Bitcoin  $123,961.58While the price of 126.200 dollars renewed the record for the first time the market value exceeded 2.5 trillion dollars. Economist Peter Schiffdescribing the rise as a “bear market rally” and doubt the permanence of the movement fell. Pointing to $ 4,000 in gold, Schiff said that the record has changed in gold comparison and that a equivalent level was approximately $ 148,000.

$123,961.58While the price of 126.200 dollars renewed the record for the first time the market value exceeded 2.5 trillion dollars. Economist Peter Schiffdescribing the rise as a “bear market rally” and doubt the permanence of the movement fell. Pointing to $ 4,000 in gold, Schiff said that the record has changed in gold comparison and that a equivalent level was approximately $ 148,000.

Schiff’s Scenario of $ 148,000 in Bitcoin

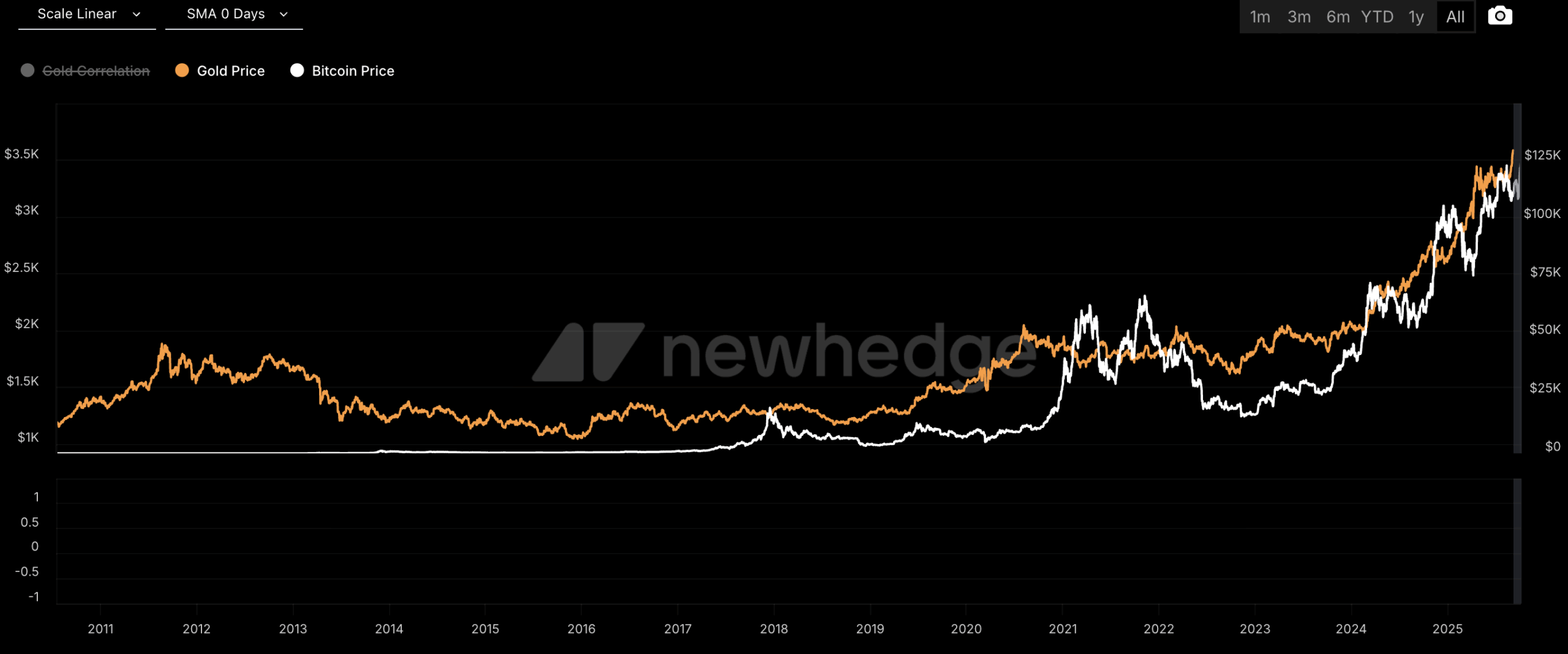

According to Schiff, Bitcoin’s dollar -based record may seem impressive, but still behind the record on gold. Ounce of gold As Bitcoin climbed up to $ 4,000, the “gold equivalent” summit was moved up. Therefore, the $ 126.200 level does not correspond to the record in the previous Gold-Bitcoin. The economist’s approach is based not only with the dollar index, but also on the shore of the yellow metal, which is considered a safe port in the monetary contraction-ratio.

The key question for market participants is the sustainability and direction determination of the new record. Ounce price of gold As it rises, the gold -based record level rises. Thus, it may not have the same effect on the reference set of corporate investors who diversify the dollar -based record portfolio on paper. This frame crypto currency-It also makes visible how the Risk premium interacts with macro expectations.

Market Balance: Return – Risk Profile and Year -End Scenarios

Since the beginning of the year gold While the risk of metrics set up to risk, Bitcoin maintained leadership in the total return league. Strong entries to crypto currency -based investment products support the view that the target of $ 150,000 is accessible by the end of the year, along with the Uptober Rally narrative and the expectations of monetary relaxation in the USA. On the other hand, the gold market of $ 27 trillion is constantly up to the scale and liquidity advantage. This brings higher levels to the table on the crypto currency side.

The main threshold closely monitored in Bitcoin in the short term is the support-requirement transformation of the 121,500-126.000 dollar band and positioning in the option market. The macro -front government closure and statements from the FED are closely monitored, while the new level of equilibrium underneath will serve as an external anchor in the pricing in crypto currencies. Corporate demand, ETF flows and Blockchain profit purchase dynamics will determine the direction of Bitcoin and the rest of the market.