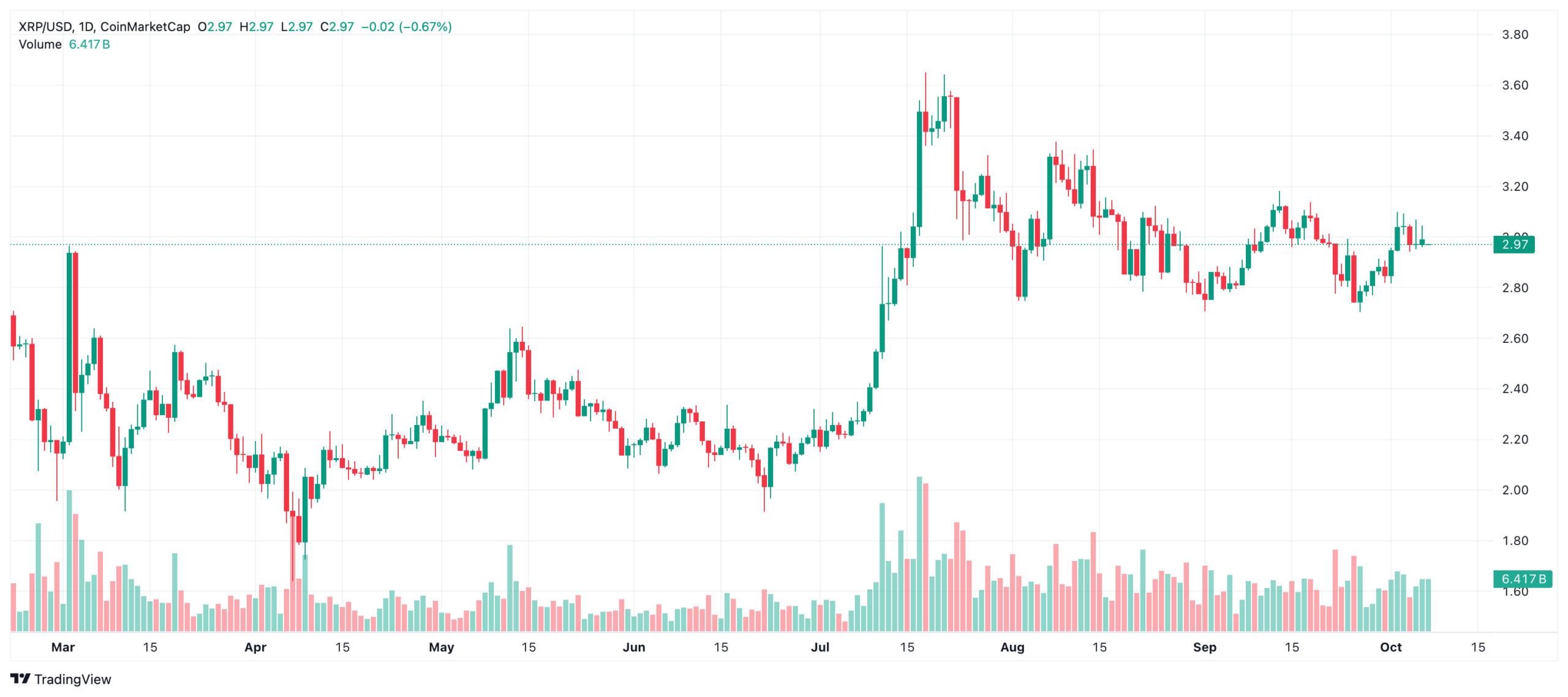

XRPAfter throwing a needle to $ 3.05, he took a horizontal movement in a narrow band around $ 2.99. Intensive sales came on the hill of resistance in the day, while buyers have repeatedly defended the $ 2,99 region. The transaction volume doubled in a short time, while exits of over $ 300 million of the big wallets drew attention. Market actors pricit the possibility of acceleration towards $ 3,10 if the dollar band is exceeded by $ 3,04–3.05 with the upcoming macro and regulatory dates.

Technical view in XRP: 2,99 dollars bottom, 3,04–3.05 dollars resistance

The most clear information in the current table is that liquidity is rapidly absorbed at $ 2,99 and there is multiple defense. The micro -structure of the market shows that the price is withdrawn in every attempt on the sales wall that concentrates on the dollar band of 3,04–3.05. The $ 2,97–3.05 -day -day -day wave width indicates that the short -term jam is evident in the short term.

The price of the price in the short term can be broken in favor of buyers with a recovery of $ 3.03 and permanently over $ 3.05. Bloching in the volume profile may trigger tracking at the time of breaking. In the other opposite scenario, sagging under $ 2.99 raises support change attempts, but in -day data shows that there may be a rapid welcome at this level.

When planning to take positions in XRP, closing/continuity confirmation of over $ 3.05 is required. In unsuccessful trials, the accumulation phase can be seen around $ 2,99. Although profit purchases from whale addresses increase the volatility in the short term, but the absorption at the bottom is read in favor of trend maturation as it is preserved.

Cryptoappsy According to data, the XRP is traded for $ 2.97 with a decrease of 0.02 percent in the last 24 hours at the time of preparation.

Medium Term Expectations

In the market narrative for XRP, the FED interest rate decision and ETF Two elements stand out as the calendar. The expectation of these headings directly affects the mobility on the spot and derivative side.

Fed Interest Discount Possibility and regulatory announcement as the windows approach before the news, the position of positioning before the news can have a rising effect towards the $ 3,10 threshold. The double -digit volume increase and the intensification of corporate fund flows observed in the process data support the short -term rise scenario.

Repeated retreats in calendar -welded disappointment or resistance can extend the compression in the $ 3,04–3.05 band. Volatility is expected if the defense of $ 2.99 is broken. Conversely, the net acceptance and continuity over $ 3.05 technically legitimizes acceleration towards the 3,10–3.12 dollar zone.