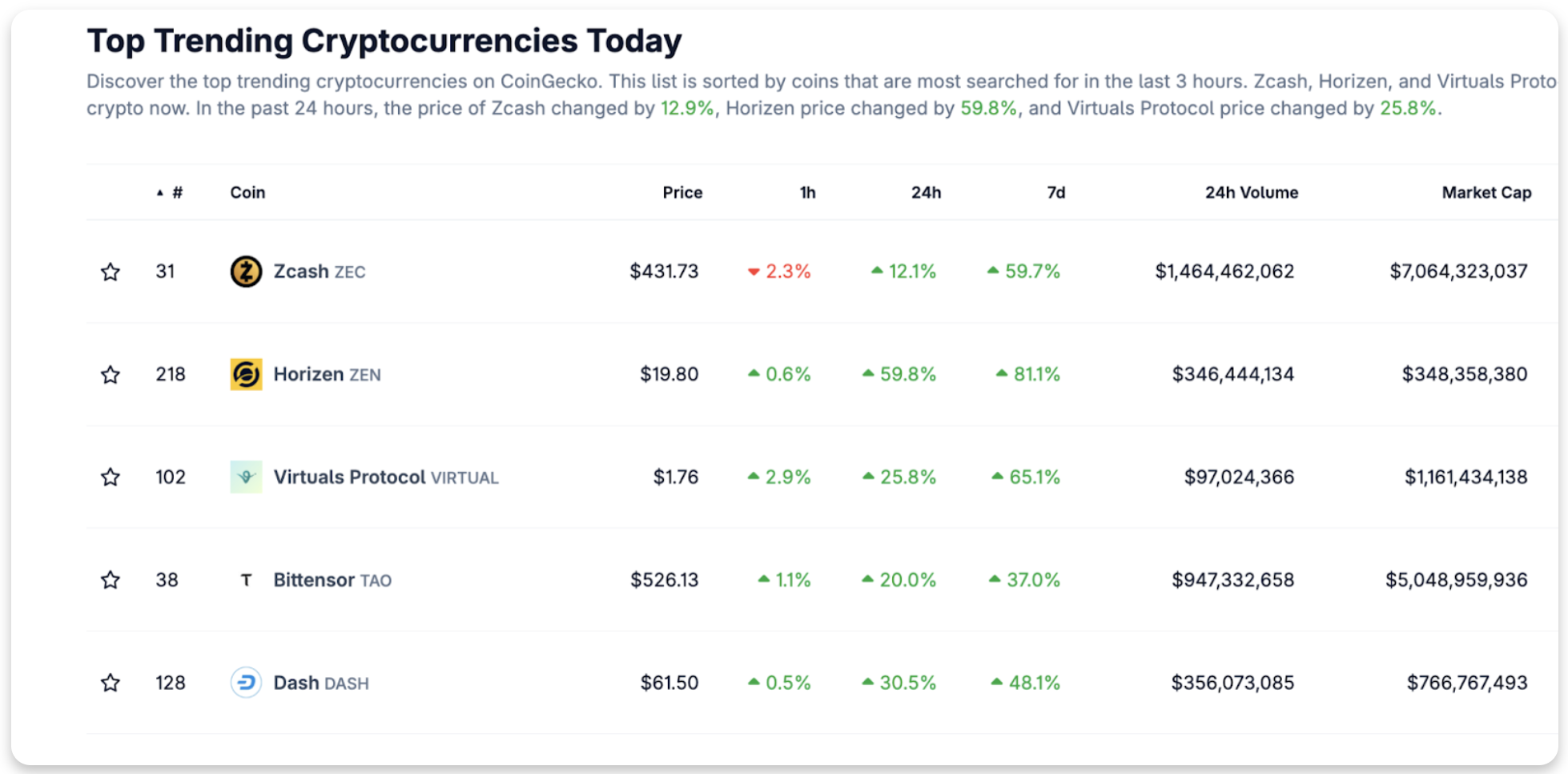

Privacy-focused cryptocurrencies have once again attracted the attention of investors, rising to the top of CoinGecko’s “Top Trending Cryptocurrencies” list this week. Zcash (ZEC), Dash (DASH) and Monero (XMR) were among the prominent names in the list prepared according to the search volumes of the last three hours.

Monero’s Different Privacy Model and Regulatory Shadow

Zcash increased by 15.7% in the last 24 hours, reaching $439.79. While the market value of the token exceeded 7.1 billion dollars, the daily transaction volume reached 1.45 billion dollars. Zcash, which increased by 63% on a weekly basis and 191% on a monthly basis, provided its investors with a gain of 1,091% in the last year. Dash, on the other hand, achieved a similar momentum, rising by 29.5% to $61.44 in the last 24 hours. The daily transaction volume of the token is at the level of 322 million dollars. The weekly increase rate was recorded as 50% and the monthly increase rate was 84%.

Monero (XMR) showed a more moderate increase compared to Zcash and Dash. The token gained 8.3% in value in the last 24 hours, reaching $347.63 and a transaction volume of $134 million. Monero’s privacy approach is different from others: it automatically hides transactions, making wallet addresses and amounts invisible. It provides untraceable transactions with RingCT and stealth addresses technologies. However, these strong privacy features raise concerns regarding money laundering and identity verification (KYC) regulations.

Zcash, on the other hand, attracts attention with its “optional privacy” approach. Users can choose between transparent or hidden addresses. Thanks to “zk-SNARKs” technology, sender, recipient and amount information can be hidden, while transaction details can be shared when desired with “view keys”.

Increasing Interest in Digital Privacy and Market Repercussions

CoinGecko’s trending list shows that investors’ quest for privacy and anonymity is on the rise again. While global regulatory bodies are closely monitoring privacy-focused cryptocurrencies due to money laundering risks, individual investors are highlighting their desire to protect financial privacy.

On the other hand, the global cryptocurrency market maintains its strong stance. While the total market value is around 3.78 trillion dollars, the daily transaction volume is over 140 billion dollars. Bitcoin  $110,116.33 57.9%, Ethereum

$110,116.33 57.9%, Ethereum  $3,874.93 maintains its leading position with a market share of 12.3%. Although the overall share of privacy coins is low, this trend shows users’ continued interest in secure and untraceable transactions.

$3,874.93 maintains its leading position with a market share of 12.3%. Although the overall share of privacy coins is low, this trend shows users’ continued interest in secure and untraceable transactions.

The US Securities and Exchange Commission (SEC) and European Union officials have introduced new draft laws to tighten controls on privacy coins. In particular, projects that support anonymous transactions such as Monero and Zcash are requested to show greater transparency regarding compliance with anti-money laundering (AML) standards. This may increase price fluctuations in the short term, but may contribute to a more robust market structure in the long term.

As a result, the rise of privacy-focused cryptocurrencies reveals that individuals continue to seek privacy in the digital world. Despite regulatory pressure, investor interest shows increasing sensitivity to financial privacy. However, for these projects to survive in the future, they will need to strike a balance that is both safe and legal.