While stocks are falling, bond yields are rising as the shutdown ends. In cryptocurrencies BTC has been falling pretty steadily for the last few hours. While altcoin investors faced losses exceeding 6 percent, ETH fell to $ 3200. So how long will this continue?

Bitcoin Drop

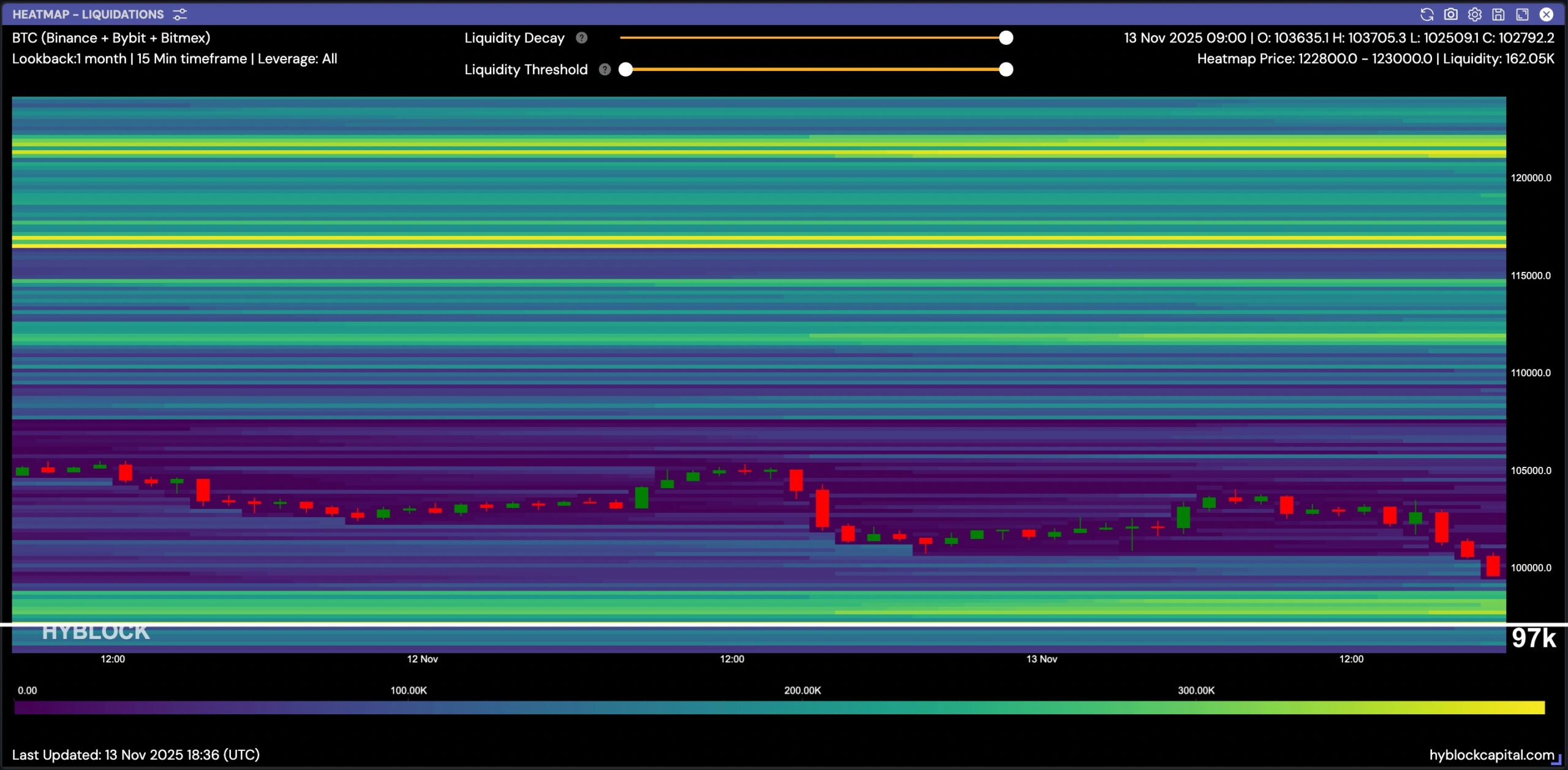

Analyst nicknamed Columbus Bitcoin  $103,128.64‘of He says he will dive into the liquidity pool at $97,000. Volatility may increase around this level. However, BTC has already fallen to $98,147 at the time of writing. trump At the time of writing, the executive order is being signed, and the statements of Fed members in recent hours have increased the expectation that interest rate cuts may not continue in December.

$103,128.64‘of He says he will dive into the liquidity pool at $97,000. Volatility may increase around this level. However, BTC has already fallen to $98,147 at the time of writing. trump At the time of writing, the executive order is being signed, and the statements of Fed members in recent hours have increased the expectation that interest rate cuts may not continue in December.

Artificial intelligence Related stocks started to lose value rapidly again. The analyst nicknamed Nachi wrote:

“After BTC firmly surpassed $100,000, the rally was short-lived as the market broke the pivot zone. US stocks also lost momentum as the likelihood of a rate cut in December decreased and the timeline of everything was postponed with the government shutdown. Investment advisors are opting to take profits to end the year on a high note.”

After breaking the pivot zone, there is still enough room for downside movement. “The cryptocurrency has already taken a big hit, so it seems a little late to go short again at this stage.”

DaanCrypto, who shared the chart above, was not very optimistic anyway. BTC price The scenario expected by the analyst, who said many times that he would not be sure of the rise in an environment where he did not regain 107 thousand dollars, came true.

“This is an interesting area to watch. I predict we will see some profit taking from short positions in this area. However, spot selling is not stopping. We have seen 14 15-minute red candles in a row.”

It is difficult to be sure of a reversal unless $107,000 is reclaimed or at least the $102,800 trend support is permanently regained.

Silent Whales are in Action

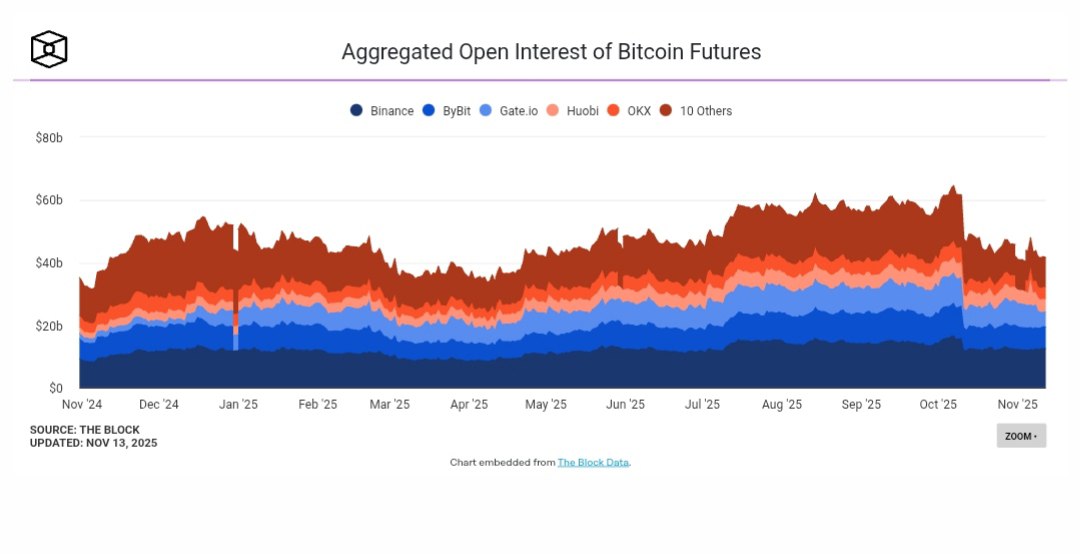

While long-term investors continue to sell ETF The investor group on the side does not help cryptocurrencies. However, Kyle says that despite this, whales have started buying again as open positions are decreasing and it is time to buy the fear.

“Futures leverage has been reset, but whales are quietly buying the dip. Open interest is down 34% from $64 billion to $42 billion.

At the same time, whales added 45,000 BTC this week. This is the second largest accumulation of 2025 and is worth approximately $4.6 billion. “The smart money is doing what it always does: buying fear.”