The Ethereum (ETH) price is holding firm above the $3,100 level even as Bitcoin slid sharply below $94,000, setting up a clear divergence ahead of a high-stakes macro week. Traders are bracing for the release of the FOMC meeting minutes, alongside key U.S. economic indicators—including unemployment claims, PMI readings, and the Treasury Currency Report—all of which could inject fresh volatility into crypto markets.

Despite this risk-heavy backdrop, ETH continues to outperform BTC, supported by stronger derivatives positioning and healthier liquidity flows.

ETH Outperforms During Risk-Off Move

Ethereum is currently trading around $3,190, holding above the key $3,100 zone while the broader market suffers. While Bitcoin lost nearly 6% in 24 hours, sliding below $94,000, ETH dropped only 2.1% over the same period and held firmly above $3,100. The ETH/BTC ratio also bounced +1.8% from its weekly low, signaling a measurable rotation of capital toward

Ethereum, despite risk-off conditions. Futures data shows ETH long liquidations came in 40% lower than BTC, helping suppress volatility and preventing the type of cascading sell pressure seen in Bitcoin. Combined, these metrics reinforce that ETH remains the stronger asset heading into a heavy macro week.

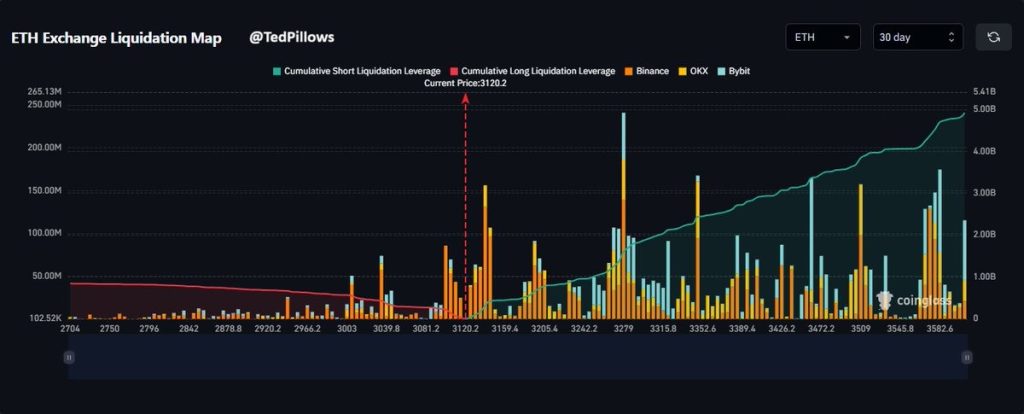

Derivatives Landscape: Liquidation Map Favors Upside Targets

New 30-day liquidation map data shows Ethereum positioned advantageously compared to the rest of the market. The chart reveals a tight cluster of long liquidations between $2,950 and $3,050, suggesting this is the nearest zone where volatility could spike if ETH wicks lower.

But the more decisive signal is above:

Most of Ethereum’s high-volume liquidation liquidity sits on the upside—not the downside.

Large accumulations of short-liquidation leverage appear in the $3,250–$3,600 band. A push into this zone could spark a series of short covers, creating a mechanical rally as positions get force-closed.

In short:

- Downside risk exists but is limited to one narrow cluster.

- Upside wicks are increasingly likely if ETH regains momentum.

- Derivatives positioning supports the idea that ETH is better positioned than BTC heading into next week.

This aligns with ETH’s broader spot-market stability and continues to reinforce its relative strength narrative.

ETH Price Analysis: Strong Structure Despite Volatility

Ethereum is trading near $3,150–$3,200, holding above the major demand zone that previously acted as a springboard during September and early November. The second-largest token has been constantly printing lower highs and lows, showing immense weakness of the bulls. The price recently lost the pivotal support zone between $3530 and $3589, which has erased the gains incurred in the past 3 to 4 months.

However, the technicals hint towards a potential rebound, but the question arises whether the bulls may help the ETH price reclaim the important support-turned-resistance levels.

Ethereum is attempting a rebound from the $3,020 support, a level it has defended twice this month. The RSI remains weak near 37, suggesting limited momentum, while the MACD continues in bearish territory, indicating sellers still dominate. ETH must reclaim the $3,360–$3,420 supply zone to confirm short-term strength. Failure to do so risks another retest of $3,020, and a breakdown could open room toward $2,850. A breakout above $3,420 would target $3,875 next.

Ethereum’s Setup Improves If Macro Data Eases

Next week’s macro releases will determine whether the market continues risk-off behavior or shifts toward stabilization. ETH is currently the least fragile major asset, and even a mild improvement in sentiment could set off an upside liquidity sweep.

A reclaim of $3,250–$3,320 is the immediate trigger to watch. If that breaks, ETH could rapidly target the $3,480–$3,600 short-liquidation zone.

On the downside, a wick into $2,950–$3,050 remains possible but is unlikely to change the broader trajectory unless accompanied by major macro deterioration.