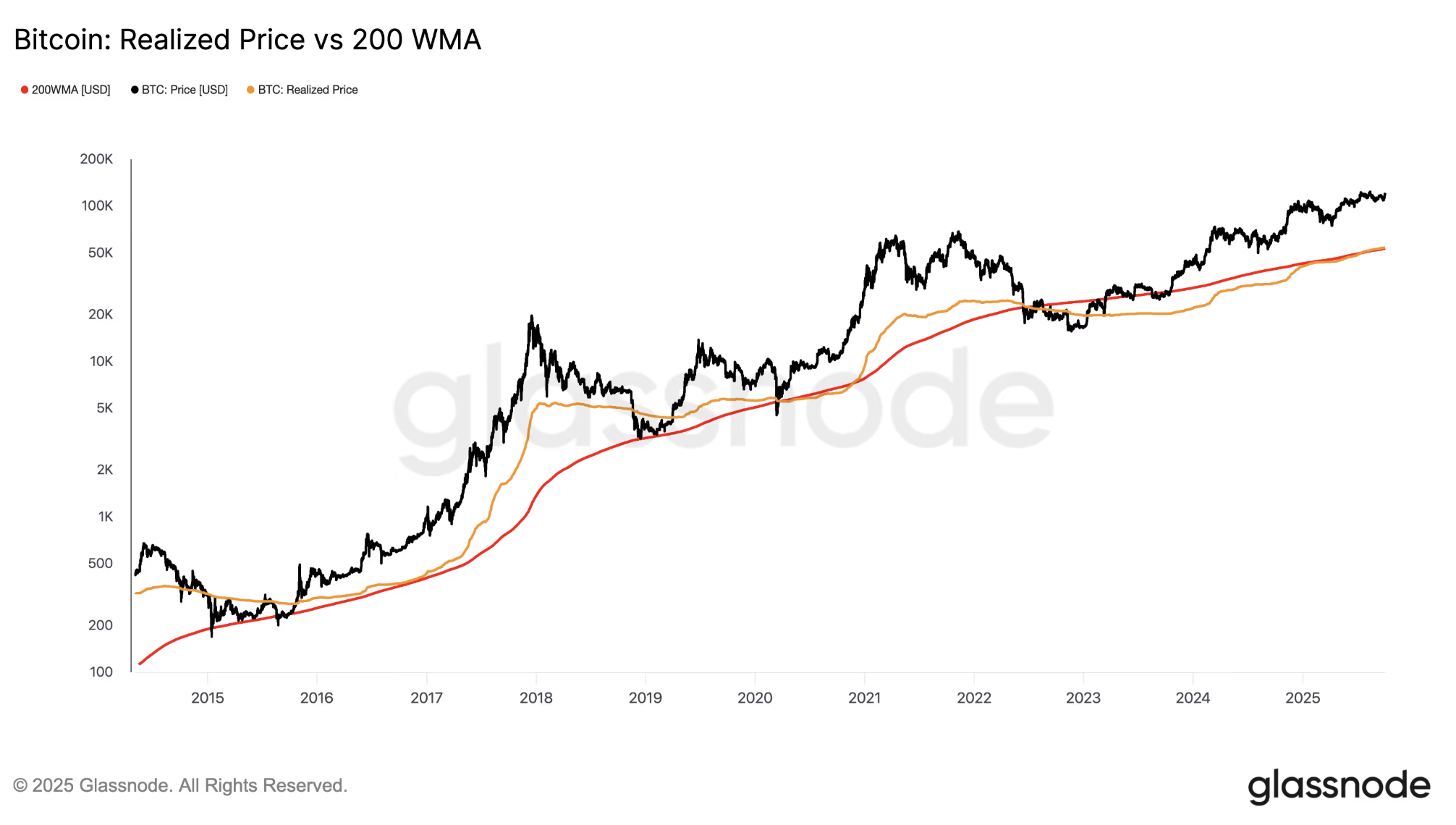

Bitcoin  $124,408.17long -term indicators, despite the expiration of the cycle, indicates that the trend of the rise will continue. At the beginning of October, an average of 200 weeks of moving $ 53,000 exceeded the $ 53,000 threshold, while the price representing the average cost of Blockchain rose to $ 54,000. While the market read the last quarter of the year as “hill ,, the binary metric historically tended to protect the upward direction when it coincided with the early phases of the bull process. Crypto Money MarketThe main determinant for decision-makers will be the price of 200-WMA whether it will be able to provide permanence.

$124,408.17long -term indicators, despite the expiration of the cycle, indicates that the trend of the rise will continue. At the beginning of October, an average of 200 weeks of moving $ 53,000 exceeded the $ 53,000 threshold, while the price representing the average cost of Blockchain rose to $ 54,000. While the market read the last quarter of the year as “hill ,, the binary metric historically tended to protect the upward direction when it coincided with the early phases of the bull process. Crypto Money MarketThe main determinant for decision-makers will be the price of 200-WMA whether it will be able to provide permanence.

The threshold test of the price realized with the average of 200-week

200-WMA, which is known for its one-way and stable rise trend, measures the long-term momentum of the market, while the price realized BTCreflects the average cost of the last transport. The latest data shows that the price of 200-WMA is up to the $ 54,000/53,000 dollar band. As the pricing on the threshold continues, a capital entrance dynamics that comply with long -term investor behavior stands out and the withdrawals are historically digested in the medium -term rise trend.

The price of the model remained on 200-WMA, the increase in the profitability rates of the Blockchain, the expansion of the market depth and the higher levels of bottom formations. Although short -term volatility continues, the positive decomposition of these two series for the main trend confirmation is considered critical.

Readings from past cycles

The price realized in 2017 and 2021 increases 200-WMA Price acceleration continued in the phases where it was located on it. As the scissors expanded, the risk appetite increased. The narrowing of the scissors and the break down pointed out the beginning of the bear period and informed the return of the trend. The re -intersection after the negative separation observed in 2022 suggests that the upward pressure gained strength in the current phase.

Although the “End of Cycle End” narrative regarding the last quarter of the year on the timing side is common, the current position of the indicator pair supports the Early-Middle Phase thesis. The main criterion of the market will be the permanence of 200-WMA and whether the difference is expanded; The expansion prepares the ground for new rise legs.