Bitcoin  $101,831.62 price It is above $103 thousand and the decline in cryptocurrencies is not yet completely over. Buyers have re-emerged, and the pace of those making the assessment that a bubble has formed in the AI space and that the overvaluation bubble has burst has slowed down a bit. Now the US Services PMI data has been announced. This report is important in terms of the state of the economy.

$101,831.62 price It is above $103 thousand and the decline in cryptocurrencies is not yet completely over. Buyers have re-emerged, and the pace of those making the assessment that a bubble has formed in the AI space and that the overvaluation bubble has burst has slowed down a bit. Now the US Services PMI data has been announced. This report is important in terms of the state of the economy.

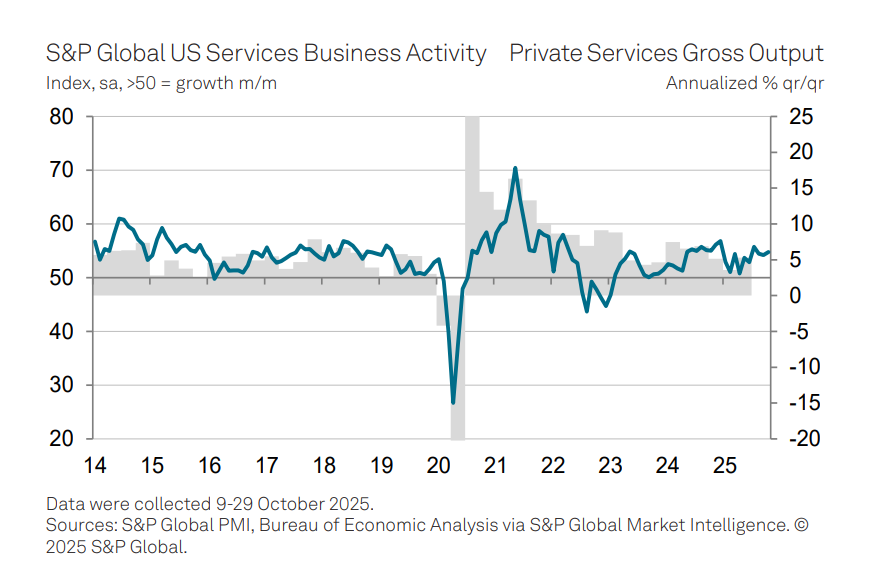

US Services PMI

The US service sector showed momentum in October and new business volume increased slightly. However, economic and political uncertainty employment While limiting its increase, confidence in the future fell to its lowest levels in the last two quarters. Services PMIThe announced figure for China was 54.8, but the expectation was 55.2. The figure from the previous month was 55.2. Although the figure above the 50 threshold indicates growth, the momentum is weak and there is some decline compared to the previous month. We have been seeing numbers above the 50 threshold, indicating that there has been no contraction for a very long time.

There is the lowest increase in pending work since March. Although employment has increased for eight months, some companies do not hire new employees due to financial concerns. Input costs are still high due to tariff and wage increases, but are at the lowest level in the last six months. While this supports the story that the impact of tariffs on inflation is limited due to costs, cryptocurrencies It offers a positive outlook for

The pace of price increases has slowed and is at its lowest levels since April, with high competition and uncertainty pushing companies to pass on fewer price increases to customers.

S&P Global Market Intelligence Chief Economic Expert Chris Williamson said;

“October’s final PMI data supports signs that the US economy is entering the fourth quarter with strong momentum. Growth in the US, a broad-based services economy, has accelerated, accompanied by a recovery in the manufacturing sector. Overall, business activity is growing at a pace commensurate with GDP, which increased by around 2.5% on an annual basis, after signaling a similarly solid growth in the third quarter. While growth is mainly driven by the financial services and technology sectors, the survey also picks up signs of improving demand from consumers. However, new businesses are increasing the competitiveness of service providers.” There are signs that customers often resist price increases, especially in consumer markets. Inflation While this is good news for the company, the lack of pricing power points to weak underlying demand and lower profits.

Job expectations for the coming year have also fallen sharply and are now at their lowest level in three years. This is due to signs of customers being cautious about spending, combined with increasing political and economic uncertainty. However, low interest rates “It has helped offset some of the downside to business confidence, and the FOMC rate cut in October should have helped further in this regard.”