Fedis preparing to reduce the policy rate by a quarter point despite the uncertainties in employment and growth data. According to a Reuters survey, economists say it is almost certain that the benchmark interest rate will be reduced to the 3.75-4.00 percent band. sees. It is considered that the decision is a step taken out of habit due to the lack of economic data.

Data Flow Stopped, Fed on Blind Flight

In the USA, it has entered its 29th day as of October. federal government shutdown It blocked the Fed’s access to employment data, which is the most critical indicator it looks at when making decisions. Since the official employment report for September cannot be published, Fed officials have to make their decisions based on August data. At that time, the unemployment rate rose to 4.3 percent, and the decrease in the foreign-born workforce limited further increases in unemployment. Fed officials employment marketAlthough he thinks that the job market is balanced, the recent layoffs of large companies such as Amazon and the increase in state-based unemployment applications necessitate a cautious approach.

On the other hand, announced in September CPI data remained below expectations due to the slowdown in housing prices. inflation He pointed out that the pressure was weakening. The softening in inflation and labor concerns strengthened expectations for an interest rate cut.

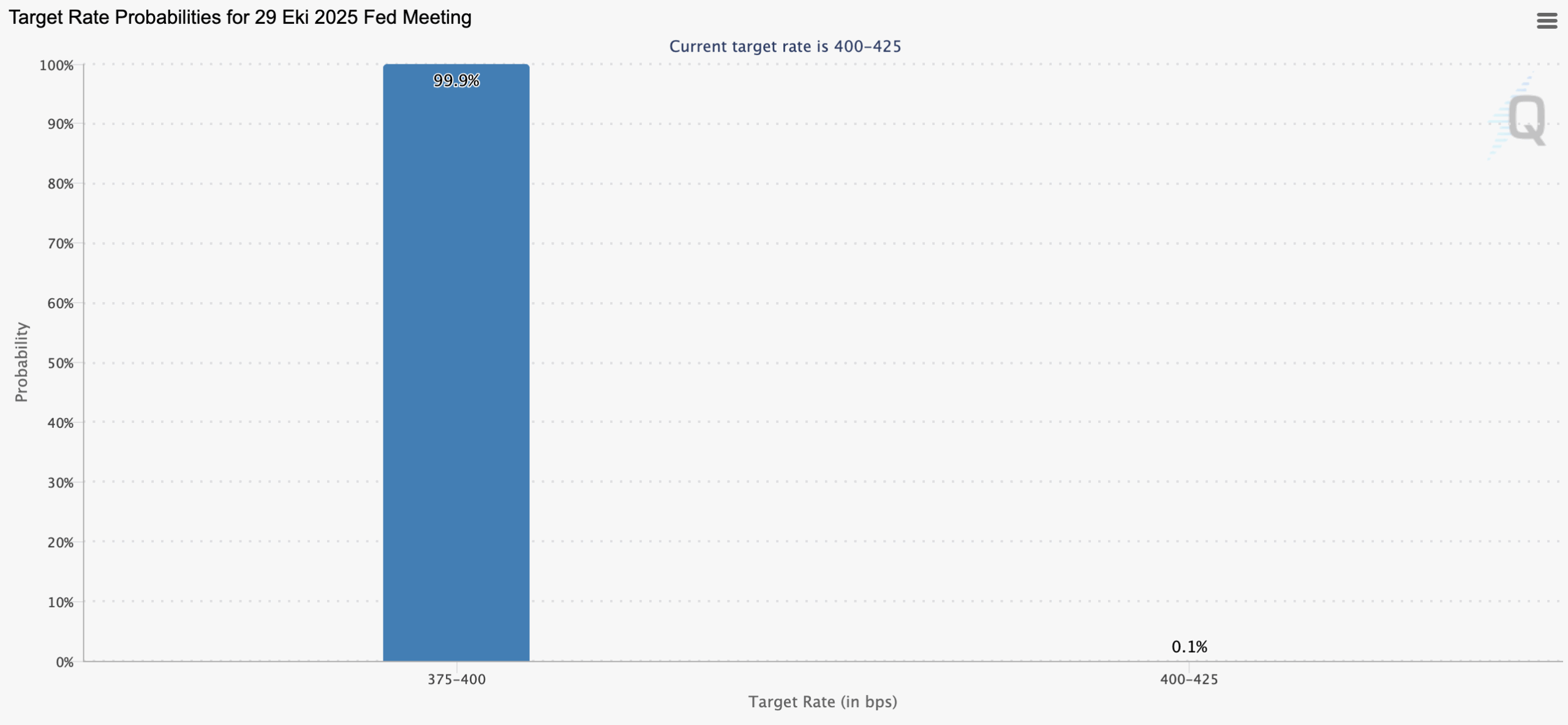

Offered by CME Group FedWatch According to the data provided by the broker, there is a very high probability of 99.9 percent that the Fed will reduce the interest rate by 25 basis points. Another 25 basis point interest rate cut is expected for December, and the probability of this is currently given as 89 percent.

Markets Await Fed Rate Decision and Powell’s Messages

Fed interest rate decision It will be announced today at 21.00. Chairman Jerome Powell is expected to give the institution’s economic evaluations and clues for the December meeting at the press conference he will hold half an hour after the interest rate decision is announced. Fed officials state that they are acting in a “foggy environment” in directing the economy because inflation data cannot be officially published.

Standard Chartered economist Steven EnglanderHe stated that some members may be in favor of a 50 basis point reduction, while others will advocate keeping the interest rate constant due to inflation concerns. Chief Economist at Oxford Economics Ryan Sweet He stated that the lack of data blurs the decision processes and that if the reopening of the government is delayed, a new interest rate cut may be on the agenda in December.

The largest cryptocurrency hours before the Fed interest rate decision Bitcoin  $112,960.43 It fell by 1.13 percent in the last 24 hours, reaching a horizontal level around $113,000. Ethereum

$112,960.43 It fell by 1.13 percent in the last 24 hours, reaching a horizontal level around $113,000. Ethereum  $3,998.89 It is priced at $4,009, just above the critical $4,000 support, with a 2.94 percent decrease in the same period. XRP, solana, BNB, dogecoin

$3,998.89 It is priced at $4,009, just above the critical $4,000 support, with a 2.94 percent decrease in the same period. XRP, solana, BNB, dogecoin  $0.193147, TRON, Cardano

$0.193147, TRON, Cardano  $0.641965 many prominent ones such as altcoinThere is a decrease in the range of 1 to 3 percent. Analysts with global markets cryptocurrency marketHe also states that the Fed has already priced in the Fed’s interest rate cut decision and that Powell’s messages are awaited rather than the interest rate decision.

$0.641965 many prominent ones such as altcoinThere is a decrease in the range of 1 to 3 percent. Analysts with global markets cryptocurrency marketHe also states that the Fed has already priced in the Fed’s interest rate cut decision and that Powell’s messages are awaited rather than the interest rate decision.