Bitcoin  $110,521.68It climbed back above $110,000 as optimism about trade relations between the US and China increased. The rise may cause options investors operating in futures markets to rebalance their positions, while the $13 billion in options volume expiring on Friday could increase volatility.

$110,521.68It climbed back above $110,000 as optimism about trade relations between the US and China increased. The rise may cause options investors operating in futures markets to rebalance their positions, while the $13 billion in options volume expiring on Friday could increase volatility.

Negative Gamma Pressure Increases Before Option Expiration

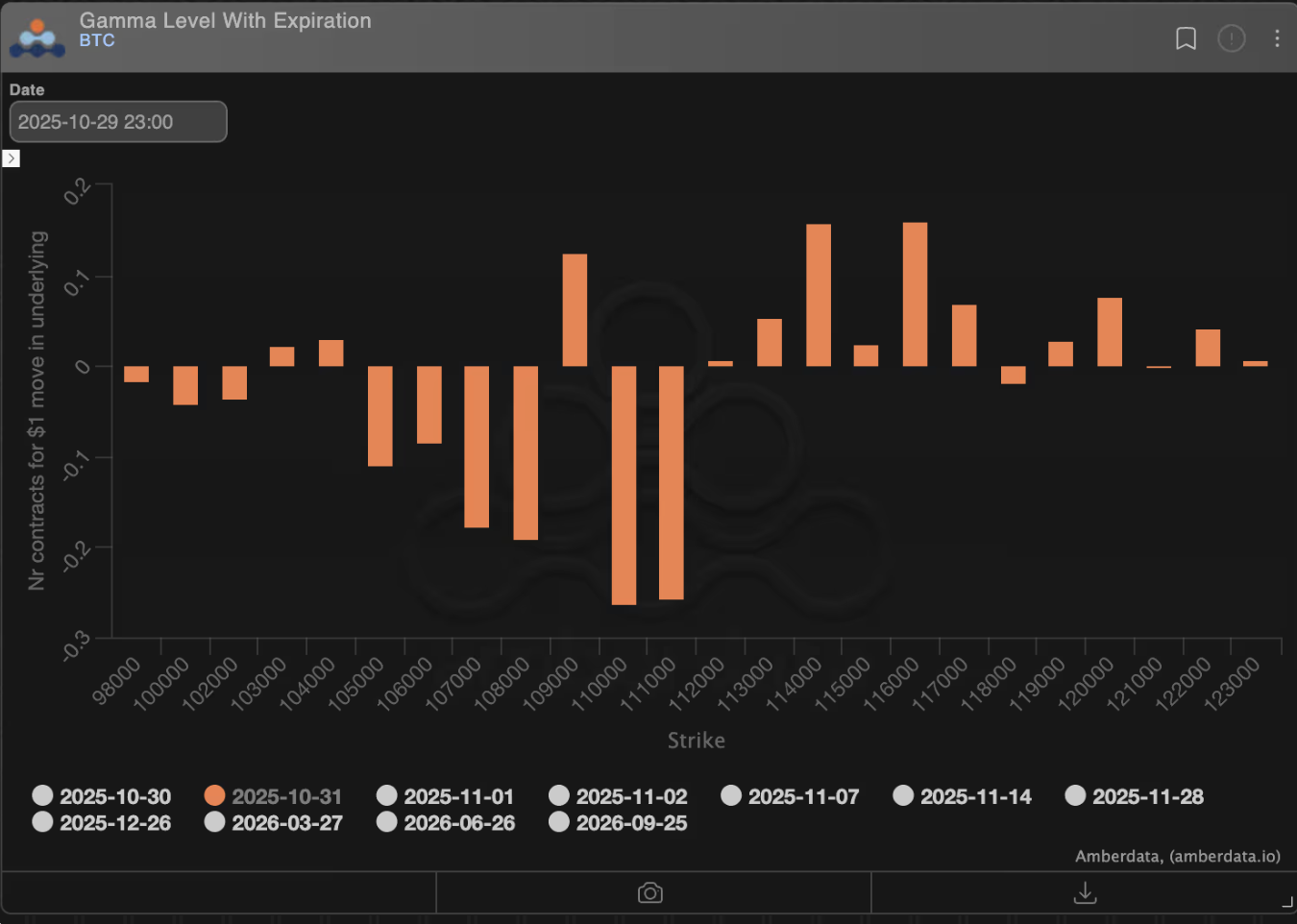

According to Deribit data, 13 billion dollars Bitcoin optionThe expiration of the call and put on Friday at 11:00 CET may trigger a major balancing movement in the market. amberdata And Deribit MetricsAccording to data tracked on , market makers have a negative gamma position at the $100,000 and $111,000 levels. This means that there are more put options than call options.

To neutralize this imbalance, market makers try to protect their delta positions by buying when the price rises and selling when it falls. As the expiration date approaches, this hedging approach becomes more intense because gamma sensitivity increases rapidly as time decreases, especially in at-the-money options.

Data ranges from $105,000 to $111,000 gammaWhile it shows that ‘ is largely negative, there is a transition to the positive zone starting from the $ 114,000 level. This threshold is seen as a critical limit that can determine in which direction the market will move.

Mechanical Effects That May Increase Volatility in Price

According to experts, the short-term direction of Bitcoin depends more on fundamental economic data. options marketIt can be shaped by mechanical hedge flows in Increased buying and selling activities in the negative gamma region may cause rapid changes in the price in the spot market. Especially positions around $110,000 are at the center of volatility.

Historically, sudden jumps or sharp corrections in Bitcoin’s price have frequently occurred ahead of major option expirations. The $13 billion maturity date this week is large enough to determine the direction of the market for a short time. If the price rises above $114,000 and the gamma moves into the positive area, the market could regain a more balanced structure.

For investors, the coming hours stand out as a period of high tension in which balance movements in the options market will be directly reflected in prices.