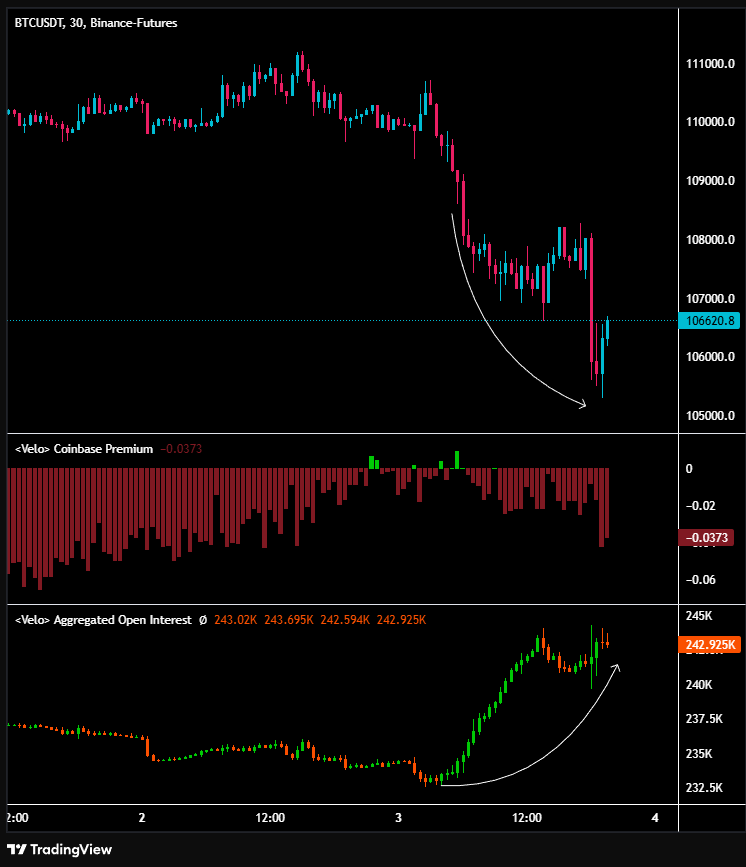

The US Secured Overnight Financing Rate (SOFR) is fluctuating and cryptocurrencies are falling due to a combination of many developments. Today we will examine the relationship of crypto with the SOFR increase and the outlook on the macro front. Today’s increase was the fastest increase in the last year (although not the highest level). So what’s happening in crypto?

Record Increase in US Overnight Interest Rate

US Secured Overnight Financing Rate (SOFR) Today it jumped to 4.22% with an increase of 18bp. It has never increased so fast in the last year. The main reason for the increase is that the US Treasury Department focuses on short-term debt issuance and the government shutdown both supports this and increases the risk.

While the increase in treasury supply increases the risk in the funding markets SOFR rising. Since the primary short-term interest rate is the reference value for US markets, fluctuation here feeds credit risk and weakening liquidity. Whatever you say, the result means a decline for risk markets, including cryptocurrencies.

The rate of 4.22% is not a record, it had seen the same level on October 31 (previous days had seen higher levels, etc.), but it was an annual record in terms of daily increase. Combined with the problems within cryptocurrencies themselves, the change here feeds the decline.

- funding stress increased.

- Cost increased for leveraged positions (general financial markets).

- The Treasury’s intense short-term borrowing weakens dollar liquidity and undermines entries in risk markets. An indeterminate part of the weakening in the ETF channel has been affected by this.

What About Cryptocurrencies?

In the last 45 minutes at the time of writing BTC It formed 15-minute bullish candles. For now, it can be said that the return from the bottom has started. Heavy short liquidity at $108,000 and above fuels the potential for price to move up to liquidate them. In the short term, it can be said that the nightmare is over. What is important for us this week is the steps to be taken regarding the government shutdown, the end of the shutdown will now have a positive impact on cryptocurrencies. Previously this was considered ineffective.

Ripple tomorrow  $2.41 And Chainlink

$2.41 And Chainlink  $16.09 There are two important events for altcoins that may stimulate appetite. While risk appetite was extremely weak last week to SOL Coin inflows were at their second largest. In other words, we cannot say that the risk appetite has been completely cut off. While all of these give us reasons not to worry, it is in your favor to follow the news flow closely. CryptoAppsy The news section will make your job much easier with both live streaming and summary capabilities.

$16.09 There are two important events for altcoins that may stimulate appetite. While risk appetite was extremely weak last week to SOL Coin inflows were at their second largest. In other words, we cannot say that the risk appetite has been completely cut off. While all of these give us reasons not to worry, it is in your favor to follow the news flow closely. CryptoAppsy The news section will make your job much easier with both live streaming and summary capabilities.