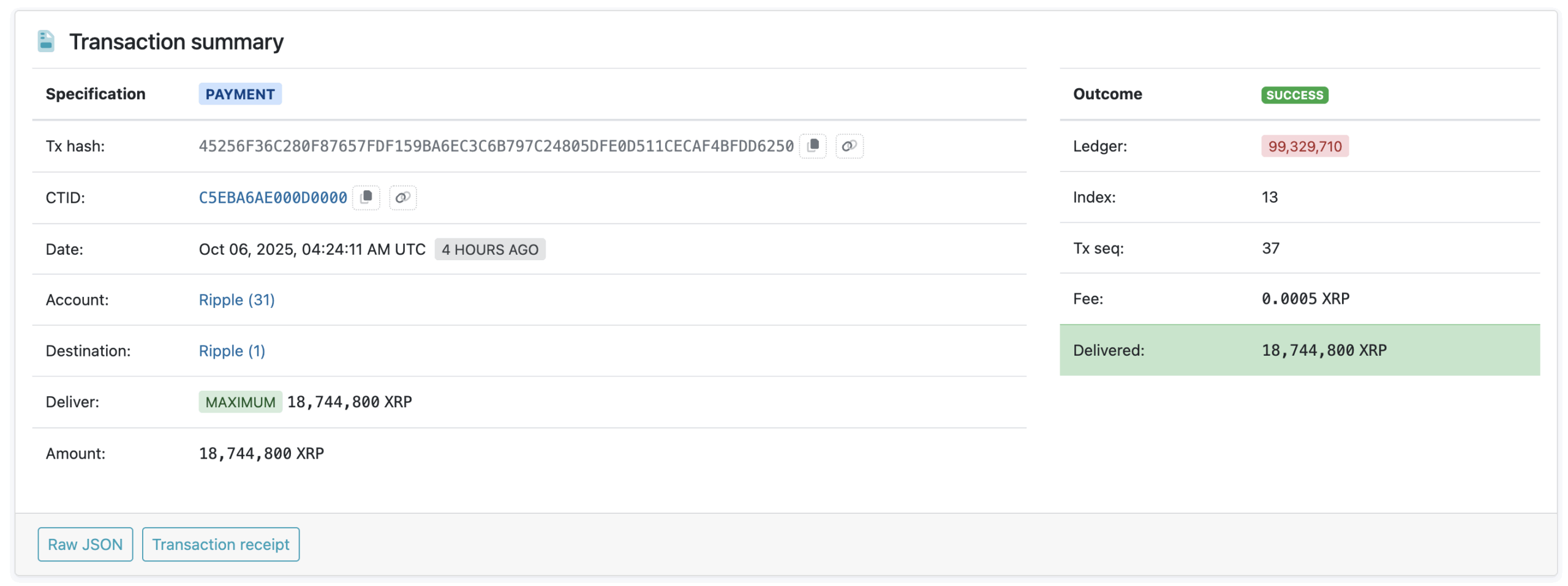

One Ripple  $3.05 whaleThe claim that he sold $ 55 million XRP was caused by question marks in the community with the fact that the price of Altcoin again dangled below $ 3. On October 6 Whale AlertAlthough the transfer of 18.744,800 XRP transfer gives the impression of sales pressure at first glance, the records in Blockchain confirm that the movement is an internal transfer to the Ripple (1) wallet from the Ripple (31) wallet. When it is descended to further, the Midnight Foundation’s “Midnight Glacier Drop” distribution Ripple (31) ‘s assets have been moved for the first time after two years. Cryptoappsy According to the data, XRP decreased by 2 percent in the last 24 hours, while the day of day was $ 2.95–3.07.

$3.05 whaleThe claim that he sold $ 55 million XRP was caused by question marks in the community with the fact that the price of Altcoin again dangled below $ 3. On October 6 Whale AlertAlthough the transfer of 18.744,800 XRP transfer gives the impression of sales pressure at first glance, the records in Blockchain confirm that the movement is an internal transfer to the Ripple (1) wallet from the Ripple (31) wallet. When it is descended to further, the Midnight Foundation’s “Midnight Glacier Drop” distribution Ripple (31) ‘s assets have been moved for the first time after two years. Cryptoappsy According to the data, XRP decreased by 2 percent in the last 24 hours, while the day of day was $ 2.95–3.07.

Details of XRP transfer of Ripple whale

XRPSCAN According to the data, the transfer took place between the two -tagged wallets in the Ripple ecosystem. In other words, there is no transfer to the stock market and directly to asset management move. Ripple (31) directed approximately 18,744,807 XRP to Ripple (1), which has recently recorded 300 million XRP inputs from Ripple (26). After the transfer, Ripple (1) ‘s balance rose to 668,745,081 XRP and in the wallet Bitstamp with Gatehub There are also related coins.

Midnight Foundation and “the biggest blockchain so far AirDrop” announced as announced Midnight Glacier DropRipple (31), the main reason for coin flow. This context weakens the discourse of “whale sales” voiced on social media.

The fact that the transaction was the subject of the Whale Alert notification dated 6 October increased the speculation when it coincided with a price decrease in terms of timing. However, the data shows that the transfer does not contain a counter -party or stock market entry that necessitates the sale of the sale, and is the internal consolidation.

The current situation in XRP price

The main reason for weakness in the short term in the short term is Cryptoquant’s 30 -day moving average “XRP Whale Flow” indicator still produces signals in the negative region. The negative flow indicates that large wallets remain on a clear distribution side, while increasing the sensitivity of around $ 3.

The derivative market data draws a mixed table. According to CoNSS, the total XRP open position increased by 0.22 percent per 24 hours to 8.95 billion dollars. On the CME side, the open position declines 1.55, while Binance increased by 2.66 percent. The 7 percent rise in volume indicates that the short -term transaction interest is preserved.

In the daily graph on the technical side Falling Wall FormationThe expectation of breaking up is alive. The first target of analysts is $ 3.33. Based on the target height, the new AD ath trial is on the table. 2.80 dollars is lock support. Protection of this level will be decisive for a permanent recovery of the $ 3 threshold and a rise to $ 3.33.