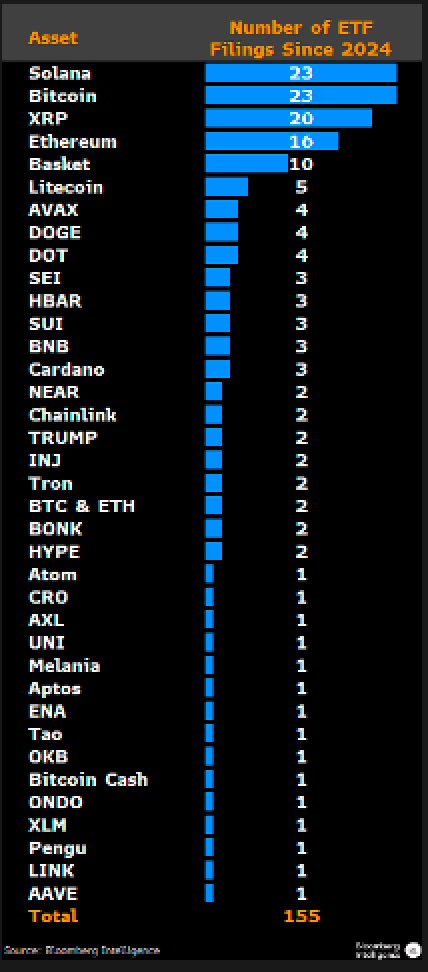

Institutional interest in the cryptocurrency market has reached its historical peak. Bloomberg’s expert ETF analyst Eric BalchunasAccording to data provided by , the number of cryptocurrency-based exchange traded product (ETP) applications globally increased to 155. These applications, covering 35 different cryptocurrencies, are expected to increase to 200 in the next 12 months. Increasing applications in the traditional financial world cryptocurrencyIt shows that he increasingly prefers .

ETP Race Heats Up as Corporate Demand Increases

Wu BlockchainAccording to the table shared by Balchunas, quoted by , investor interest is most solana (23), Bitcoin  $108,190.87 (23) and XRP (20) concentrated on focused ETPs. Ethereum

$108,190.87 (23) and XRP (20) concentrated on focused ETPs. Ethereum  $3,849.72 and basket ETPs covering multiple cryptocurrencies also reached double-digit application numbers. This trend reveals that the investment flow is not limited to Bitcoin alone, but is also rapidly turning to alternative cryptocurrencies. Different usage areas, such as Solana’s high transaction speed and XRP’s role in cross-border payments, support diversified investment strategies.

$3,849.72 and basket ETPs covering multiple cryptocurrencies also reached double-digit application numbers. This trend reveals that the investment flow is not limited to Bitcoin alone, but is also rapidly turning to alternative cryptocurrencies. Different usage areas, such as Solana’s high transaction speed and XRP’s role in cross-border payments, support diversified investment strategies.

Cryptocurrency ETP There are three main factors behind the increase in applications. The first is that regulations have become clearer in many countries. The second is the desire of institutional investors to invest in cryptocurrencies without directly owning them. The third is competition between asset management companies. Each of these drivers wants to gain an advantage in the market by getting the first product approval for trending cryptocurrencies.

Even though the Market Matures, Risks Continue

The increase in the number of ETPs means a wider range of investment options for both individual and institutional investors. These products, which can be accessed through brokerage firms instead of cryptocurrency exchanges, have regulated structures. portfolio diversityIt makes it easier. However, not every product is equally safe or liquid. Investors need to have a good understanding of the underlying assets and their risk levels. It should also be noted that many applications are still at the approval stage. The attitude of the authorities will determine which ETPs enter the market.

As competition increases, a serious downward pressure is expected in fund management fees. Companies that want to stand out among more than 150 applications will try to attract investors with low-cost products. However, gaining investor trust is as important as gaining approval.