Bitcoin  $114,239.93, Ethereum

$114,239.93, Ethereum  $4,108.09 And solana -based spot ETFs showed renewed investor interest on October 28. While there was a net inflow of $202 million into Spot Bitcoin ETFs, there was a net inflow of $169.65 million into Ethereum ETFs. Bitwise Solana Staking ETF (BSOL), which started trading on the same day, stood out with a first-day net inflow of $69.45 million. Industry analysts say the big three cryptocurrencyHe stated that this activity in Turkey indicates that corporate appetite continues.

$4,108.09 And solana -based spot ETFs showed renewed investor interest on October 28. While there was a net inflow of $202 million into Spot Bitcoin ETFs, there was a net inflow of $169.65 million into Ethereum ETFs. Bitwise Solana Staking ETF (BSOL), which started trading on the same day, stood out with a first-day net inflow of $69.45 million. Industry analysts say the big three cryptocurrencyHe stated that this activity in Turkey indicates that corporate appetite continues.

Ethereum and Bitcoin ETFs Sparkle with Inflows

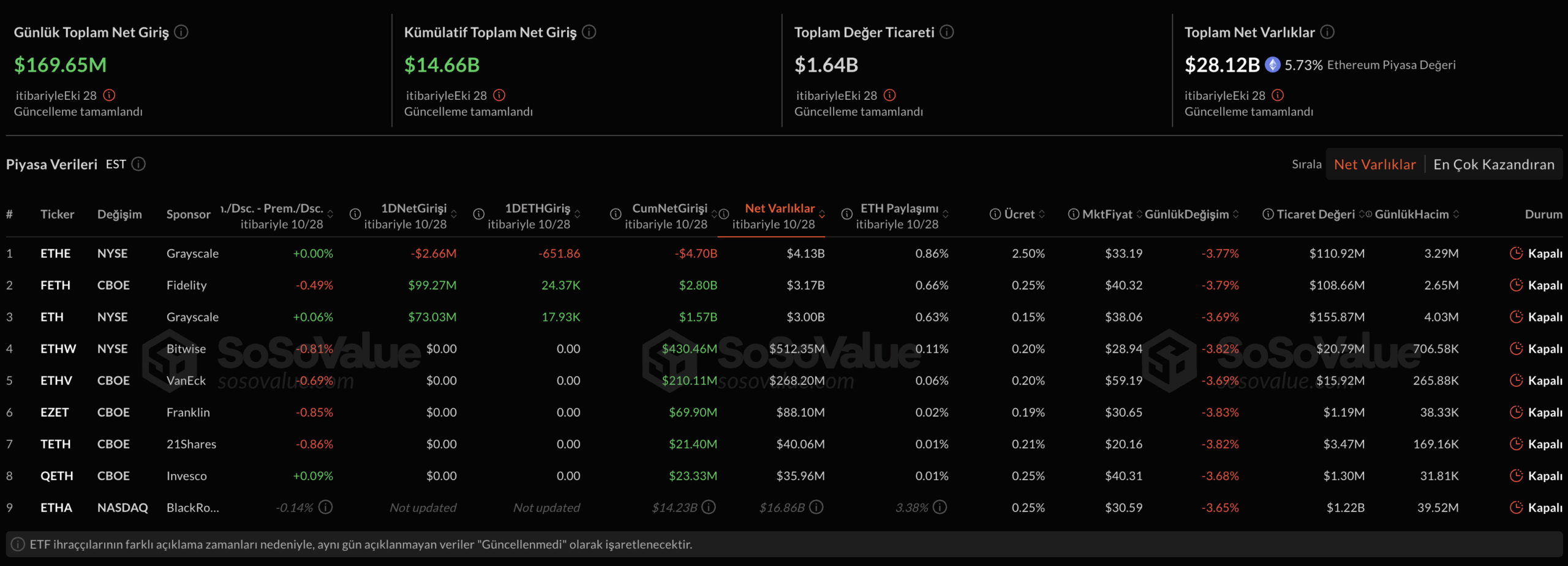

cryptocurrency marketWhile the search for stability in the general outlook of spot Bitcoin ETFThere was net inflow for four consecutive days. SoSoValue‘s data dated October 28 shows that there was a total inflow of 202 million dollars into ETFs on the last trading day. Net $169.65 million worth of new capital flows into Ethereum-focused ETFs on the same day happened. In this segment, Fidelity CONQUEST Its product took the leading position with a net inflow of 99.27 million dollars.

Experts interpreted the interest in both Bitcoin and Ethereum ETFs as investors evaluating short-term market fluctuations as opportunities. Especially the Fed interest discount The approaching cycle and increasing uncertainties in traditional markets are among the factors that support the trend towards cryptocurrencies.

Strong Start from Solana’s First Spot ETF

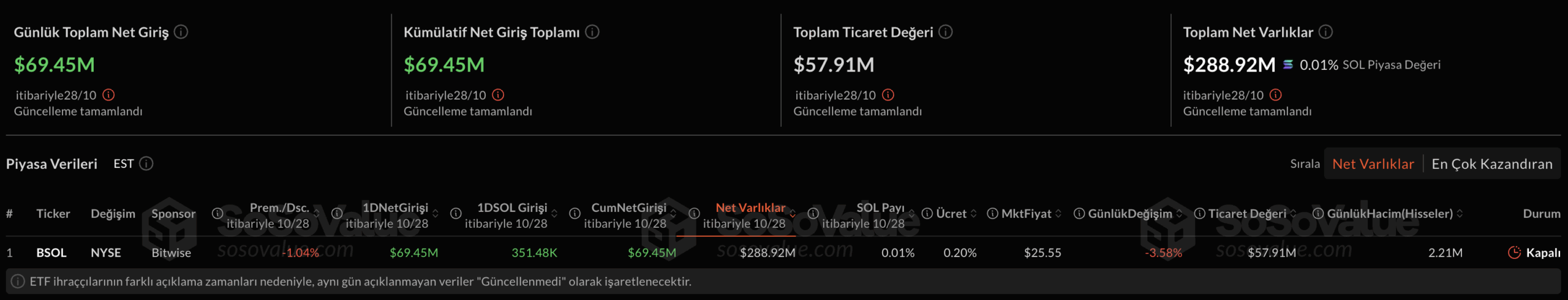

On the same day, a first occurred in the US markets. Bitwise exported Solana Staking ETF(BSOL) started trading on October 28. The ETF attracted net inflows of $69.45 million on its first day of trading, reaching a net asset value of $289 million. Thus, BSOL came to represent 0.27 percent of Solana’s total market value. Bitwise executives emphasize that supporting the ETF with staking returns offers additional value for the investor.

On the other hand, it is listed on the stock exchange and opened for trading on the same day. Canary HBAR ETF And Canary Litecoin  $101.51 ETFThere were no inflows or outflows in the first trading days. This difference reveals that investor interest is mainly concentrated in projects with high liquidity.

$101.51 ETFThere were no inflows or outflows in the first trading days. This difference reveals that investor interest is mainly concentrated in projects with high liquidity.