Ethereum  $3,890.97The transaction volume of stablecoins in October reached the highest level in history, reaching 2.82 trillion dollars. As the market slowed down and investors turned to return opportunities, the volume in Blockchain exceeded the previous month’s record by 45 percent, marking a new milestone.

$3,890.97The transaction volume of stablecoins in October reached the highest level in history, reaching 2.82 trillion dollars. As the market slowed down and investors turned to return opportunities, the volume in Blockchain exceeded the previous month’s record by 45 percent, marking a new milestone.

Historic Jump in Stablecoin Volume

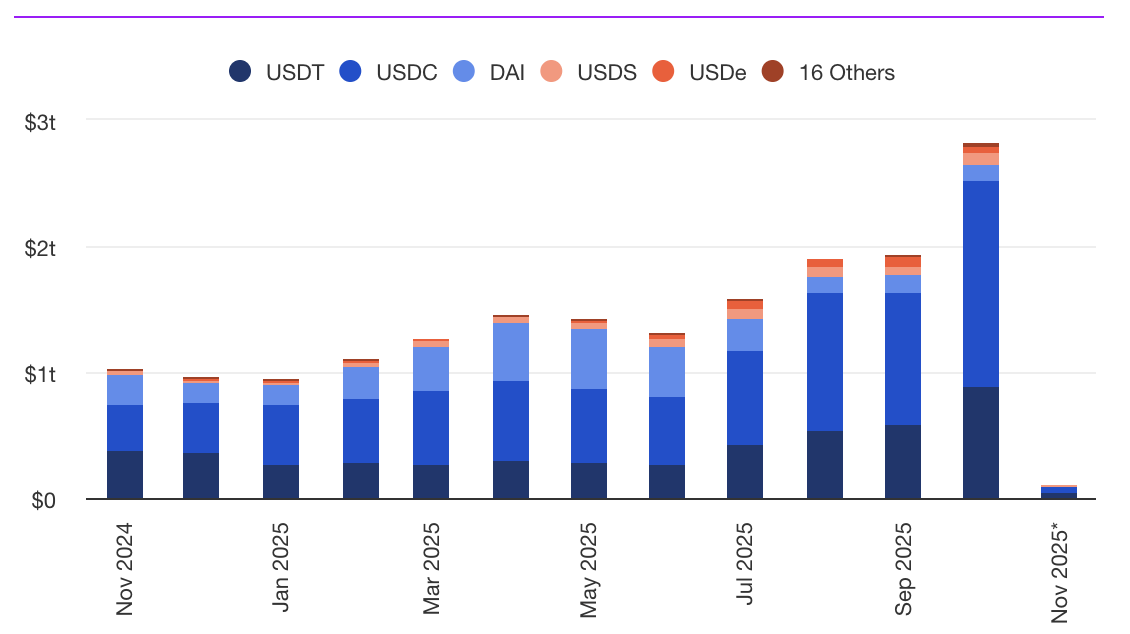

According to The Block’s data, the number of transactions traded on the Ethereum network stablecoin‘s reached a transaction volume of $2.82 trillion in October. This increase, which follows the record of $1.94 trillion in September, corresponds to a growth of 45 percent on a monthly basis. Circle exported USDC While it takes the leadership with a volume of 1.62 trillion dollars, Tether USDTranked second with a volume of 895.5 billion dollars. MakerDAO DAI The coin fell to third place, falling to 136 billion dollars.

Presto Research researcher Min Jung“The stablecoin market has become one of the most dynamic segments in recent months following Circle’s IPO and the passage of the Genius Act,” he evaluated. According to Jung, the search for returns, especially around liquid yield tokens, increases user interest and innovative stablecoin projects are in serious demand.

Liquidity Management and Revenue Sharing Increases

CIO of Kronos Research Vincent LiuHe stated that the increase in stablecoin volume indicates that investors are actively managing liquidity. According to Liu, investors are the major cryptocurrencyThey take positions for new opportunities by investing their capital in stablecoins during the profit sales that continue in 2017. Bitcoin  $110,860.50The fact that ‘s value has decreased by 11.5 percent and Ethereum has lost 16.4 percent in the last month supports this strategy.

$110,860.50The fact that ‘s value has decreased by 11.5 percent and Ethereum has lost 16.4 percent in the last month supports this strategy.

According to data, stablecoin issuers accounted for 65–70 percent of daily revenues throughout October, outpacing other cryptocurrency protocols. Large issuers like Tether and Circle keep user deposits US Treasury bonds It has made interest income its main income item by keeping it in low-risk instruments such as. LVRG Research Director Nick RuckHe emphasized that stablecoin transactions are now growing for non-speculative, functional purposes such as payment and cross-border transfer.