Spot traded in the USA Bitcoin  $107,888.00 ETFs moved back into positive territory on the second trading day of the week, drawing net inflows of $477.2 million. This recovery, following the outflows in recent weeks, has renewed the confidence of institutional investors in cryptocurrencies. LVRG Research Director Nick Ruckstated that the change in entry direction “carries a signal of stability for institutions seeking portfolio diversification.”

$107,888.00 ETFs moved back into positive territory on the second trading day of the week, drawing net inflows of $477.2 million. This recovery, following the outflows in recent weeks, has renewed the confidence of institutional investors in cryptocurrencies. LVRG Research Director Nick Ruckstated that the change in entry direction “carries a signal of stability for institutions seeking portfolio diversification.”

Institutional Capital is Back

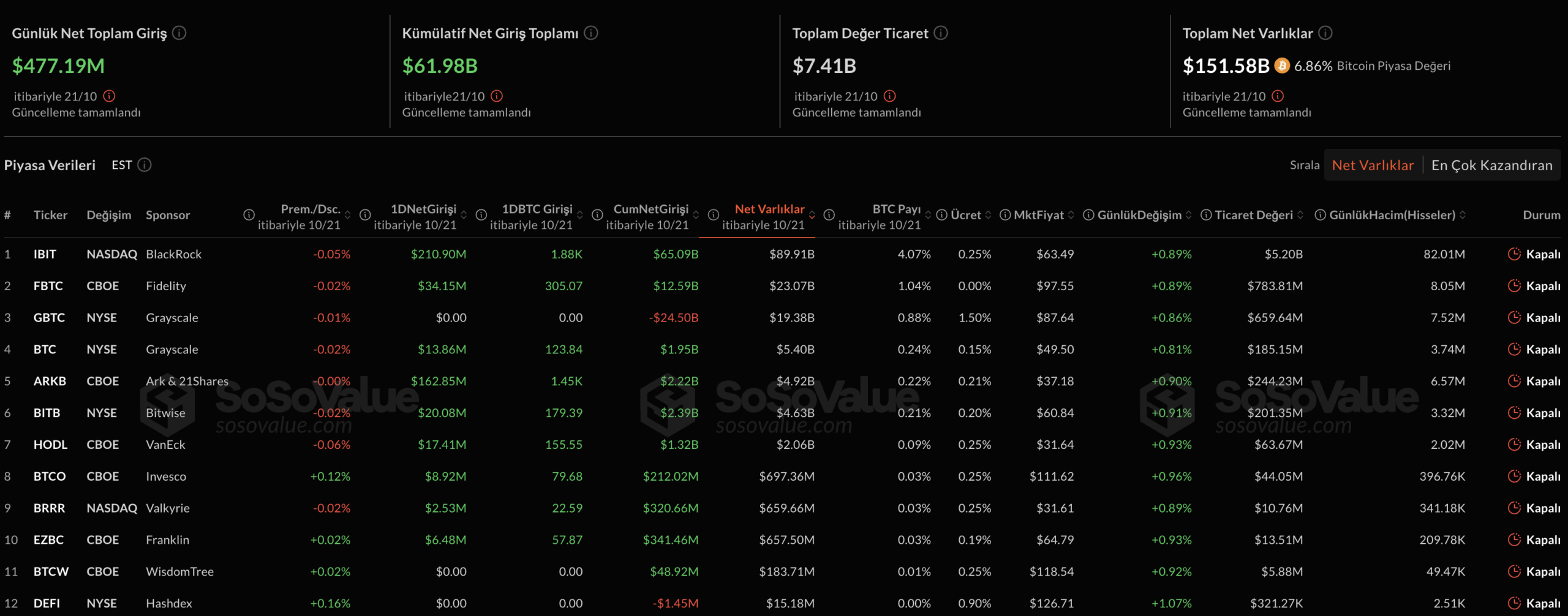

SoSoValue According to data, 12 spots in the USA Bitcoin ETF9 of them completed the day with a positive entry. BlackRock’s IBIT pulled in $210.9 million, Ark & 21Shares’ ARKB pulled in $162.8 million, and Fidelity’s FBTC pulled in $34.15 million. Ethereum  $3,874.69 While there was a net inflow of 141.6 million dollars on the side, Fidelity’s FETH took the lead with an inflow of 59 million dollars.

$3,874.69 While there was a net inflow of 141.6 million dollars on the side, Fidelity’s FETH took the lead with an inflow of 59 million dollars.

In recent days, there has been an outflow of over $1 billion from cryptocurrency-based investment products due to trade tensions between the USA and China. However, with Tuesday’s entries, the total transaction volume reached $7.41 billion. Volumes ranging from 5 to 9.78 billion dollars throughout October are considered to indicate a rapidly increasing institutional interest compared to the 2-4 billion dollar range in September.

While Gold Falls, Bitcoin Stands Out

According to LVRG’s analysis, increasing transaction volumes indicate a rebirth of risk appetite for cryptocurrencies. “While strengthening institutional participation deepens liquidity, investors are looking for return and protection in the same pot,” Ruck said.

Moreover goldStating that the demand for cryptocurrencies has reached its peak, Ruck said that they expect investors to turn to cryptocurrencies for alternative risk-return opportunities. The price of spot gold fell 5.9 percent on Tuesday, its steepest daily decline since 2020. Analysts state that this development strengthens the possibility of an aggressive catch-up rally for Bitcoin.

Market data shows a stable trend. At the time the news was being prepared, Bitcoin was traded at $108,450 with a 0.18 percent increase in the last 24 hours, and Ethereum was traded at $3,869 with a 0.19 percent decrease.