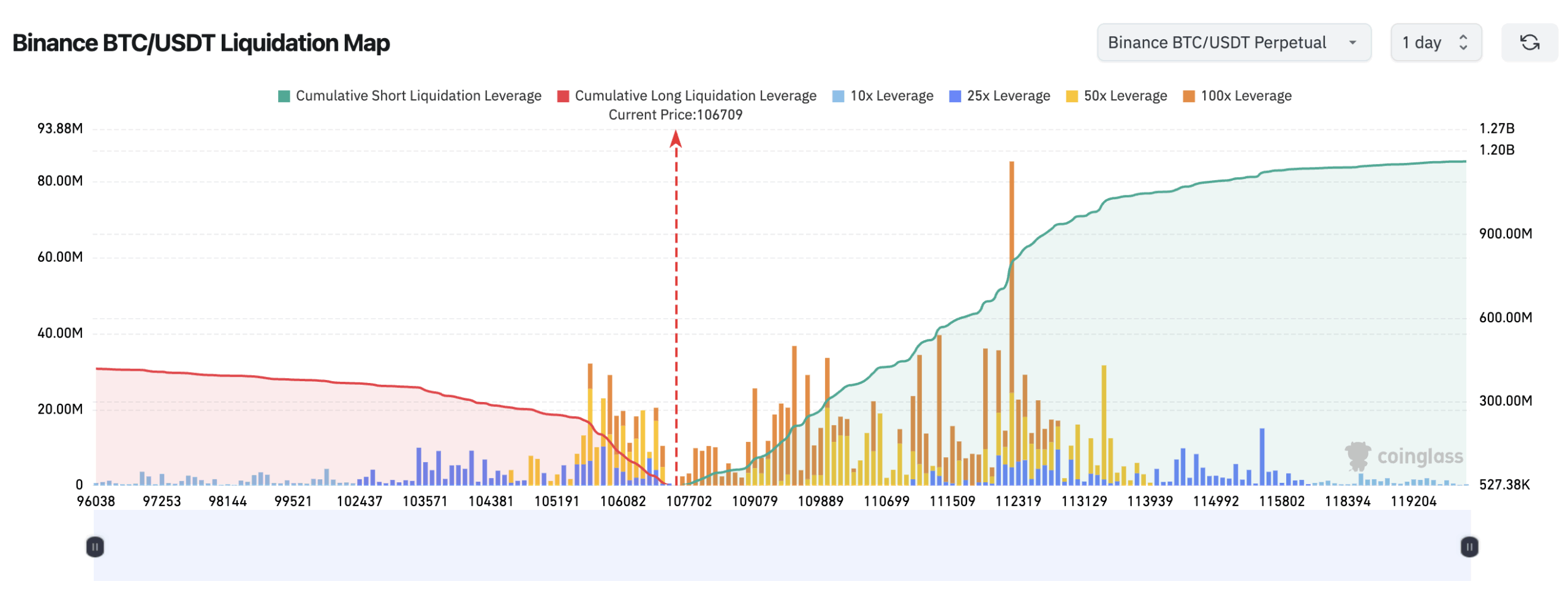

cryptocurrency marketThe tension is increasing. According to Coinglass data, Bitcoin  $110,871.06If the price of ‘s falls below $105,000, the total liquidation power of long positions accumulated on major centralized cryptocurrency exchanges will reach $1.12 billion. Data dated October 17 show that a similar danger also applies in the opposite direction in rising price ranges. If Bitcoin exceeds $ 110,000, the liquidation of the $ 1.26 billion position will be on the agenda.

$110,871.06If the price of ‘s falls below $105,000, the total liquidation power of long positions accumulated on major centralized cryptocurrency exchanges will reach $1.12 billion. Data dated October 17 show that a similar danger also applies in the opposite direction in rising price ranges. If Bitcoin exceeds $ 110,000, the liquidation of the $ 1.26 billion position will be on the agenda.

Two Critical Thresholds in Bitcoin

Offered by analysis platform Coinglass liquidation heat map It reveals the price clusters where investors concentrate. At this point, the $ 105,000 level stands out as the breaking point for large leveraged transactions compared to the current market position. If Bitcoin If it falls below this level, chain liquidations in futures market contracts could be triggered. Such waves often cause sharp declines in price in a short period of time and temporarily weaken market depth.

Conversely, short positions will come under pressure if the price exceeds the $110,000 threshold. Liquidating short positions on this scale can accelerate upward price movement and create a “short squeeze” effect. This dynamic has become the main source of increasing volatility in the market in recent weeks.

How is Liquidation Power Measured?

Seen in Coinglass data liquidation power It does not directly indicate the number of contracts to be liquidated or their monetary equivalent. The columns on the map represent the relative importance of liquidation clusters in each price zone, that is, the possible severity of the market reaction.

Higher liquidation columns indicate that if the price reaches that level, liquidity will change direction rapidly and an intense reaction wave will occur in the market. Therefore, the $105,000–$110,000 range in Bitcoin stands out as not only a technical limit, but also a critical band where market psychology is tested.

For investors, this band constitutes the riskiest area for leveraged transactions. Unwinding margin positions, especially on high-volume centralized cryptocurrency exchanges, can increase price volatility within seconds.

CryptoAppsy According to data, Bitcoin is trading at $106,804, with a decrease of 4.37 percent in the last 24 hours, at the time of writing. The current price threshold indicates that the liquidation cluster at $105,000 could be targeted at any time.