Experienced investor and analyst Peter Brandt,Bitcoin  $108,190.87He suggested that a formation similar to the soybean crash of 1977 was formed on the price chart of . The famous analyst warned that if such a scenario occurs, the shares of Strategy, the largest institutional Bitcoin investor, may be shaken by deep losses.

$108,190.87He suggested that a formation similar to the soybean crash of 1977 was formed on the price chart of . The famous analyst warned that if such a scenario occurs, the shares of Strategy, the largest institutional Bitcoin investor, may be shaken by deep losses.

Expanding Peak Formation Warning for Bitcoin from Brandt

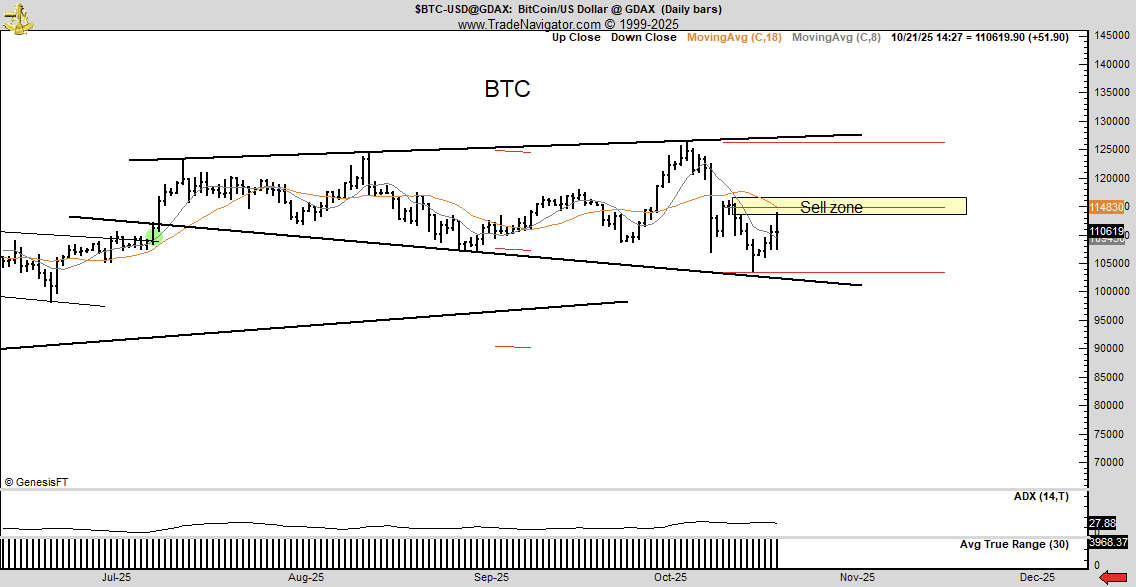

Peter Brandt, X In his post on his account, he drew attention to the sharp collapse in the soybean market in 1977. At that time, the price dropped by nearly 50 percent after an expanding top formation formed on the chart. According to Brandt Bitcoin‘s chart is currently in a similar structure, and a possible repeat could put Strategy’s leveraged Bitcoin plan to a severe test.

Brandt also touched upon the basic mistakes made by investors in risk management and said, “Anyone who trades with 5 percent of his capital will eventually destroy his own portfolio. It is only a matter of time.” he said. The analyst stated that two opposite scenarios are on the table for Bitcoin and said that the price could rise to $ 250,000 or fall to $ 60,000.

Replying to the same post TheMarketSniper Another analyst named argued that the graphic similarity could be misleading in terms of results. Brandt gave an unusually humble response: “You may be right. If it goes up, I want to be long; if it goes down, I want to be short.” He accepted the opposing view with his statement.

Brandt’s warning is critical for Strategy, which keeps over 640,000 BTC on its balance sheet. A possible 50 percent drop in Bitcoin could lead to a dramatic meltdown in the company’s asset value and severely challenge its high-debt-backed strategy.

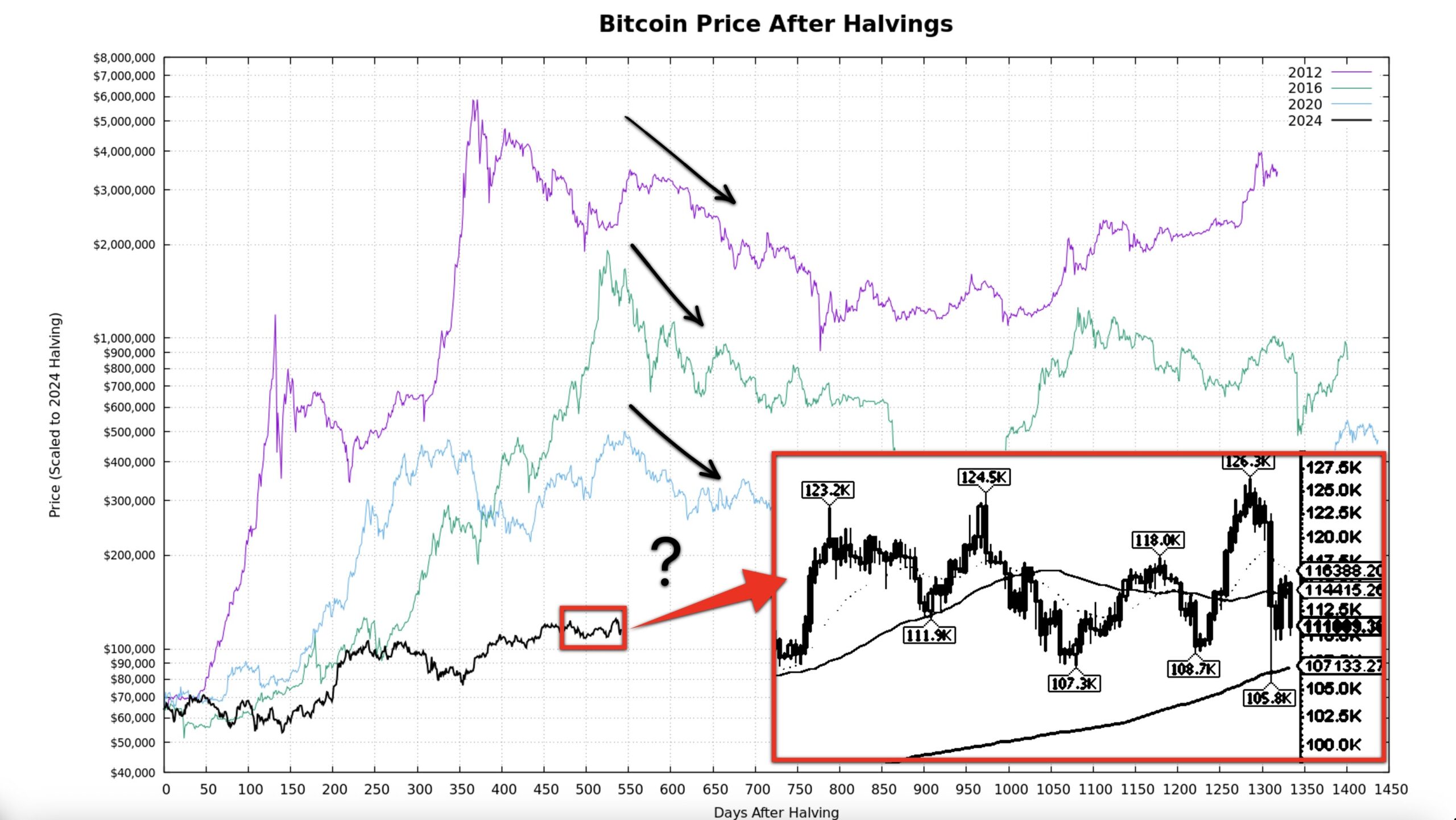

Has Cycle Peak Neared in Bitcoin?

Different analyzes in the market indicate that Bitcoin is approaching a mature cycle phase. Analyst Crypto₿irbclaimed that according to the Cycle Peak Countdown model, 99.3 percent of the current cycle is complete and the possible peak could come in a few days. The model in question is based on profit taking by institutional investors and weakening signals in intra-blockchain data.

In the same period, Binance founder Changpeng Zhaobrought the classic comparison between Bitcoin and gold back to the agenda. “My guess is that Bitcoin will surpass gold. I don’t know when it will happen, but it will happen,” Zhao said. He emphasized the potential of the largest cryptocurrency. Experts report that capital flows are turning to Bitcoin after the steepest daily decline in gold prices since 2013.