Trillion dollar asset management companies, billions of dollars investment banks and others crypto- He’s already got his job. The best of such big companies is that they quickly evaluate new opportunities. As of 2023 Your crypto coins The giants, who are sure of the future, have taken great steps in this field and we have come to these days. It is now an investment tool that is accepted in the crypto world. What is the advice of giants as a crypto currency investment strategy?

Crypto Monetary Investment Strategy

The lock figure 4 is recommended that the budget allocated to crypto currencies for aggressive customer portfolios is not exceeding 4 %. The Global Investment Committee of Morgan Stanley said that they can invest in crypto currencies up to 4 %to their customers in their new note. This is a big step for the normalization of crypto currencies in multiple asset portfolios.

Now the largest in the world, “you can invest in crypto money, but not to exceed 4 %” has come to the point. Crypto Coins Morgan Stanley, who classifies it as digital gold, sees this as a reality that becomes “speculative and increasingly popular ..

In doing so, it was recommended that regular income -oriented investors and those who do not like volatility avoid crypto and crypto was offered to those who will benefit from opportunistic growth advantages.

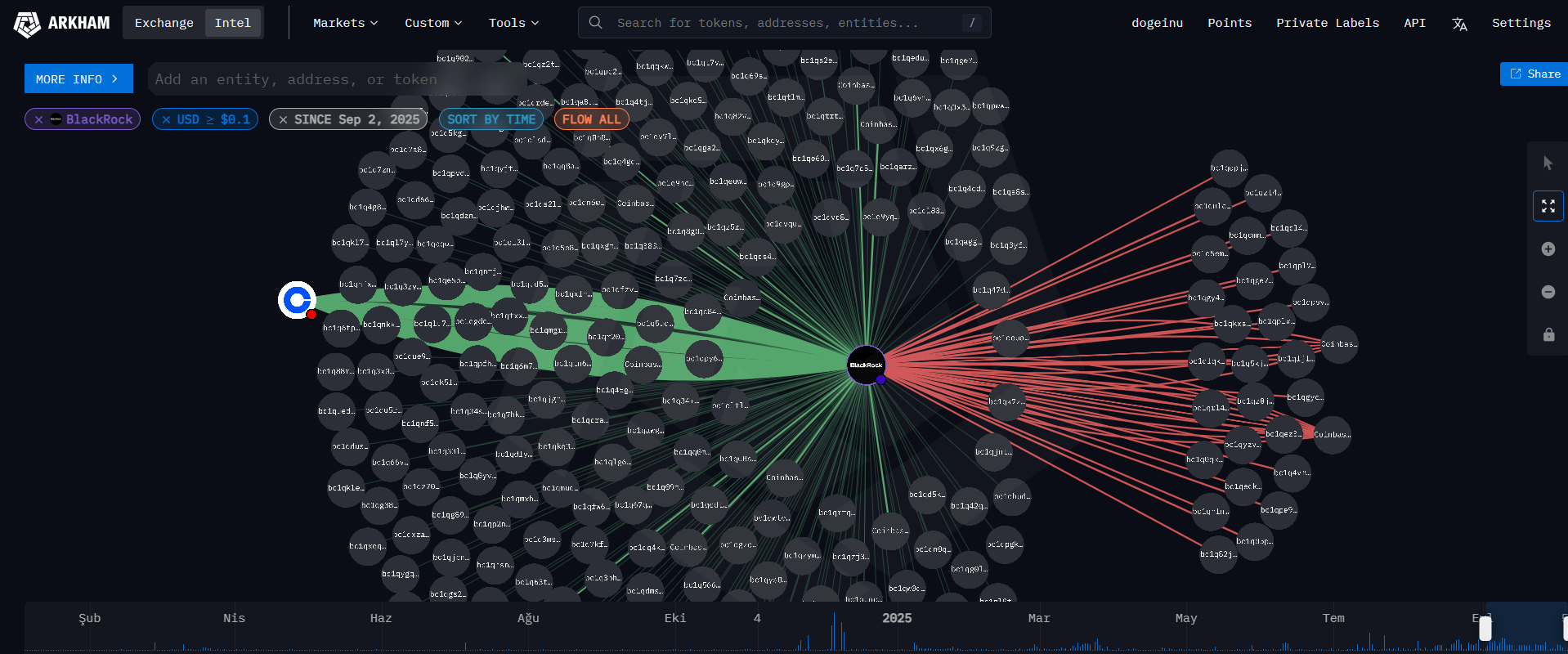

Blackrock and others

Blackrock With the presence of customer exceeding $ 10 trillion, it is the largest in the world. In 2023, the company applied for BTC ETF and was sure to get approval. In those days, the BTC is around 25 thousand dollars, today it sees new summits over 126 thousand dollars. So he added 100 thousand dollars on it.

Blackrock’s suggestion is 1-2 %of its customers Bitcoin  $123,961.58to invest in. So if you have $ 100 million, you can make a purchase of $ 1-2 million. Blackrock has a lot of customers with more than $ 100 million. Grayscale sees 5 %allocation as a good investment strategy.

$123,961.58to invest in. So if you have $ 100 million, you can make a purchase of $ 1-2 million. Blackrock has a lot of customers with more than $ 100 million. Grayscale sees 5 %allocation as a good investment strategy.

Schwab has not yet released a allocation guide for crypto deposit, but in 2026, he will start the purchase and sale of crypto money. Moreover, it allows customers to access crypto money ETFs. The world’s second largest being manager Vanguard plans to allow its customers to invest in crypto currencies soon. Vanguard saw crypto ETF investors as nonsense last year, but BTC became huge gains, and probably customers are not very satisfied with this.

All this is the largest in the world. Well Crypto coins The owners of the pools where the future corporate capital is kept. And the investment guidelines they publish, crypto currencies are going to a historical period in many major portfolios around the world. 1 %allocation of $ 10 trillion asset manager’s customers’ allocation means a net entry of $ 100 billion for Bitcoin. Even for a single company, the number is quite large.

Nowadays, the news flow is extremely intense and we see intensive price movements due to developments. Soon left coins and others may come. For that reason Cryptoappsy It may be in your favor to follow the live news flow and summary of the application.