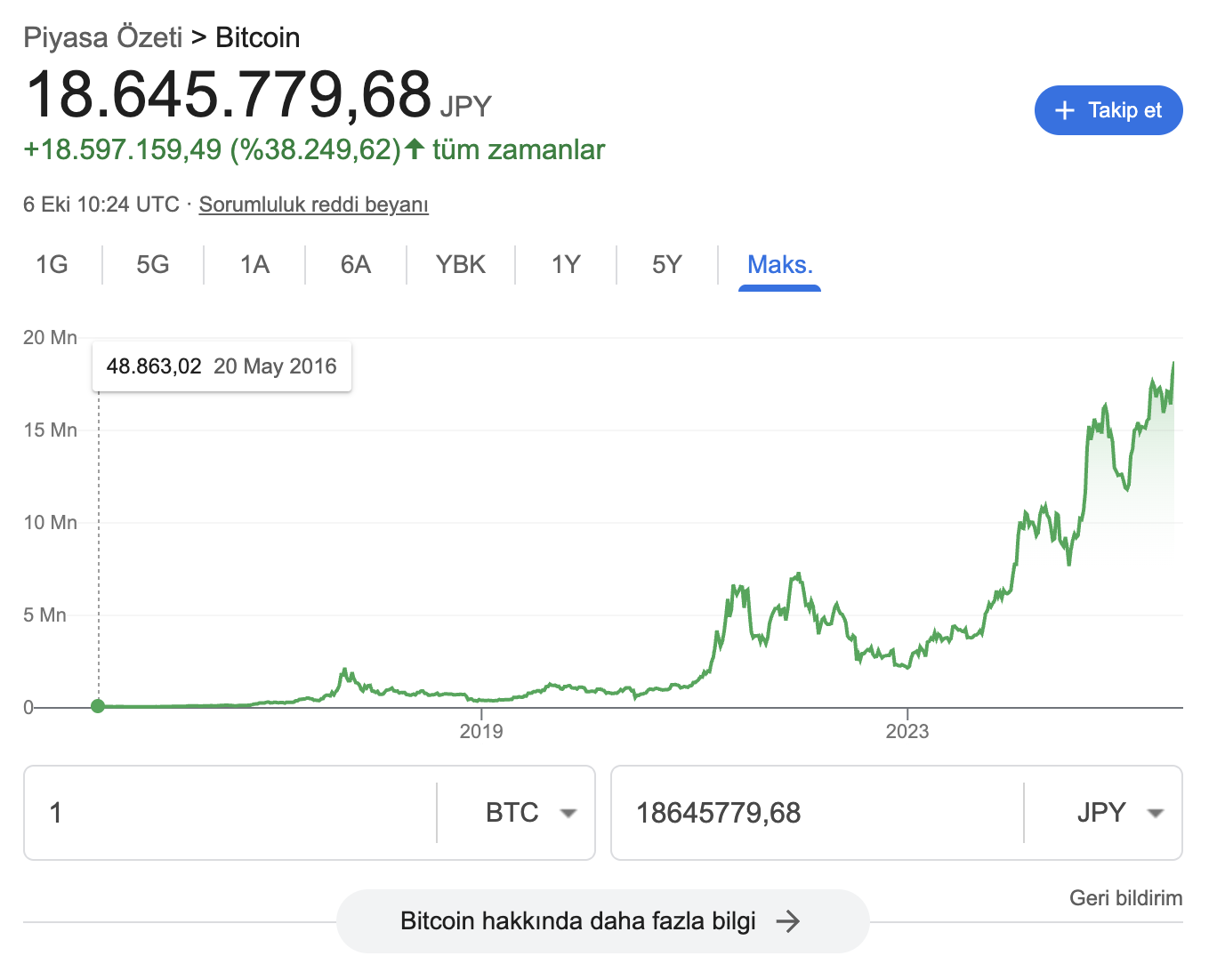

According to the BBC, Japan’s new prime minister, who gives signals to ABENomics Takaichi Sanae‘ PostsThe Bitcoin/Yen Parity has increased to the highest level of all time with 18,640,000 JPY in Bitflyer today. At Coinbase, BTC/USD watched $ 125,000 at $ 125,000 at $ 125,000. Yen, since August 1, the lowest level against the US dollar to 150.35, while the Nikkei index exceeded 48,000 points. The market is pricing the compatible incentive moves that prioritize the government and the Central Bank of the Central Bank prioritizing demand inflation and wage increases.

How will the return to Abenomics affect crypto currencies?

SanaE’s emphasis on the route router role of the government in money and finance policy ğu strengthened the expectation that ABenomics, which consists of aggressive growth, cheap borrowing and structural reforms, could re -engage. Reutersaccording to Central Bank of JapanThis month’s probability of interest rate hike this month has significantly decreased. The Central Bank is expected to be more cautious. In this context, low interest and expansion monetary policy supports the risk appetite while increasing the pressure on the new. As a result, the depreciation of the man, both the rise in the exporting indices and the record on the Bitcoin/Yen side.

Analysts, with the expected money relaxation steps in the United States, new incentive packages that may come from Japan, gold and crypto currencyLara states that it can strengthen the demand. While the theme of reflation stands out on both fronts, the comments of Swiss Franc in recent years in the perception of safe harbor draws attention. On such a ground, crypto currencies are supported by alternative value protection narrative, especially in the economies of weakening in the local currency.

The table that emerged in Japan has already increased the demand for Bitcoin

The record came with the prolongation of the record five -day rise series in BTC/JPY. This is in the short term Bitcoin  $123,961.58It indicates that acceleration is fed by local dynamics. Technically, Bitcoin, which is under the hill of dollars, reached the new summit in a yen thanks to the volatility in the exchange rate. So your price dollar Based consolidation was masked with weakness on the yen side.

$123,961.58It indicates that acceleration is fed by local dynamics. Technically, Bitcoin, which is under the hill of dollars, reached the new summit in a yen thanks to the volatility in the exchange rate. So your price dollar Based consolidation was masked with weakness on the yen side.

On the monetary policy front, the target of “supported demand inflation with wage increases” can keep the message volatility in the exchange rate that the monetary conditions will be loose. On the investor front, the Step Speed and Scope of the Central Bank of Japan with the dollar/yen BTC/JPY will determine the course of the correlation. This table keeps the Japanese investor’s crypto money -oriented motivation in the short term, while the Fed’s relaxation path on the global side continues to be complementary for risky assets.