Bitcoin  $95,870.81 And altcoins We are not having a great weekend again. BTC is just below $96,000 and the rest of the cryptocurrencies have yet to recover. Continuing losses throughout the week pushed the king cryptocurrency to five-digit levels and caused a deeper bottom to form.

$95,870.81 And altcoins We are not having a great weekend again. BTC is just below $96,000 and the rest of the cryptocurrencies have yet to recover. Continuing losses throughout the week pushed the king cryptocurrency to five-digit levels and caused a deeper bottom to form.

Bitcoin (BTC)

whale sales and ETF In addition to the outflows, we also saw that individuals reduced their assets as the December interest rate cut fell short. Coinbase Premium tells us that US-based investors are in one of their weakest periods. While the fear index lingers at rarely seen levels, historical data suggests further declines to come.

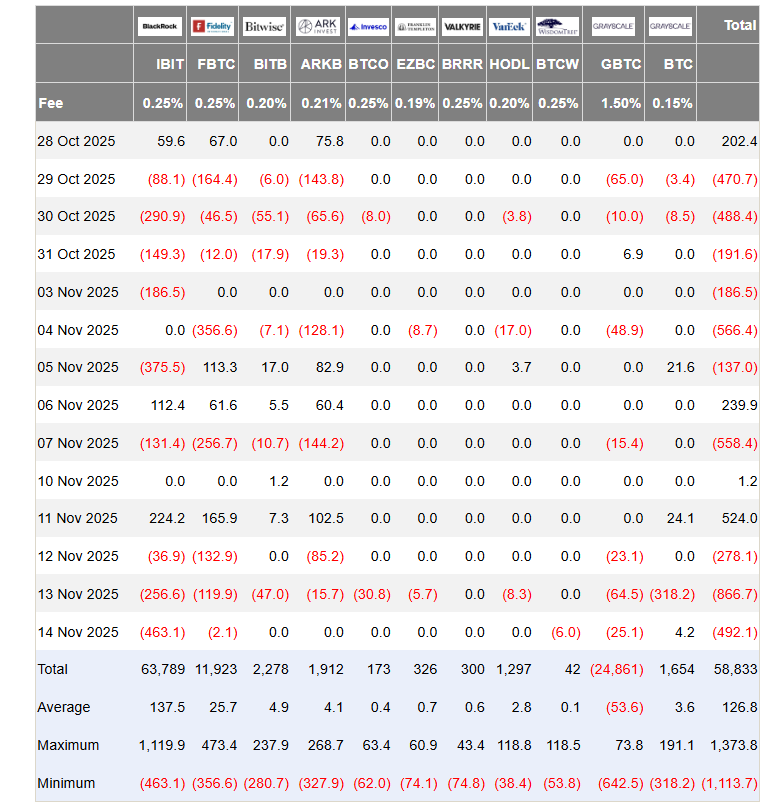

There was a total outflow of $492 million from Bitcoin ETFs on Friday. BlackRock is almost single-handedly responsible for all exits. We saw a net outflow of nearly 1.8 billion dollars in the 3-day period between November 12-14 alone.

Although the end of the government shutdown caused an inflow of half a million dollars at the beginning of the week, the fact that the data would be delayed and the Fed members mentioned that they would make blind decisions in December, as in October, disrupted the expectation of a stable discount. Although the decline seems to have stopped for now, the interest rate policy direction, which may change depending on the economic data coming next week, is the only hope of cryptocurrency investors.

$94,000 was a good base for BTC in April and May. We can expect the same to happen again. In a reasonable scenario, BTC can be expected to linger in this range for a while and then reclaim $102,800.

Cryptocurrencies

Although annoying, if Bitcoin price lingers in the current range, opens up space for altcoins, and then returns to six-digit levels, it could have good results for the rest of the cryptocurrencies. For a long time, BTC has been experiencing frequent declines, forcing most cryptocurrencies to make deeper bottoms. What is needed now is for BTC to avoid deeper bottoms and create room for recovery from now on.

In the short term ETH It does not seem logical for other major cryptocurrencies to diverge positively and experience modest increases. However, if BTC does not maintain its current region and carry sales to 85 thousand dollars, the charts may reverse when the priced December interest rate decision and the high court tariff concern become reality.

cryptocurrencies The most important aspect is that it overprices upcoming risks and positive developments. We see that fear is overpriced these days. It makes sense to me that the lagging altcoin bull would rise against such a backdrop as we have seen major rallies following years of overpriced fear. And of course, who can’t see the future?