It would not be a wrong statement if we said that the only topic of the cryptocurrency market since late last night was Trump and his statements. In fact, the only topic on the agenda of not only the cryptocurrency market but also the entire world was Trump and his statements about China.

Fear in the cryptocurrency market increased after US President Donald Trump announced that he would impose 100 percent customs duties on China. The Crypto Fear & Greed Index experienced a dramatic decline of 37 points, falling from the “greed” level (64) on Friday to the “fear” level (27) on Saturday. Bitcoin  $111,822.89 Its price dropped to $102,000 in Binance futures after Trump’s statement.

$111,822.89 Its price dropped to $102,000 in Binance futures after Trump’s statement.

According to CoinGlass data, approximately 19.27 billion dollars of long and short positions were liquidated in the last 24 hours. This development once again revealed how sharp the rapid decline in investor confidence was.

Opposite Signal from Analysts: “Buying Opportunity”

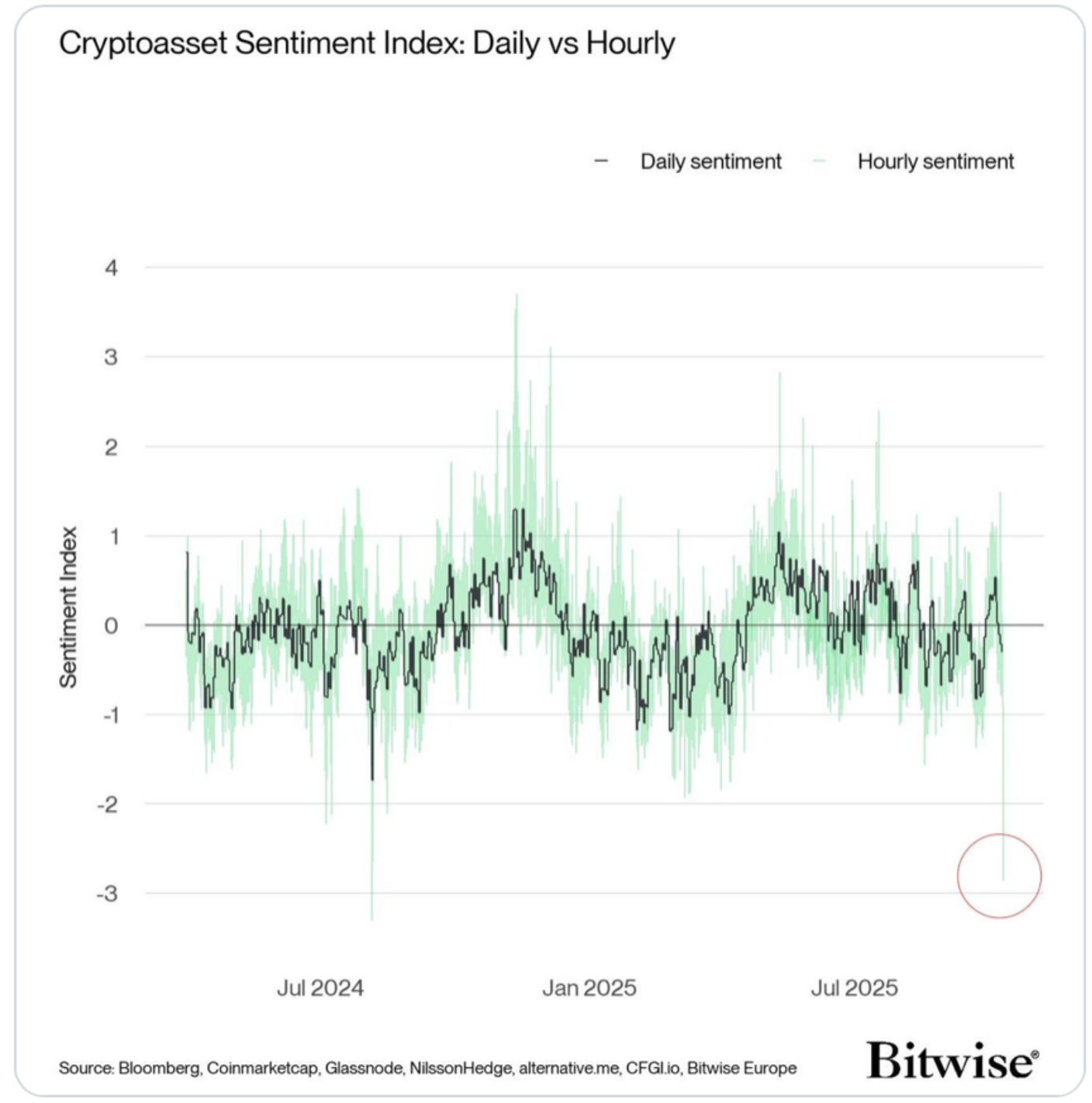

However, despite all this, Bitwise Europe Research Director Andre Dragosch said in his post on the X account that the company’s “intraday sentiment index produced a strong reverse buy signal.” Dragosch stated that the index fell to its lowest level since the “Yen Carry Trade Unwind” period in the summer of 2024, with a standard deviation of -2.8.

Similarly, the last time the market had such low sentiment was April 16, 2024. In those days, Bitcoin dropped to $77,000 as trade tensions increased. At the time, Trump announced a 90-day pause on tariffs and reduced rates to 10 percent for most countries.

Bitcoin’s Records Did Not Create Excitement on Social Media

Santiment analyst Brian Quinlivan said that the new record that Bitcoin reached at $ 125,100 at the beginning of the week did not create the expected enthusiasm on social media. “The response this time was extremely limited, there wasn’t as much enthusiasm as there was on previous records,” Quinlivan said on the Thinking Crypto podcast. The expert emphasized that investors now accept the increases as normal and that this situation may be an indicator of a “saturation phase” in market psychology.

Similarly, in a Glassnode analysis conducted last week, it was stated that Bitcoin’s new peaks were not supported by the increase in transaction volume, and investors tended to take profits.

In short, Trump’s tariff announcement created an atmosphere of uncertainty in the crypto market that has not been seen in a long time. However, some analysts consider this decline as a “buying opportunity” as the market enters the extreme fear zone. Although it seems likely that volatility will increase in the short term, it should not be forgotten that historically such panic periods have generally occurred before recovery.