Spherical cryptocurrency -based investment products saw the sharpest weekly outflow of the year with a total outflow of $ 2 billion last week. Selling pressure from the US strengthened investors’ tendency to avoid uncertainty in monetary policy and local whale sales. Bitcoin, one of the leading cryptocurrencies  $95,650.36 and Ethereum

$95,650.36 and Ethereum  $3,195.79 While Germany led the fund outflows, it showed a positive divergence despite the negative atmosphere in the overall market.

$3,195.79 While Germany led the fund outflows, it showed a positive divergence despite the negative atmosphere in the overall market.

USA Became the Dominant Exit Point, Germany Seized the Opportunity

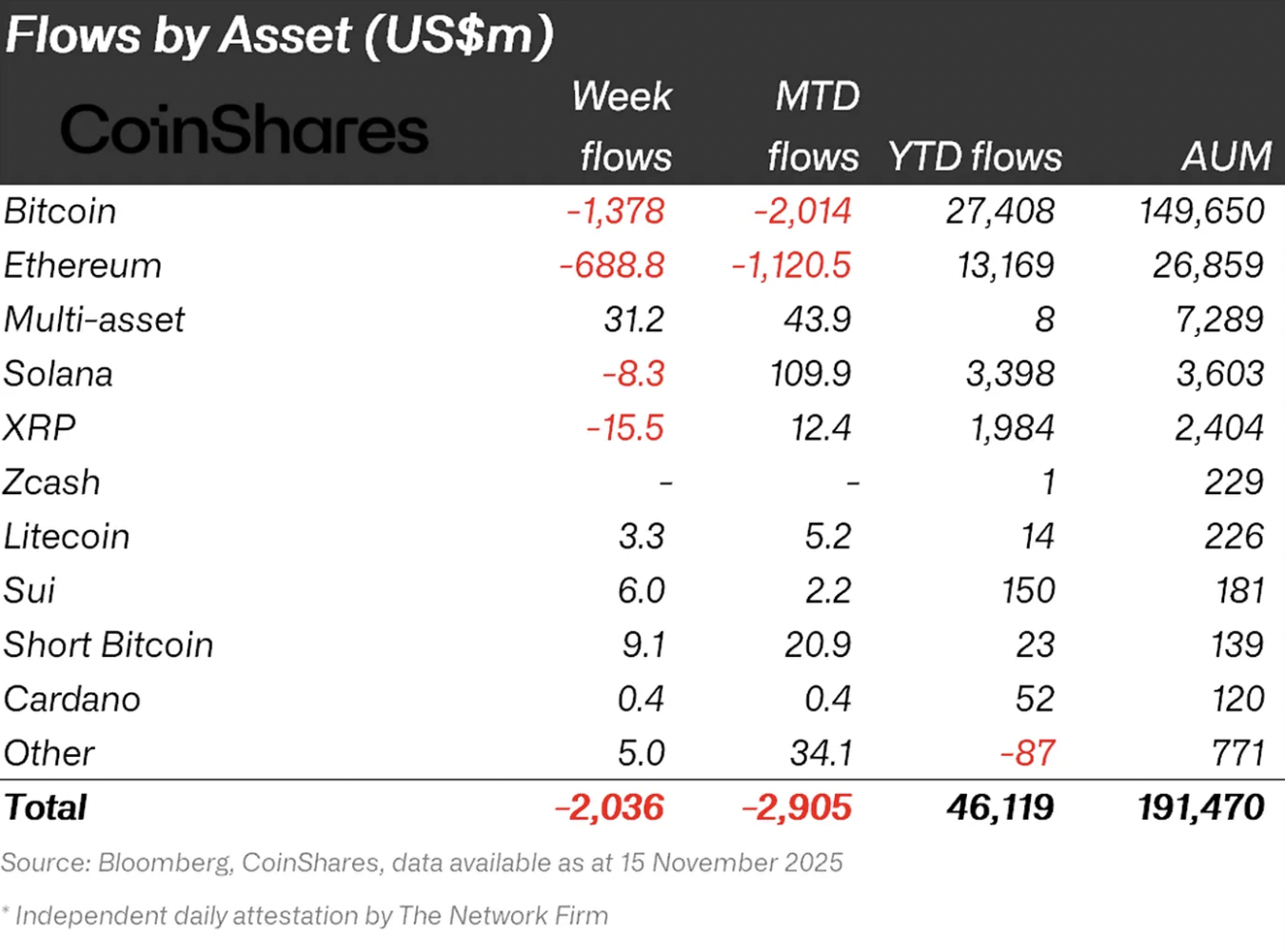

CoinShares’ 260th weekly to the report according to USA Based investors accounted for 97 percent of the global outflow with a fund outflow of $1.97 billion. Switzerland And Hong Kong While recording an output of 39.9 million and 12.3 million dollars, respectively, German Investors turned low prices into a buying opportunity and made an inflow of 13.2 million dollars. The resulting picture clearly reflects the divergence in regional investment behavior.

The report notes that the total asset size under management (AuM) of cryptocurrency-based investment products fell to $191 billion from a peak of $264 billion in early October, indicating a 27 percent decrease in the last six weeks. Analysts emphasize that uncertainty about the Fed’s interest rate policies and large investor sales were effective in this decline.

Hard Exit in Bitcoin and Ethereum

Last week Bitcoin 1.38 billion dollars from based investment products, EthereumThere was an outflow of 689 million dollars from . The resulting figures correspond to 2 percent of total assets in Bitcoin and 4 percent in Ethereum. solana And XRP On the front, there was a limited outflow of 8.3 million and 15.5 million dollars, respectively. Litecoin  $96.56, Sui And cardanThe entry into o was $3.3 million, $6 million and $400,000, respectively.

$96.56, Sui And cardanThe entry into o was $3.3 million, $6 million and $400,000, respectively.

On the other hand, investors moved away from the volatility in single assets and turned to multi-asset-based investment products. A total of 69 million dollars have been entered into these products in the last three weeks. In the same period shortBitcoin There was also an increase in their positions. It was noted that investors turned to risk hedging strategies. Experts evaluate that, despite the short-term selling pressure, these movements may be supportive in the medium term in terms of restoring market balance.