Ethereum, the largest altcoin by market cap  $3,195.79By adopting ‘ as a reserve asset, BitMine has accumulated billions of dollars. Moreover, he did this in just a few months and unfortunately ETH continues to decline. A comprehensive announcement was released today regarding both the current situation and bullish expectations for the future.

$3,195.79By adopting ‘ as a reserve asset, BitMine has accumulated billions of dollars. Moreover, he did this in just a few months and unfortunately ETH continues to decline. A comprehensive announcement was released today regarding both the current situation and bullish expectations for the future.

Ethereum Reserve Company

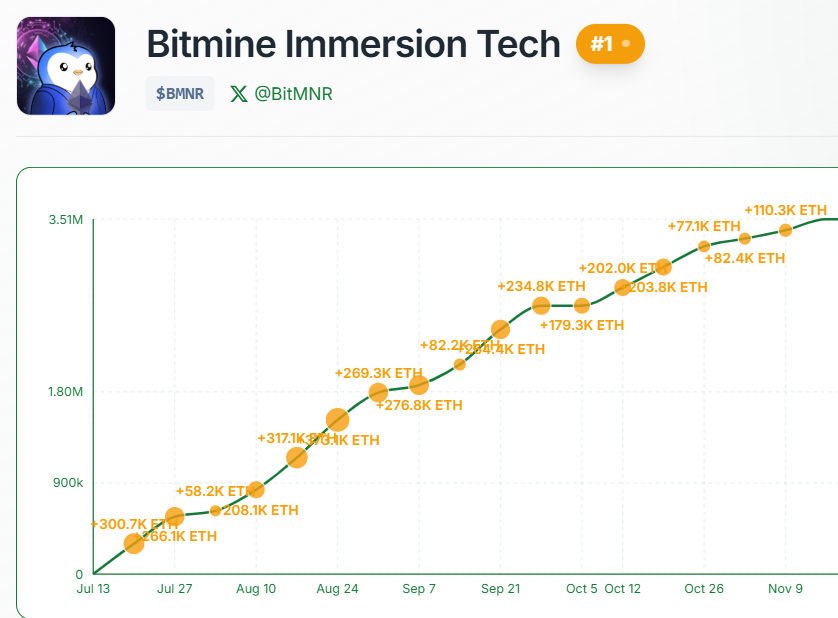

Even though it doesn’t continue at the pace it started ETH reserve companies continues to stand. At the time of writing, BTC has fallen back to $93,000 and ETH is struggling to maintain $3100. With the announcement published a few minutes ago, BitMine announced that its total assets reached 11.8 billion dollars and its ETH reserves are based on 3.6 million. The company, which currently has close to $607 million in cash assets, is determined to make more acquisitions.

The company, which currently owns 2.9% of the ETH supply, wants to increase it to 5%. They’re already halfway there. BitMine, which maintains its place among the 48 most traded stocks in the USA with an average transaction volume of $ 1.4 billion, holds 3,559,879 ETH at an average cost of $ 3,120. ETH price is right in the cost zone right now.

Cryptocurrency Bull Predictions

BitMine President Fundstrat’s Thomas Lee argues that the decline is due to some market makers. Especially the abnormal movements experienced on October 10 told us that there was a problem with market makers. Some currency pairs reached zero dollars and the price difference between exchanges increased significantly.

“crypto prices It has not recovered since the liquidation event on October 10. And continued weakness points to a market maker (or two) with a weakened balance sheet. When a market maker has a ‘gap’ on its balance sheet, it attempts to raise capital and reduces its liquidity functions in the market. This is equivalent to QT (quantitative tightening) for crypto and has the effect of lowering prices. In 2022, this QT effect lasted 6-8 weeks. And this probably still happens today.

However, we do not think crypto prices have peaked for this ‘cycle’.”

Lee argues that the crypto cycle peak will likely be seen in 12-36 months and that we are in a different environment from past cycle behavior.

“The fourth quarter is a seasonally strong period for crypto and equity prices and has historically encouraged investors to increase their ‘short positions’, so respective trading volumes should improve in the coming weeks.”