Spot traded in the USA Bitcoin  $104,050.19 and Ethereum

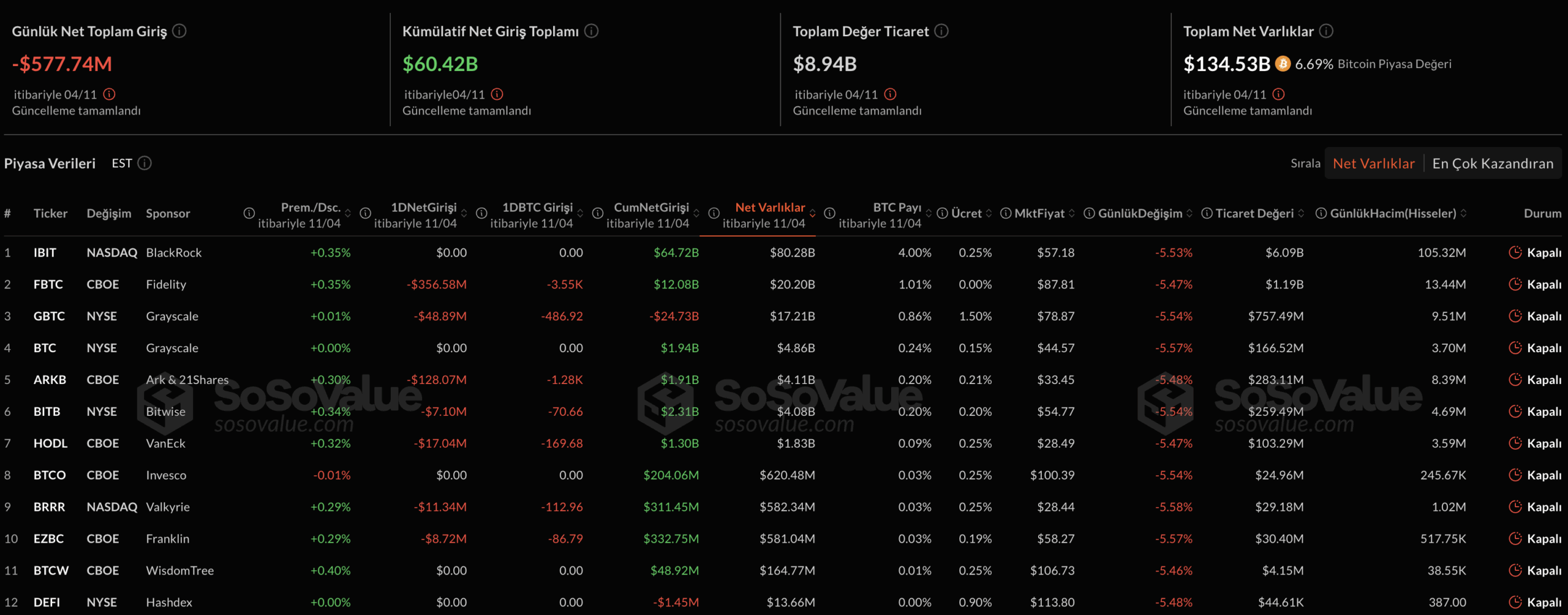

$104,050.19 and Ethereum  $3,494.70 There was a total net outflow of about $800 million from its ETFs on Tuesday. During the deepening selling wave in the markets, institutional investors repositioned their portfolios. SoSoValue According to the data, there was an outflow of $ 577.7 million only from spot Bitcoin ETFs, and this figure was recorded as the highest daily outflow since August 1. Fidelity$356.6 million from ‘s FBTC ETF, Ark & 21Shares$128 million from ‘s ARKB ETF, GrayscaleThere was an outflow of 48.9 million dollars in ‘s GBTC ETF.

$3,494.70 There was a total net outflow of about $800 million from its ETFs on Tuesday. During the deepening selling wave in the markets, institutional investors repositioned their portfolios. SoSoValue According to the data, there was an outflow of $ 577.7 million only from spot Bitcoin ETFs, and this figure was recorded as the highest daily outflow since August 1. Fidelity$356.6 million from ‘s FBTC ETF, Ark & 21Shares$128 million from ‘s ARKB ETF, GrayscaleThere was an outflow of 48.9 million dollars in ‘s GBTC ETF.

Rebalancing Corporate Positions

Bitcoin ETFs reported negative flows for the fifth consecutive day, totaling $1.9 billion in outflows. Ethereum The picture is similar on the side. According to the data, while there was an outflow of $219.3 million from spot Ethereum ETFs, BlackRock’s ETHA ETF suffered the biggest loss with $111 million. Grayscale and Fidelity’s ETFs also saw outflows. Only Solana ETFs had positive divergence with limited inflows of $14.8 million.

BTC Markets analyst Rachael Lucas“The outflows for the fifth day in a row indicate a significant change in direction in corporate positioning,” he said. According to Lucas, the selling wave is a tactical move based on risk management. Fed Chairman Jerome Powell‘s hawkish statements last month extinguished interest rate cut expectations for December and pushed the dollar index above the 100 level. Lucas said, “Risky assets are being repriced. cryptocurrency“Due to its strong correlation with technology stocks, it cannot escape this wave,” he said.

Extreme Fear and Short-Term Pressure

Crypto Fear and Greed Index It fell to 21 on Tuesday, landing in the market’s “extreme fear” zone. Caladan Research Director Derek LimHe stated that Powell’s statements strengthened the dollar and investors turned to risk aversion. The risk of a government shutdown in the US also increases macro uncertainty.

Despite this, Lim argued that the cryptocurrency market is still structurally in a bull trend. “Although the delay in interest rate cuts is negative for risky assets in the short term, macro conditions have not changed in general. We are approaching the end of quantitative tightening,” said Lim, reminding that Bitcoin’s decline from $ 125,000 to $ 99,000 was more limited compared to the 31 percent decline in the first quarter of the year. Lucas warned of liquidity contraction and increased volatility if the outflows continued.