Bitcoin (BTC) reached an all-time high of $126,198 in the first week of October  $111,672.87has lost over $15,000 in value since then. Although the large-scale liquidation wave in the crypto market caused a sharp decline in prices, on-chain data points to a renewed upward movement in the coming days. Analysts state that Bitcoin’s selling pressure is gradually decreasing and a new balance is starting to form in the market.

$111,672.87has lost over $15,000 in value since then. Although the large-scale liquidation wave in the crypto market caused a sharp decline in prices, on-chain data points to a renewed upward movement in the coming days. Analysts state that Bitcoin’s selling pressure is gradually decreasing and a new balance is starting to form in the market.

Selling Pressure Reduces, Investors Are Waiting

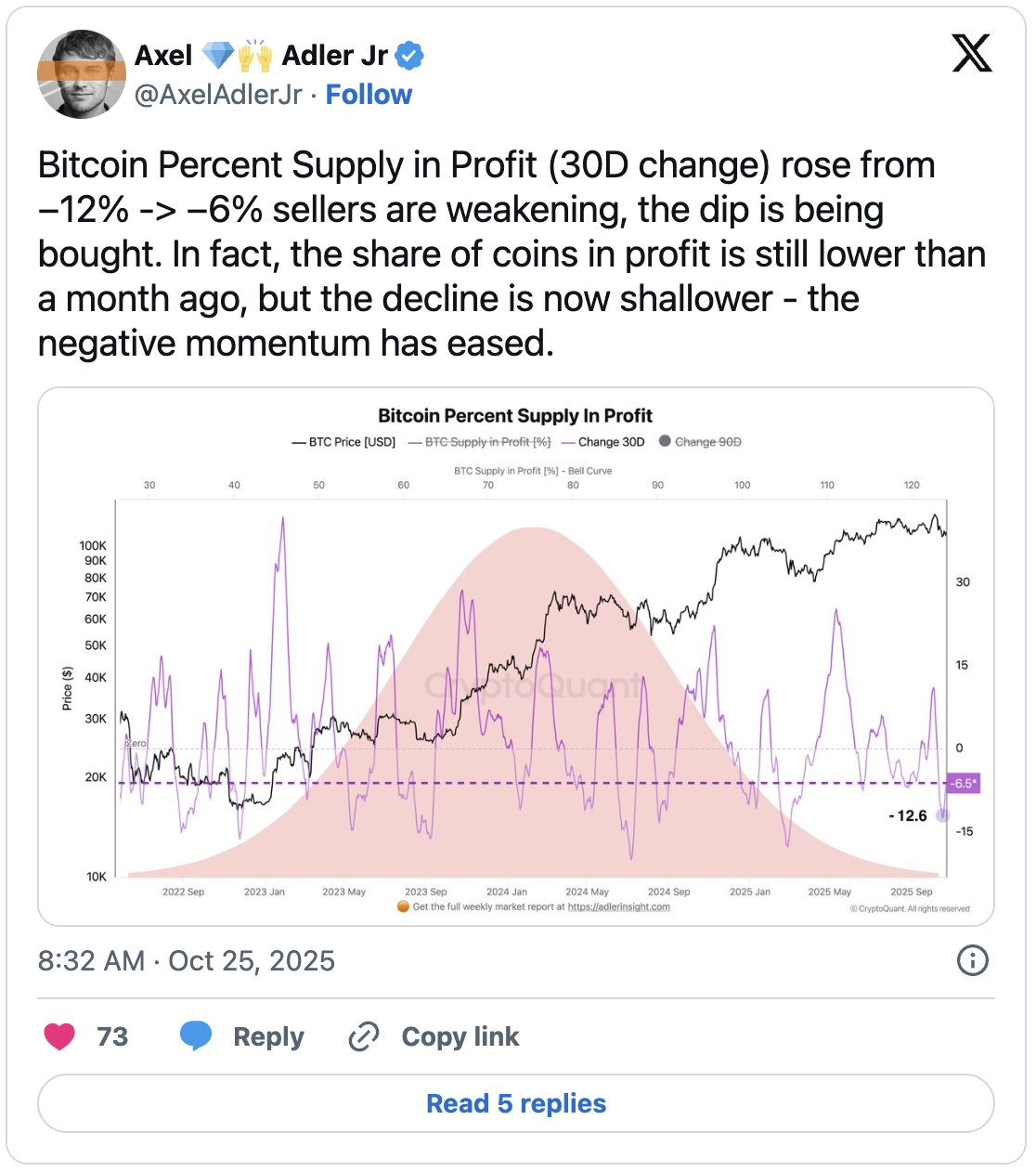

According to on-chain analyst Axel Adler, Bitcoin’s “in-profit supply ratio” has declined significantly in recent weeks. This ratio shows how much profit investors can make at the current price level. Adler stated that the amount of Bitcoin purchased below the current price has decreased in the last 30 days. This shows that investors’ desire to sell at a loss has decreased and the selling pressure in the market has weakened.

On the other hand, although the market has still not fully reached the pre-liquidation levels at the beginning of October, it is noteworthy that sales have decreased in recent weeks. According to analysts, this chart shows that the harshest part of the downtrend is behind and Bitcoin has regained stability. Historical data also reveals that recovery in price movements in similar periods usually results in a strong rise.

Institutional Interest Adds Power to Bitcoin

At the time of writing, Bitcoin is trading at $111,616 and has increased by 0.32% in the last 24 hours. BTC, which tested the highest level of $ 111,850 during the day, exhibits strong resistance despite the low trading volume. On the volume side, transactions amounted to $40.43 billion, with a decrease of 20.9%. This decrease may cause a supply squeeze in the market, creating a positive pressure on the price.

It seems that institutional investor interest has started to increase again. JPMorgan’s latest move towards Bitcoin confirms this interest. The bank is working on a system that will allow corporate customers to use their BTC assets as collateral by the end of 2025. This development may increase the demand for Bitcoin and support the upward movement of the price in the long term.

In addition, the growth in BlackRock’s Bitcoin ETF applications and MicroStrategy’s new BTC purchases also show that the corporate front has become active again. In particular, the ETF approval wave that started at the end of 2024 brought billions of dollars of new capital inflow to the market. According to experts, if this trend continues, Bitcoin may rise to the $ 120,000 range again.

In summary, the decrease in selling pressure seen in the Bitcoin market in recent weeks and the increase in institutional interest give promising signals for investors. However, it should not be forgotten that the market is still fragile. The price maintaining the $110,000 support will be critical in determining the short-term direction. Experts consider this period as the “accumulation phase” and emphasize the importance of investors thinking long-term.