The biggest cryptocurrency Bitcoin  $96,065.54 As we start the new week, it continues to be priced below the $ 100,000 threshold. The decline experienced last week, combined with the sharp retreat in US technology stocks and the decrease in risk appetite of institutional investors, increased the atmosphere of panic in the markets. Ethereum

$96,065.54 As we start the new week, it continues to be priced below the $ 100,000 threshold. The decline experienced last week, combined with the sharp retreat in US technology stocks and the decrease in risk appetite of institutional investors, increased the atmosphere of panic in the markets. Ethereum  $3,216.28XRP, Solana and Cardano

$3,216.28XRP, Solana and Cardano  $0.504067 Major altcoins such as lost between 8 and 16 percent in value. Experts state that the market has technically entered a bear cycle with the slowdown in fund inflows to ETFs and the increase in sales by long-term investors.

$0.504067 Major altcoins such as lost between 8 and 16 percent in value. Experts state that the market has technically entered a bear cycle with the slowdown in fund inflows to ETFs and the increase in sales by long-term investors.

Technical Disruption in Bitcoin

Bitcoin breaking the monthly average at $100,266 shows that a strong technical support zone has disappeared. It is stated that the price may form a base in the range of $ 93,000-95,000. According to Bitunix, if this region is lost, the price may rapidly decline towards the liquidity gap around $89,600. On the upside, $100,200 and $107,300 levels stand out as resistance. Liquidity contraction and weak volume limit the possibility of a short-term recovery.

LVRG Research analyst Nick Ruckbiggest cryptocurrencyHe stated that the Turkish lira’s effort to hold on around $92,000 will depend on the FOMC minutes to be published next week. According to Ruck, outflows from ETFs and the death cross signal in technical indicators support the downward trend, while uncertainty in economic data in the US may increase volatility in the markets. Especially government shutdownThe new data to be published after will be decisive for investor psychology.

Blood Loss in Altcoins: Solana and Cardano Stand Out

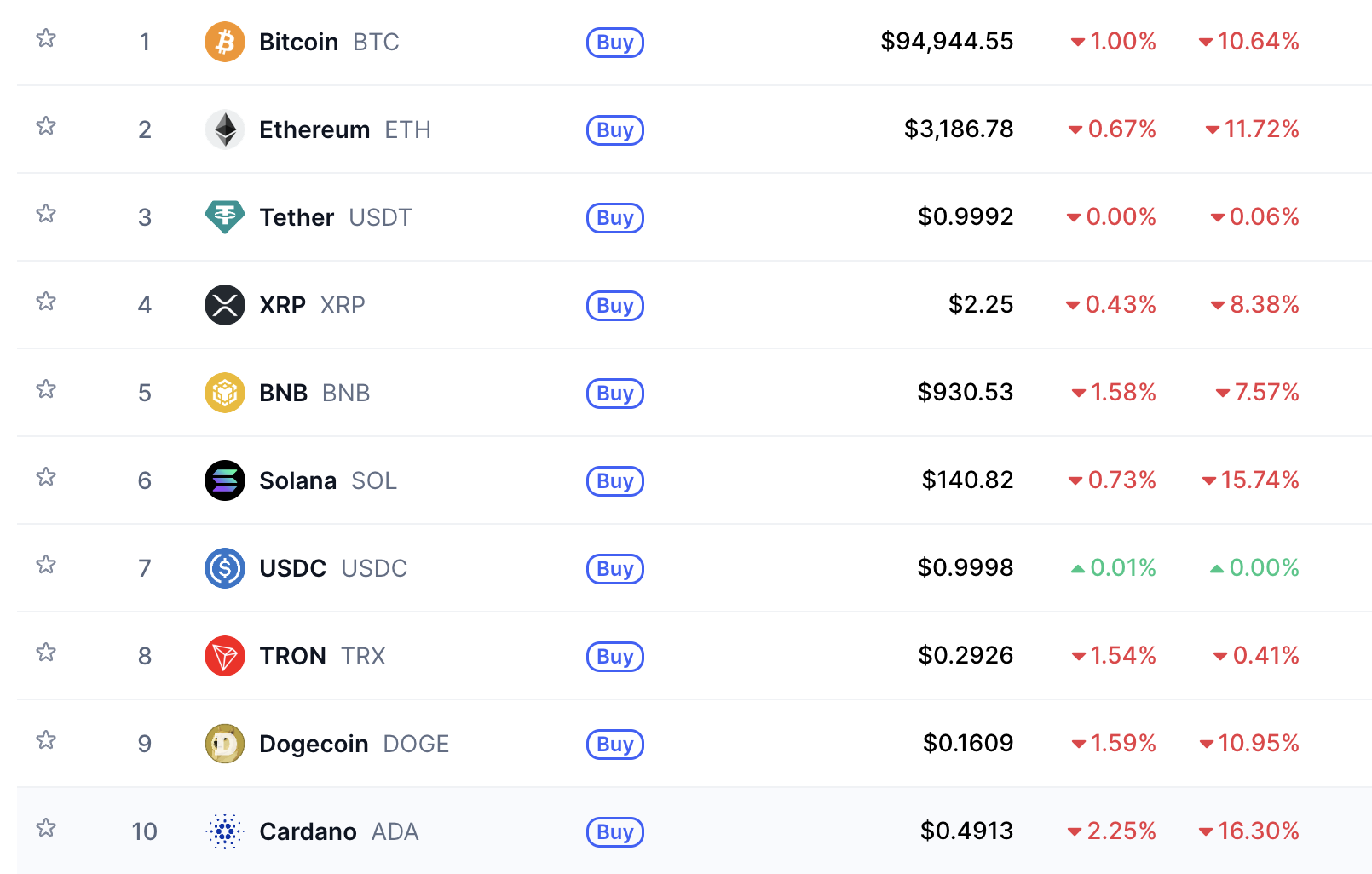

In parallel with the decline in Bitcoin, a large altcoinHard sales were also observed in ‘s. Ethereum While it lost 12 percent of its value on a weekly basis and fell to 3,182 dollars, XRP It fell to $2.25. BNB It closed the week with a loss of nearly 8 percent, trading at $932. The steepest decline is solanaIt happened in . The giant altcoin dropped 16.5 percent weekly to $140. dogecoin  $0.163939 to $0.161, Cardano While it decreased to $0.491, TRX It remained relatively stable and held at $0.292.

$0.163939 to $0.161, Cardano While it decreased to $0.491, TRX It remained relatively stable and held at $0.292.

BTSE COO Jeff MeiHe stated that the markets may be preparing for the possibility of the Fed pausing interest rate cuts in December. According to Mei, investors will remain cautious until new and supportive macroeconomic catalysts are seen. In particular, the fact that Bitcoin completely erased the 30 percent performance it gained at the beginning of the year shows that institutional demand has weakened and the market has entered the risk aversion phase. The 25 percent decline since the peak of $126,251 on October 6 accelerated after the Trump administration’s statements about trade policies.