Short-term performance differences Bitcoin  $111,463.88‘of causing it to be overshadowed by some assets or stocks. So, when we look at the earnings chart for the last 12 months, how does Bitcoin compare to other assets? What does JPMorgan CEO’s changing Bitcoin attitude from 2017 to today tell us today?

$111,463.88‘of causing it to be overshadowed by some assets or stocks. So, when we look at the earnings chart for the last 12 months, how does Bitcoin compare to other assets? What does JPMorgan CEO’s changing Bitcoin attitude from 2017 to today tell us today?

Bitcoin Comparison

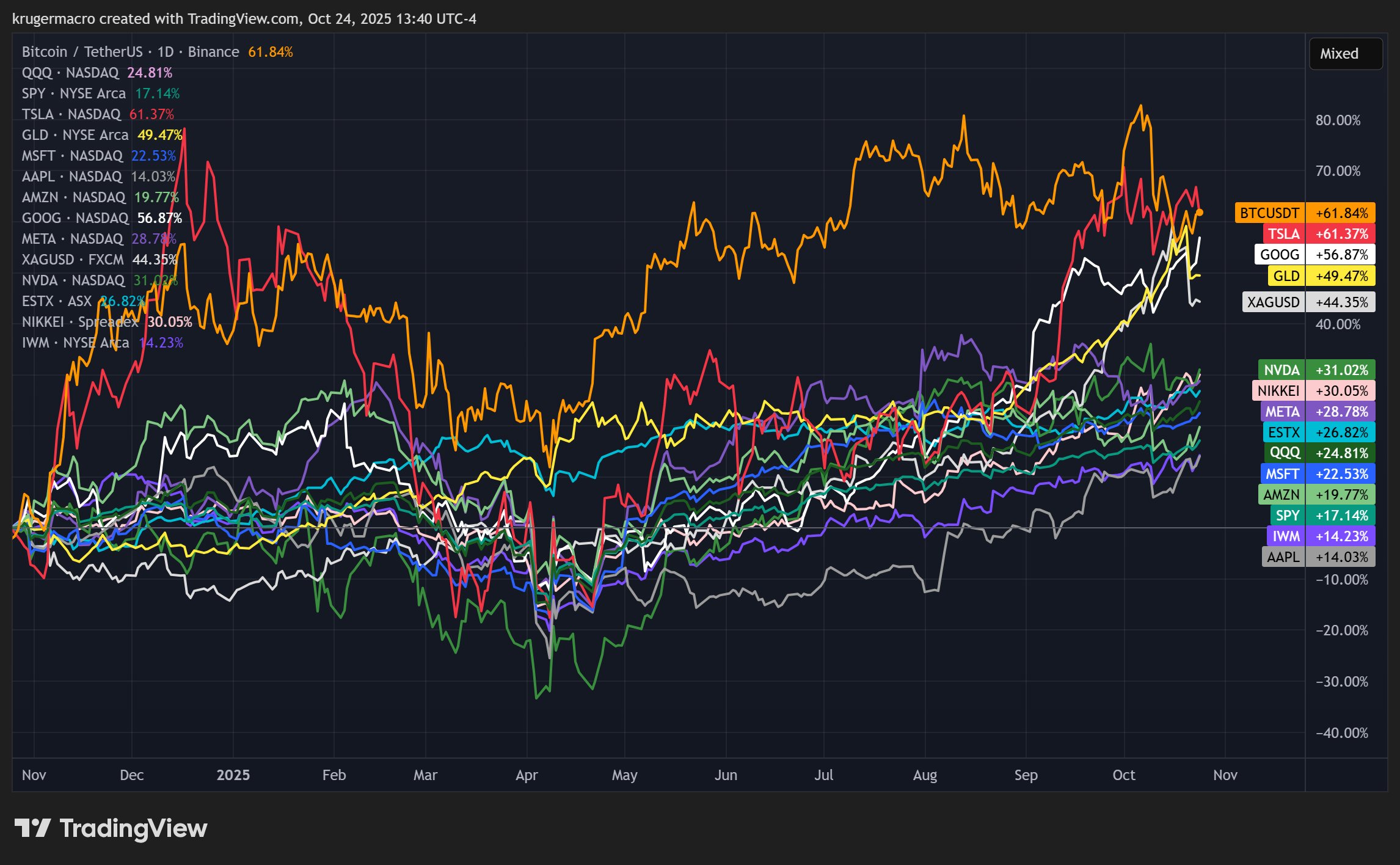

Over the last 12 months, Apple has gained 14% and ranks 15th. Tesla, on the other hand, ranks 2nd on the list comparing Bitcoin with 61% gains. Bitcoin Despite short-term fluctuations and sudden ups and downs, it maintains its first place with a gain rate of 62% in the last 12 months. Moreover, if you examine Bitcoin’s situation on the chart, you will see that it is a stable leader. Although he lost his throne only in the fall after the November elections, he later regained it.

Moreover, it has achieved profitability that no competitor has achieved in the last 12 months, with an annual gain of over 80%. This happened despite the general rally in the stock market. Moreover, Gold made one of the biggest rallies in history and reached new all-time record levels. And since this happens once every few decades, it’s a feat that probably won’t be repeated next year.

There is more. In the continuation of interest rate cuts, BTC and cryptocurrencies It’s possible it’s outperforming other assets because it hasn’t yet seen the same amount of inflow from institutional investors as most of its rivals.

Alex Krüger shared this graphic of Bitcoin showed how profitable it is.

Looking back, people like Jamie Dimon had an extremely strict attitude towards Bitcoin. However, at the point we have reached today, they have turned into completely different people. For example, Michael Saylor, one of the biggest crypto enemies, has been accumulating BTC since 2020 and is the largest corporate crypto treasury company today.

Lark Davis reminded me of the old times.

“Jamie Dimon in 2017: “I will fire any employee who touches cryptocurrency.” He said.

Today, JPMorgan plans to allow institutional clients to use Bitcoin and ETH as collateral. Bankers and politicians make their living by lying. So you should always ignore what they say and watch what they do.”

SUI Coin Target

CryptoBullet continues to look for opportunity altcoins. In the chart he shared SUI Coin Saying that it looks technically advantageous, the analyst argues that a new ATH is possible. Important levels to watch out for are $1.99 and $1.71. Losing the second level would mean the end of the bullish story, but due to the BTC.D chart, the analyst is confident in the uptrend. The target is $8 and above.