We are not in great shape compared to the previous meeting, but we did not see the kind of statements that were feared. BTC This was the reason why its price recovered after the decline. Bitcoin  $112,960.43 Even though the price dropped to 109 thousand dollars while Powell was speaking, CME closed the gap and carried out the last long liquidations for the possible rise. So what are the predictions for November?

$112,960.43 Even though the price dropped to 109 thousand dollars while Powell was speaking, CME closed the gap and carried out the last long liquidations for the possible rise. So what are the predictions for November?

Fed and Cryptocurrencies

Fed’s crypto coins In order to raise money, it needs to reduce interest rates, expand its balance sheet, that is, make money more affordable. But it’s not that simple. The Fed is moving on a path, and this path is not one that will end in a few months or come to a halt. For example, unemployment is increasing, interest rates must decrease, but inflation has also stopped decreasing, so interest rates must remain constant or go up.

Fed In equilibrium, this equilibrium situation shows that the rise of cryptocurrencies, which previous cycles of monetary easing have opened the door to, will not be that easy. So, are cryptocurrencies very disadvantageous in the current process? Never. First of all, inflationary risks are more moderate than in previous months. The Fed has moved away from the idea that tariffs would have incredible consequences on inflation. In other words, we do not and will not hear things like “we will increase interest rates if necessary.”

On the other hand, although the layoffs are not incredible, it was seen a few minutes ago that hiring was seriously weakened. Powell It was also confirmed by. In other words, we are faced with a scenario where layoffs will cause unemployment to explode. You can compare this to the horror stories that say tariffs will cause inflation to explode. The only difference is that this results in monetary loosening, not monetary tightening.

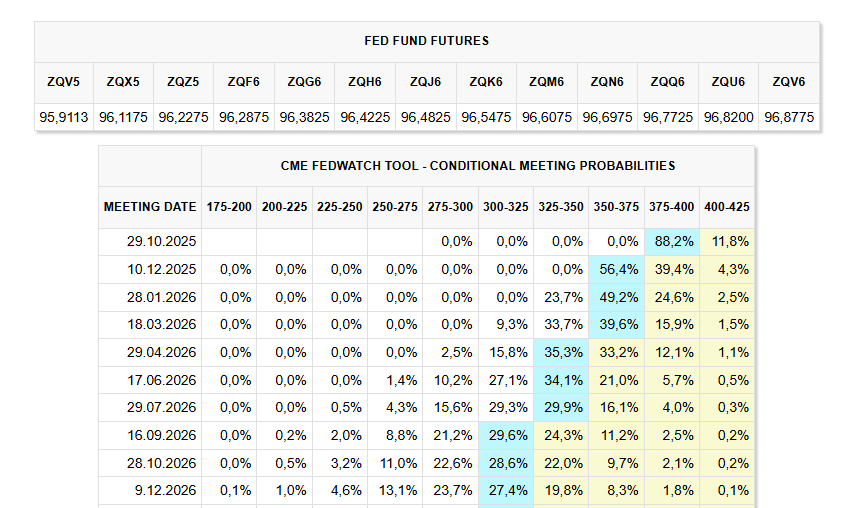

So Fed cryptocurrencies Even though it does not give us the best scenario for the future, it does offer us the good scenario. The statement that “the probability of an interest rate cut is low” for December is related to the fact that it is still 6 weeks away and the hopes of getting a signal of recovery in employment. After the closure ends, employment reports will come with a delay of 2 months and if these are in favor of cryptocurrencies, we will see a rapid rise.

On the bright side, while a 75bp discount was a bullish scenario this year, we have already received a 50bp discount, and we still have a 6-week period and significant potential ahead of us for the best. If you remember the hawkish statements of Fed members who saw a single or maximum 2 reductions for this year, you can understand why these days are good.

November Expectations Cryptocurrencies

Fed went well, not perfect but good and explained his reasons in the first episode. Earnings reports of trillion-dollar technology giants will arrive in approximately 1 hour and they should be at or above expectations. crypto coins supports.

Positive statements from Trump, who will talk to Xi about 2 hours after the US market opening tomorrow, will further support cryptocurrencies. The new earnings reports we will see later in the week and the disappearance of the November 1 retaliation will increase the positive sentiment in cryptocurrencies. Where do you get the early signal of this? From ETF flow comes today’s crypto ETF flow data towards the close of the daily candle. We should see an appetite here.

We are moving towards days when price movements based on news flow are important in altcoins. For this reason CryptoAppsy The news section will make your job easier, don’t forget to check it from time to time. The ability to access live news feed, summary and details gives you an advantage.