FTX crash in November 2022 cryptocurrency It created a huge hole in the markets. Investors lost billions of dollars. The losses of corporates working with FTX and its affiliated companies were much greater. SBF was put in jail, and at that time the Democrats vented as much anger as they could against cryptocurrencies. And today, it is said that 143% has been refunded and the damage has been covered. So is this real?

FTX Refunds

Long-running restitutions have largely been completed, with billions of dollars in payments to victims. Creditors received their refunds, more or less, by following the steps we informed them throughout the process. However, the refunds made at prices valid for the 2022 crash period certainly did not please investors.

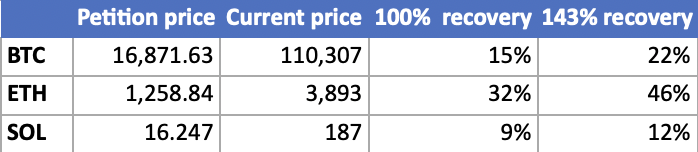

The collapse of the markets during the FTX bankruptcy period caused us to see huge losses in altcoins. BTC It fell below 20 thousand dollars and in those days it was mentioned that we could see bigger bottoms at 15 thousand dollars and below. Creditors could not make withdrawals under the conditions of that day because the full amount of their receivables was not in their FTX wallets. The assets on hand were gradually sold and converted into cash, and as the markets rose, the FTX bankruptcy committee had the opportunity to sell the assets of the customers to whom it would pay under the terms of November 2022, at higher prices. The fact that the sales in 2023 and the following years were at higher prices caused the misconception that all receivables were paid more than enough.

Airdrop to FTX Victims

FTX Creditor representative Sunil said that victims did not actually receive 143% payment, but recovery rates varied between 9% and 46%. Crypto prices rose very high in many altcoins, and since cash payments were made at 2022 prices (even though the issue of payment in kind, that is, in altcoins, was much discussed, it could not be accepted in court), compensation remained very weak. Even if the nominal payout is 143%, creditors will never be able to replace their cryptocurrencies with the returned funds.

“Outside of the bankruptcy process, additional recovery is expected from airdrops that projects will make to FTX creditors. Paradex has airdropped tokens to FTX creditors and more projects are expected to follow.” – FTX creditor representative Sunil

Bringing the airdrop issue to the agenda by Sunil gives hope for FTX creditors to be compensated for some of their losses.