Spot Bitcoin  $111,963.18 And Ethereum

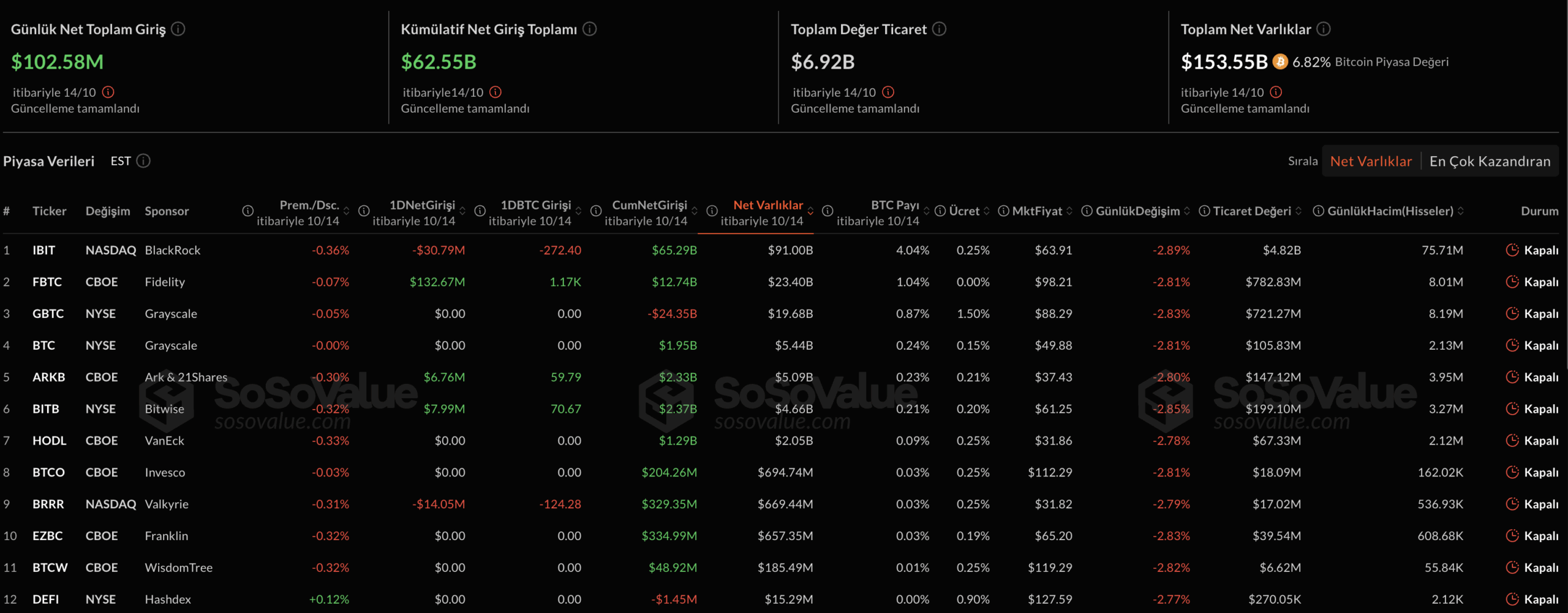

$111,963.18 And Ethereum  $4,011.20 There was a total net inflow of 340 million dollars to ETFs on October 14, corresponding to the last trading day. The inflow is a partial offset to the $755 million outflow seen on Monday, following historic liquidations over the weekend. SoSoValue data shows that there was a total inflow of $102.6 million on the Bitcoin side, with Fidelity’s FBTC standing out with an inflow of $132.67 million. Ark & 21Shares and Bitwise’s ETFs saw positive fund flows, while BlackRock’s IBIT saw $30.8 million in outflows and Valkyrie’s BRRR saw $14 million in outflows. On the Ethereum side, a total of $236.22 million inflow to six ETFs attracted attention, while Fidelity’s FETH took the lead with $154.62 million.

$4,011.20 There was a total net inflow of 340 million dollars to ETFs on October 14, corresponding to the last trading day. The inflow is a partial offset to the $755 million outflow seen on Monday, following historic liquidations over the weekend. SoSoValue data shows that there was a total inflow of $102.6 million on the Bitcoin side, with Fidelity’s FBTC standing out with an inflow of $132.67 million. Ark & 21Shares and Bitwise’s ETFs saw positive fund flows, while BlackRock’s IBIT saw $30.8 million in outflows and Valkyrie’s BRRR saw $14 million in outflows. On the Ethereum side, a total of $236.22 million inflow to six ETFs attracted attention, while Fidelity’s FETH took the lead with $154.62 million.

Current Table of Fund Flows to ETFs

Daily data points to a clear divergence in ETFs. In the world of Bitcoin ETF FBTC Sourced powerful inputs, IBIT And BRRR It brought a net positive fund inflow of $102.6 million at the end of the day, balanced with outflows on the front. Ethereum ETFOn the ‘i side, a significant part of the total inflow of 236.22 million dollars was concentrated in FETH. ETFs from Grayscale, Bitwise, VanEck and Franklin Templeton also made meaningful contributions.

CIO of Kronos Research Vincent LiuHe described Monday’s net outflows of $755 million as a reflection of the cautious approach of institutional investors after the harsh shock experienced over the weekend. Although fund flows have turned positive again, it seems that the ETF-based performance divergence continues and risk appetite is gradually recovering.

On the price front CryptoAppsy Data shows that Bitcoin increased by 0.95 percent to $112,781 in the last 24 hours, and Ethereum increased by 4.04 percent to $4,133. Both BTC both ETH On the side, short-term band movement is maintained.

Reflection of the Recovery in ETFs to the Market

Large-scale liquidation wave over the weekend cryptocurrency marketWhile it caused a loss of more than 500 billion dollars from the total value of Turkey, it pulled the prices back by around 10 percent. The trigger of the decline is the US President Donald Trump‘s statement confirming that it will impose 100 percent customs duty on China. The potential trade war narrative has weighed on risky assets.

Head of SignalPlus Insights Augustine FanHe evaluated, “Noise is normal in daily movements after Friday’s multi-standard deviation sales. Volatility should be expected to continue as we approach the tariff threshold pronounced as November 1.” Remaining high sensitivity to news flow will continue to be decisive for the stability of ETF inflows.

Market players are re-adjusting the risk balance in parallel with the tone of discourse on the US-China line and the flow of macro data. In general, the recovery in fund flows into ETFs is considered an interim respite rather than a permanent reversal.