BTC, which peaked at 126 thousand dollars, is about to breach 100 thousand dollars with a drop of more than 20 percent after about 1 month. We have never seen such deep bottoms, even when Trump declared a trade war on China. Many altcoins are dying. cryptocurrency regulations, moves of reserve companies, new ETF approvals and countless other positive developments have long been forgotten. What’s going on?

Binance Sells, USA Runs Away

Today’s sales are mainly Binance It was triggered by large investors in the stock market. US investors have been avoiding risk for days, Coinbase Premium We were sharing analysts who said it gave a negative signal. While the USA was avoiding risk, large investors on the Binance exchange began to reduce their risks, resulting in long liquidations of over $1 billion and BTC falling to $100,010.

In many exchanges, especially futures parities BTC He dropped the needle below 100 thousand dollars. The $102,000 and $100,400 supports are the most important levels currently. The government shutdown must end, US data should support crypto, and AI growth prospects weakened by the Palantir report should be revived. Michael Burry talked about the AI crash today and announced that he was pressing the short button. Burry has been wrong a lot lately, maybe we are heading towards the day when he will be wrong again?

MikybullCrypto was expecting a decline due to the deterioration in the long-term structure and wrote that Binance investors triggered this. The above stock market CVDs explain the decline.

Cryptocurrency Analyst Comments

DonAlt was one of those who had been expecting a decline for days. He says we can see lower levels before ETH regains $ 3,800. ETH While it found buyers even below $ 3,300, it continues the day with a loss of 9 percent.

Like many other analysts, Jelle shared key levels for BTC.

“Now it is necessary to defend the area reached.

Here are some joins:

-

50w MA/EMA cluster

-

$000 round figure support

-

“We saw a 20% decline from the highs, 20-22% corrections, and then 4 major bottoms.”

Ali Martinez ether We have just seen the worst case scenario for The analyst predicts a drop to $2,400 and $1,700 in an environment where the $3,800 support cannot be regained. The graph it follows is as follows.

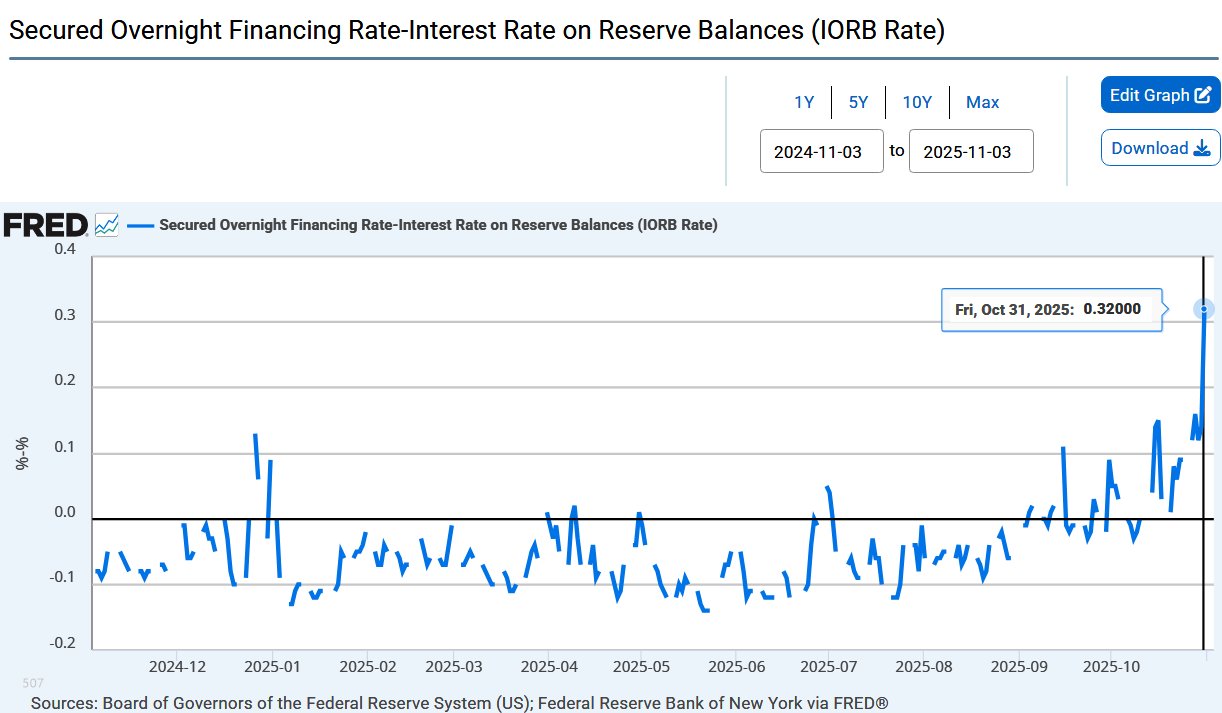

We saw the big signal yesterday of the accelerating negativity today. The SOFR increase mentioned that the risks were increasing, and the user with the pseudonym e507 summarized what was going on as follows;

“The “Dollar repo rate” (SOFR), which has a daily transaction volume of $3.2 trillion, was 4.22% today. The interest paid by the Fed on idle reserves of $3 trillion (IORB) is 3.90%. That is, the margin of both increased to 32 basis points. This is perceived by the market as “fragile / dispersed liquidity” = funding risk.”

Fed’s What happened to cryptocurrencies has turned into a complete trap, with the effect of the closure following his statement last week, “We are stopping asset sales and starting purchases in December”, that is, we are going for monetary expansion. There are many reasons for upside, but BTC must hold $100,000 for a while longer until long-term investor selling calms down and the shutdown ends.