Short selling (short positions) cryptocurrency He inflicted great losses on his enemies in the long run. made in 2015 The Big Short The opportunity in the 2007-2010 financial crisis was discussed in the movie. It was about a true story, but cryptocurrencies represent innovation to a large extent, contrary to those who think it is a bubble. Kerrisdale Capital is not directly opposing cryptocurrencies anyway, it is playing for the collapse of another story.

Cryptocurrency Short Operation

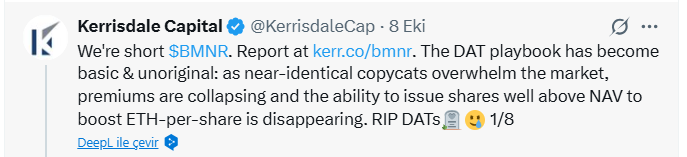

Kerrisdale Capital, famous for its short sales, announced that it has taken a short selling position in Bitmine (BMNR) shares. This is actually the first step predicting the collapse of cryptocurrency reserve companies. And there is not a single company on the stock exchange of many countries that has not established a cryptocurrency reserve company yet. There are companies in the USA, Japan and many non-German countries that have discovered the trick to keep crypto currencies as reserves and make their share prices rise rapidly.

Martı company from Türkiye also did this to increase its shares in the US stock market. If we are talking about a bubble, this bubble occurs in public companies that create cryptocurrency reserves. Their shares trading at a premium, their story of consistent cash generation, and the assumption that crypto will constantly rise pushed them to imitate Microstrategy.

MSTR There were also short sellers of its shares, but Saylor was early and managed to survive because its average cost was quite low. Those who shorted it faced the shock of MSTR shares exceeding the ATH level of 20 years ago.

Let’s go back to Kerrisdale Capital. According to the latest statement, it was stated that the crypto reserve strategy has become homogeneous and the intensifying market competition has caused the premiums to decrease rapidly. Kerrisdale said that he was not shorting ETH, but that BMNR’s model lacked scarcity and sustainability and that the logic behind premium trading was no longer valid.

Cryptocurrency Reserve Bubble

BTC He earned a lot of money from this job. ETH benefited somewhat and SOL Coin He was able to touch upon the crypto reserve story. BNB felt its support in its ATH journey. Companies that quickly create cryptocurrency reserves are now losing the advantage of being the first, and Kerrisdale Capital says;

“The DAT playbook has ceased to be fundamental and original: almost identical copies are invading the market, premiums are collapsing and the possibility of issuing shares well above NAV to increase ETH per share is disappearing. Goodbye reserve companies.

Competition is exploding. The capital increase of over $100 billion planned by companies pursuing crypto treasury strategies has eliminated the scarcity that was keeping premiums high. Many firms now trade at or below par as their reflexive cycles grind to a halt and their models collapse.

MSTR saw its premium fall from 2-2.5x NAV to ~1.4x after unpopular financings and policy changes broke the spell. If even a pioneer with a cult following can’t keep the magic going, no one else can.

Tom Lee has proven to be a disappointing meme lord. No cat videos. There are no conversations telling you to mortgage your house to buy ETH. Poor use of caps lock, emojis, GIFs and AI slop. Lee, who is very TradFi and boring, pales in comparison to Saylor and Chamath.

BMNR’s premium is gradually decreasing and will likely continue to decrease until it drops to NAV or below. The greater the decline, the slower the increase of ETH per share until it drops below 1. MNav is ~1.4x today, down over 40%.

Management changed reporting when growth stalled. After August 25, it stopped providing NAV per share and number of shares, which are important data that investors need and demand. If EPS growth were improving, they’d market that, right?

Last month’s “lucrative” $365 million direct deal with a $70 headline price was not what it seemed. When you value the attached warrants, this was actually a discounted cash raise disguised as a premium increase.

DATs are pretty stupid. In what world can random companies set up random companies to issue stock forever to accumulate the same liquid tradable asset, without all of those companies’ stocks trading at a discount to their NAV?

We do not short sell ETH. If you want ETH, go buy ETH. This has never been easier. The whole point of $BMNR is to get investors to overpay to copy a playbook that no longer works. “There is no strategy, there is no scarcity, there is no reason why this company deserves a bonus.”

Months before this announcement came on October 9, 2025, I mentioned that the next bear markets would be sparked at the point when crypto reserve companies started selling their assets. Kerrisdale is the first official statement in this direction, keep your eyes open and watch what happens. Sure, it might take a few quarters, but at some point you’ve spent enough time in crypto to watch every bubble of crypto pop, right? metaverseyour ICO madness lasts a few hours meme coinsNFTs, denominations like 3AC and much more.