When Trump spoke today he said he was able to shake the markets but Bessent did the exact opposite. Chinese Trump, who shook the markets twice this month and at least 7 times throughout the year with his statements, is enjoying this. Cryptocurrency regulations Although it was a great thing for the company, Trump’s coming into office caused news-driven declines and rises to occur more frequently. So what do analysts say?

Gold and Bitcoin

gold ounce price It is below $4,000 and the rally appears to be over for now. The halt of the gold rally is related to the cessation of the China trade war and the balancing of concerns about global markets. So when we look at cryptocurrencies, we can see it as a positive development. Michael Poppe also wrote that this is great for cryptocurrencies and previously mentioned that he expects an uptrend with this rally pause.

Although there has not been a big altcoin rise as desired yet, BTC’s willingness to take back $ 116 thousand is positive.

“I said this yesterday and before, Gold falling and consolidating is a very positive development for risky assets including Altcoins.

with ETH/BTC Gold There is a negative correlation between . The best period for altcoins is the consolidation period of gold. If this happens, we will see risky assets start to rise, and some select, strong Altcoins are already starting to strengthen.

“I repeat, we still have a 1-2 year rise period ahead of us.”

Tokenization Its story and number support the story of a 1-2 year rise period for the giant company to venture into crypto-related businesses. Many large banks, trillion-dollar asset managers have not yet launched cryptocurrency services and will do so by 2026. If this is a bubble, it looks like it has a lot of room to grow.

Cryptocurrencies Are Possible for Ascension

Fed interest rate cuts will continue and problems with China are being resolved. Let’s hope we see an agreement on Thursday that points to at least a 1-year compromise, not a tariff freeze. Prior to this, over 16 billion dollars of positions were liquidated within hours, making the environment more suitable for the rise. Especially since the cleansing in altcoins has turned into a complete reset, the environment is more suitable for a bullish story.

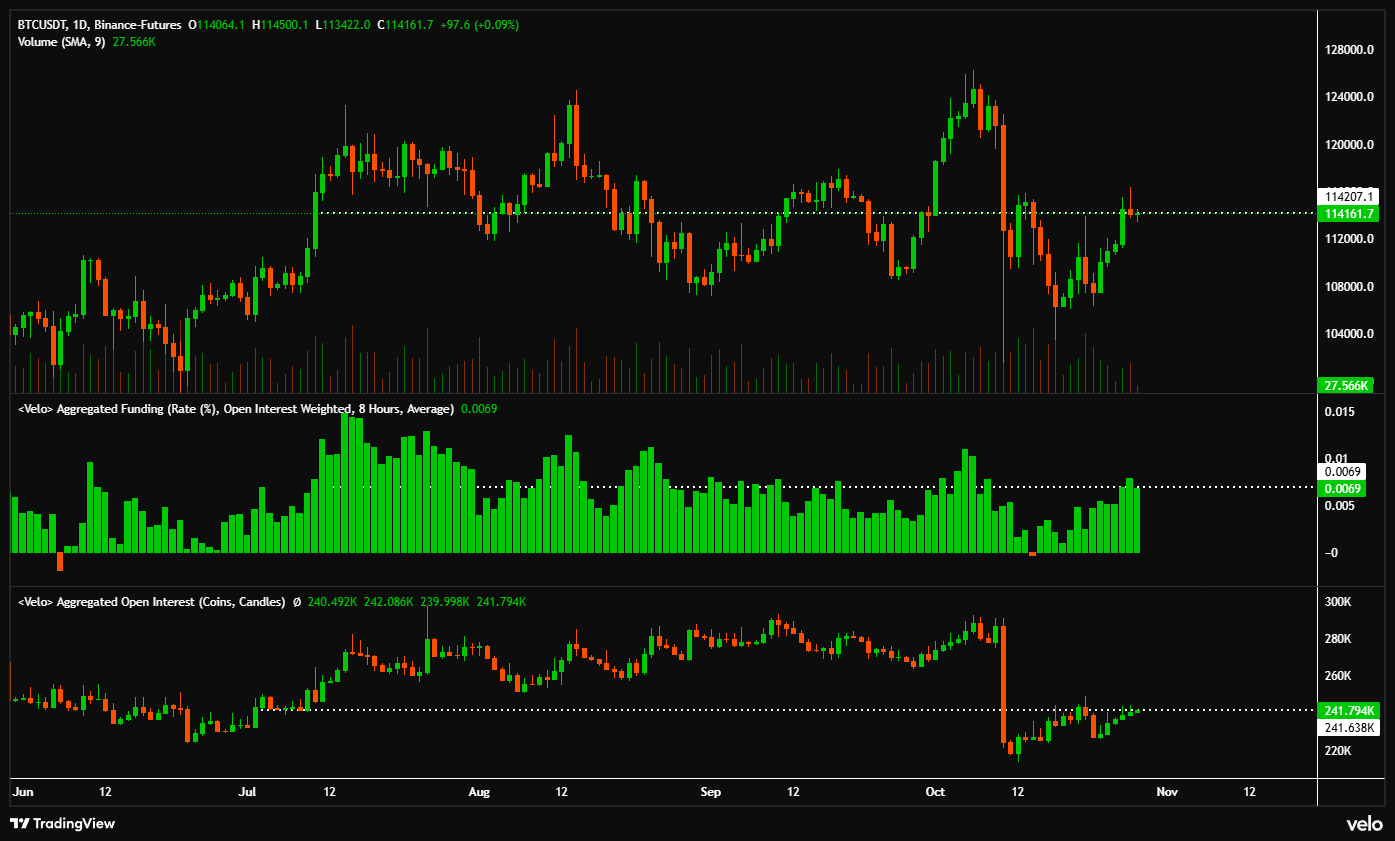

“Looking at the BTC funding rate and open interest, there has been almost no change this month. The price has remained flat in October, although it did drop up to 20% after first reaching an all-time high. The funding rate is fairly neutral at the levels it has been trading at for the last 2-3 months.”

Open interest is back to July levels and that’s the only big change here. It’s still well below the levels it was trading at at those prices in August and September. “This is a good thing as it means there is less leverage in the system.”