as the futures base difference lost its appeal. Hayes emphasized that this balance has now collapsed, saying, “Institutional investors were buying Bitcoin not because they believed in it, but because they were getting returns above interest rates.”

The capital coming out of Bitcoin ETFs also creates demoralization in individual investors. DAT The discounting of their structures, for example Strategy (MSTR) falling below its net asset value, further limits corporate demand. According to Hayes ETF and the halt in the flow of funds to DATs eliminated the last elements obscuring the negative dollar liquidity outlook.

Wave of “Money Printing” Following the Repression

Although Hayes predicts a decline in the short term, he argues that this will not turn into a permanent bear trend. According to him, US Treasury Secretary Buffalo Bill BessentDespite the Fed, it will have to take steps to reassure the markets. A 10-20 percent correction in stocks and bond interest rates approaching 5 percent may lead policy makers to print money again.

Famous investor China also has its own monetary expansion He also noted that he was preparing for his move. According to him, the People’s Bank of China’s resumption of purchasing government bonds indicates that the global liquidity cycle will gain momentum again. He concluded his blog post by saying, “Both Trump and Xi openly accept the value of Bitcoin. How can one be pessimistic in the long term when there is such a clear picture?”