At the beginning of October, there were high hopes in the cryptocurrency world: price increases, new records and a bull run were expected. These expectations, Bitcoin  $110,116.33 It became a reality for us in the first days of October. The recovery that began in late September allowed Bitcoin to surpass the $120,000 level, surpassing its previous all-time high and approaching $126,000. However, then headwinds blew across the entire cryptocurrency market, and Bitcoin was at the forefront of this decline.

$110,116.33 It became a reality for us in the first days of October. The recovery that began in late September allowed Bitcoin to surpass the $120,000 level, surpassing its previous all-time high and approaching $126,000. However, then headwinds blew across the entire cryptocurrency market, and Bitcoin was at the forefront of this decline.

The Decline After the Record

On October 10, there was a drop from $ 121,000 to $ 101,000 on some stock exchanges, and although there was a short recovery attempt, it fell again to $ 104,000 a week later. This decline process was considered “daunting” for the market. Although there were positive factors in the remaining days of October, such as low inflation data, the Federal Reserve’s approach to interest rate cuts, and promising trade news on the Washington-Beijing front, these factors failed to deliver as expected, and Bitcoin closed the month slightly red — in October, historically known as the “bull month”. This also ended Bitcoin’s six-year October green close streak.

The record rise at the beginning of October raised investors’ expectations. For example, global crypto ETFs saw a historic inflow of $5.95 billion in one week, a move that contributed to Bitcoin rising to a new high of $126,223. However, after this rise, the market started to act wisely with the sudden decline on October 10. Such sharp declines are yet another reminder that the digital asset class is still volatile and fragile.

Historical Similarity and Market Confidence

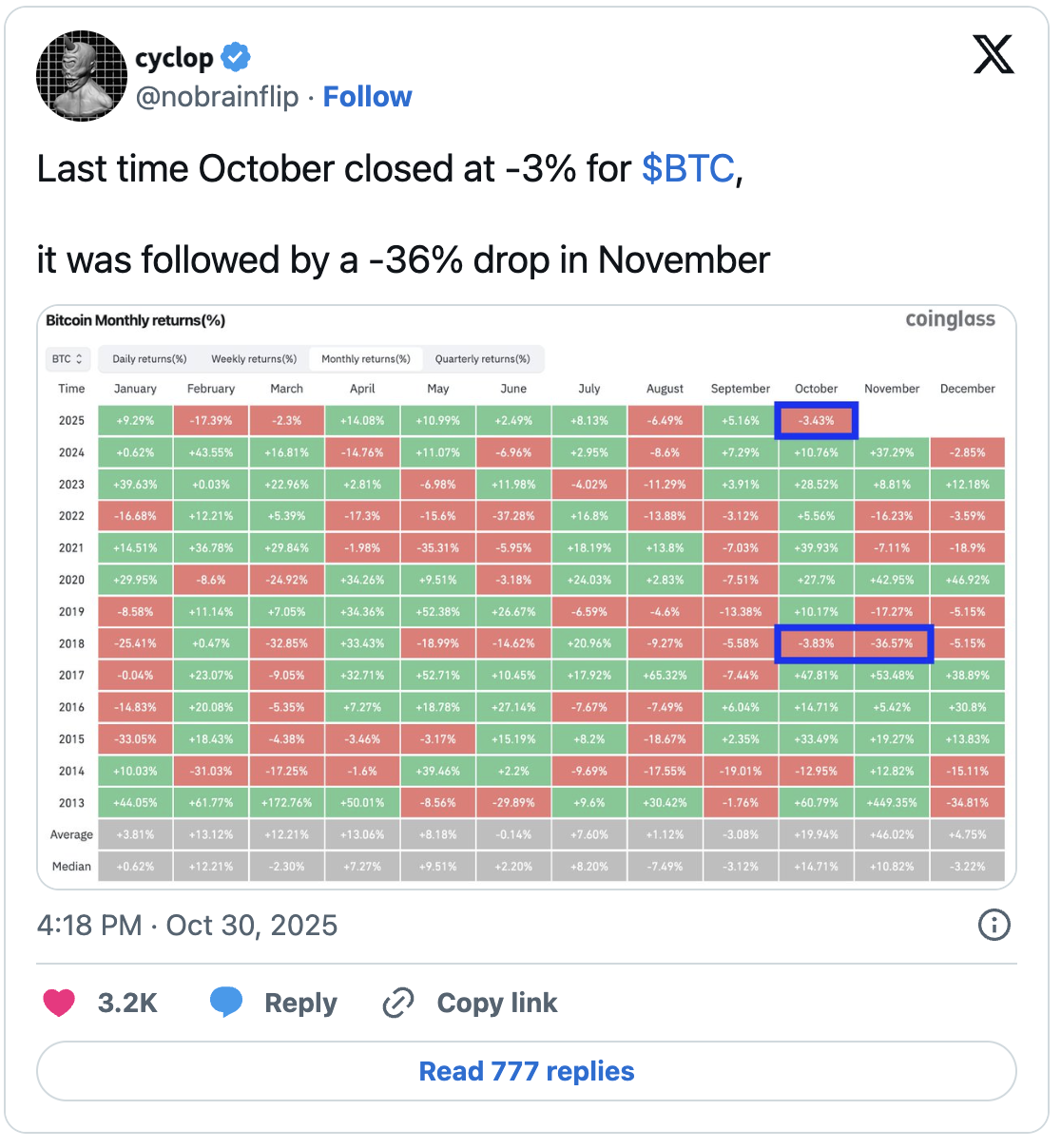

Past data are warning about whether the decline will turn into a “short-term” or “deeper” collapse after such October declines. For example, in October 2018, Bitcoin lost approximately 3.83%; However, this was followed by a decrease of around 36% in November. In this picture, macro variables such as investor confidence and interest rate environment also gained serious importance. This year, uncertainty over fed policy and geopolitical tensions have limited Bitcoin’s upward momentum.

In light of these developments, October is no longer a “time of celebration” for the cryptocurrency market and investors are urged to be careful again. Bitcoin’s record climb attracted a lot of attention; However, the subsequent pullback sent the message that markets were still fragile and “not every record rise is guaranteed to continue.” Historical similarities and current economic indicators may require a more cautious stance in the coming months. The important thing for investors is not only to focus on price movements but also to consider the macroeconomic context.