BlackRock Bitcoin in 2023  $114,239.93 When it applied for a spot ETF for , most investors were confident of approval. What some academic financiers announced in those days with the headline “The end of Bitcoin” was actually what ignited the 6-digit BTC price. When they said BTC would die with this move, BTC was at 28 thousand dollars and now it is at 114 thousand dollars. So what will the story be for altcoin ETFs?

$114,239.93 When it applied for a spot ETF for , most investors were confident of approval. What some academic financiers announced in those days with the headline “The end of Bitcoin” was actually what ignited the 6-digit BTC price. When they said BTC would die with this move, BTC was at 28 thousand dollars and now it is at 114 thousand dollars. So what will the story be for altcoin ETFs?

Altcoin ETF and Bull

The scenario on everyone’s mind before the end of this year altcoin ETF With their approval, the altcoin bull will start. It’s a logical thesis and it has many takers. Many cryptocurrencies are not accessible to institutional investors. At least, institutional and professional investors who want to invest safely must rely on CEX or DEX.

ETF will eliminate this obligation. Moreover, millions of dollars of inflows are already seen in assets such as XRP and SOL Coin, which have trusts and ETPs. The SEC is expected to give ETF approvals, especially for LTC, XRP, SOL, once the shutdown ends in November. In his last statement, Hester said that the ETF process was not progressing due to the closure and did not give a clear date.

Altcoin Bull Without BlackRock

BlackRock Except for ETH because it has not seen enough demand from its customers for 2 years. altcoin ETF He says he won’t apply. So is this a serious problem? Yes, it’s a serious problem, and K33’s head of research, Vetle Lunde, believes it will cause disappointment. The reason is BTC ETF performance.

“No BlackRock, no party?

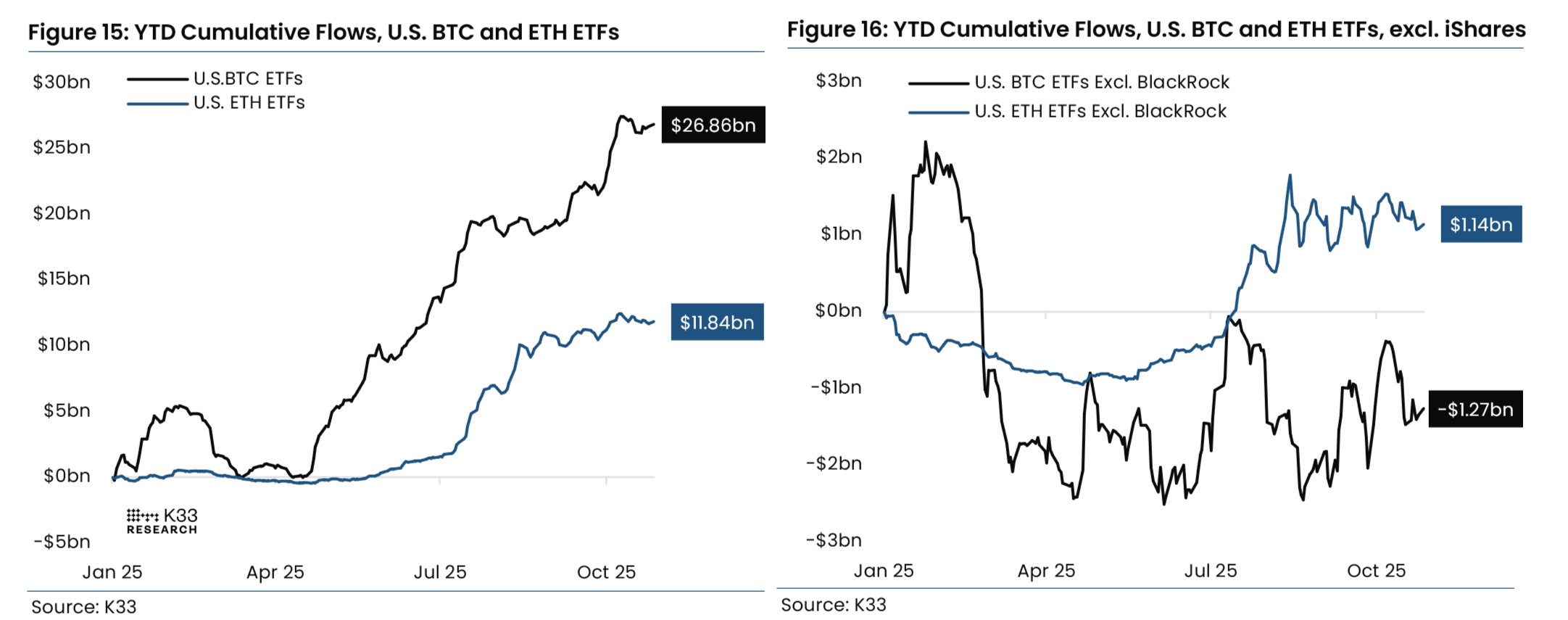

BTC ETFs are up $26.9 billion year-to-date, but $28.1 billion is from BlackRock’s IBIT. Except for IBIT, flows are negative.

BlackRock is not participating in the upcoming altcoin ETF wave. “There is an opportunity for competitors to get strong flows, but on a net basis, their overall flow could be limiting.”

BlackRock The iShares Bitcoin Trust ETF sees inflows of $28.1 billion in 2025. It’s no surprise that an investment firm that manages over $10 trillion in assets is raising more capital from its clients. The problem is that altcoin ETFs don’t have the same support, so long-term demand may be much more limited. This shows the potential for the altcoin bull, which was dreamed of with the approval of the altcoin ETF, to turn into disappointment.

BlackRock, which manages $13.5 trillion in assets, is known as a government lender and there is no larger asset management company.

Especially LEFT and XRP It is possible for assets other than some exceptional altcoins to see very funny volumes and entries.