BTC suddenly surpassed $95,500 after a rapid decline, and at the time of writing, volatility is increasing again. Markets in cryptocurrencies have not recovered since October 10th. Let’s examine what happened and what could happen from the perspective of on-chain analysts.

Bitcoin Price and Comment

BTC It suddenly jumped from 94 thousand dollars to 96 thousand dollars in the minutes when the article was being prepared, and while the decline was accelerating, it was doing similar things days ago. Maybe we can see the exact opposite of what we experienced in the decline. Today we will examine the current evaluations of 2 different on-chain analysts. Firstly CryptoQuant Let’s look at its CEO, Ki Young Ju.

This name is a world-famous on-chain analyst and the CEO of one of the largest on-chain analysis tools, and he also has many self-produced metrics and so on. The analyst, who said on March 18 that there would be a decline for 6-12 months, said weeks later that some signals misled him and wrote the following today.

“This decline is due to long-term investors converting among themselves. Bitcoin

$95,650.36ciciIt sells to Tradfi players who will keep it in the long term.

The reason I predicted a top earlier this year was because OG whales were selling hard. However, the market structure has changed. ETFs, MSTR and other new channels constantly injected new liquidity. Onchain inflows are still strong. This decline is mainly due to OG whales pulling the market down.

Now sovereign wealth funds, pension funds, multi-asset funds and corporate treasuries are creating even larger liquidity channels. “Until these liquidity channels stop working, cycle theory is invalid.”

As you can see, Ki Young Ju says that the declines will fail and the rise will continue while everyone screams in panic and covers their ears. Let’s hope 401k retirement plans start accumulating BTC quickly as soon as possible.

Long Termers and Crypto

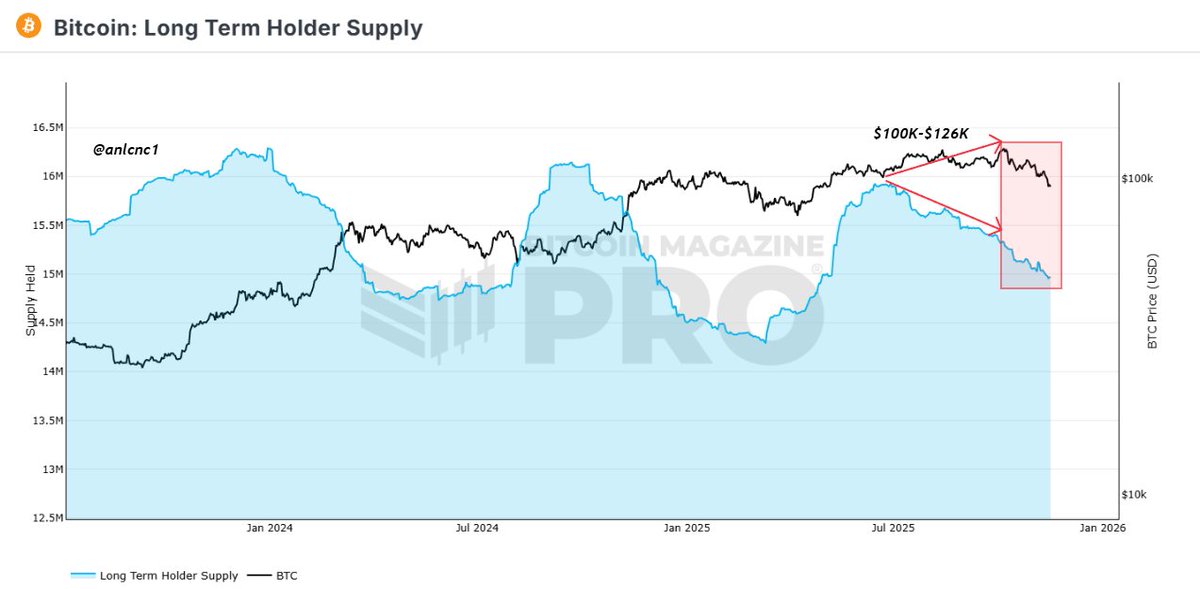

Ki Young Ju says long-termers are selling to institutions and are not falling into bearish psychology. On-chain analyst anlcnc1 is not that pessimistic either, but he looks at the current situation from a slightly different perspective. His theory is now that long-termers are no longer motivated to collect as things fall, and things like tariffs and government shutdowns discourage them.

“It was going well up to a point. Its accumulation at the bottom point saved lives. As I shared at that time, the supply started to increase at 82K along with the price. Probably, if it weren’t for Trump’s interventions, this equation would not have been disrupted, because it was working well between 100-126, even if it was delayed. The reasons for the delay were, as usual, tariffs and war conversations. If the wallet recorded on the chain has not moved for 155 days, it is reflected in the LTHS metric, and they become long-termists.”

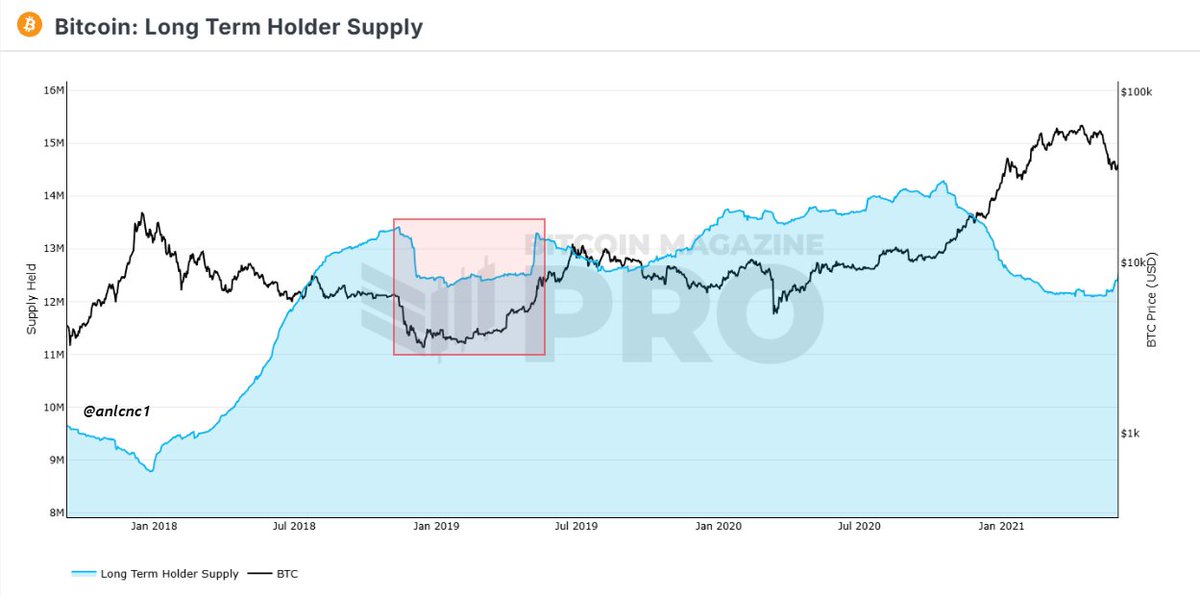

So has anything like this happened before? Anıl gives an example from 2018. of BTC The period when it decreased from 6 thousand dollars to 3 thousand dollars. Corporate FUD was big in those days and interest had waned significantly.

“I follow this closely. If we see an increase again, it will be positive, if not, it will continue as negative data. Because it is not good for us to lose long-term investors, we need to win.”